What to do with our natural gas networks?

This is about the pipes that currently move our natural gas around. And the answer is not as simple as you might first think. Carbon Tracker has recently published a series of research reports on the three main European gas transmission network operators, Snam, Italgas (both Italy) and Enagas (Spain). As they point out in their reports, "the energy transition is rendering future cash flows from (natural) gas transport and distribution increasingly uncertain."

One focus of the report is on Paris alignment, and the companies' Scope 1,2 & 3 reporting/reduction. For instance Snam is targeting carbon neutrality, including offsets, by 2040 and net zero by 2050.

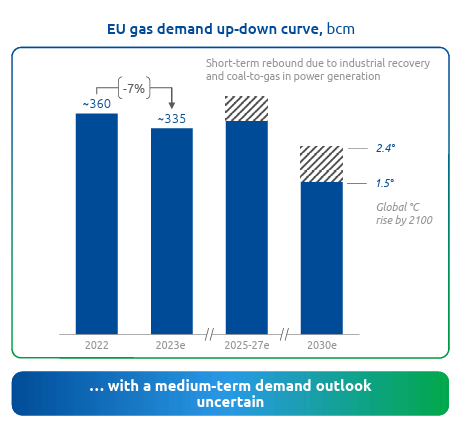

But a material part of the analysis also looks at what happens next. How do the companies respond to the expected decline in demand for natural gas? Sticking with the Italian examples - "Snam & Terna scenarios are for a fall in gas demand in Italy from 62 bcm in 2023 to 53-64 bcm by 2030 and 46-58 bcm by 2040". And as the chart below shows, this is an issue of concern across Europe.

In the case of Snam, they are transitioning fairly 'quickly' (for utilities) from being a mover of gas, to also being a major player in green hydrogen transmission.

Will the gas grids become stranded assets? Some people might start with the position that our gas networks are similar to coal and O&G production - over time demand will fall to zero - and that this is just a necessary consequence of our moves to deliver net zero. In the absence of a viable green hydrogen market, gas networks in this scenario are a future example of stranded assets.

But, is it that simple? As the analysis highlights, we are going to need gas transmission for a number of decades. To heat our homes and power some of our electricity generation (such as the efficient Combined Cycle Gas Turbines or CCGTs). Given that these are highly regulated utilities, how does the regulator ensure that basic services continue to be provided (energy security), and how do they decide who pays (energy price)? As the amount of gas transported reduces, the cost per user rises.

One 'answer' that gets talked about a lot is to transition the existing gas networks to transport green hydrogen. Regular readers will know that while we can see a possible future for green hydrogen as a replacement for existing hydrogen demand, we are sceptics when it comes to many new applications. This outlook could be wrong if governments are prepared to step up, providing material levels of financial support. But, based on what we can see, the most likely financially viable green hydrogen applications will be what are known as co-located. This is where the green hydrogen production takes place along side the customer's processing facility. In which case, how much transmission will we really need? And can we do it at a reasonable cost? Here is a discussion we had on what is going on in Germany 👉🏾 https://www.thesustainableinvestor.org.uk/germany-going-for-broke/

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Click this link to register 👉🏾 https://www.thesustainableinvestor.org.uk/register/

Please read: important legal stuff.