Scaling access to cleaner stoves; lower gas prices and sustainability; more sustainable shift to EVs

Scaling up access to electric cooking services in Tanzania

According to the IEA, 2.3 billion people or nearly one third of the global population cook their meals over open fires or basic cook stoves. The fuels used are typically firewood, agricultural waste, charcoal, coal, kerosene and even animal dung. All of these emit harmful smoke, often in enclosed spaces, that is unhealthy for their users. Household air pollution is the third leading cause of premature death globally among women and children, and the second in Africa, concentrated in countries with a high reliance on biomass and coal for cooking.

But it is not just the smoke. The leading cause of childhood poisonings is the accidental ingestion of kerosene. A large proportion of the severe burns and injuries occurring in low- and middle-income countries are linked to household energy use for cooking, heating and lighting. And it disproportionately impacts women and children.

Therefore a shift to cleaner cooking stoves would have clear health benefits and be good for the environment - reducing methane and other gas emissions, as well as saving trees from being cut down for firewood. But that shift costs money - the IEA estimates US$ 8 billion per year with investment needing to grow from roughly US$ 2.5 billion currently. Most of the growth is needed in Sub-Saharan Africa (SSA) where an estimated 900 million people use inefficient wood and charcoal stoves and affordability is a clear problem. Almost three quarters of SSA's energy demand comes from woodfuels used for cooking.

This is why a development in Tanzania caught our eye.

The Modern Cooking Facility for Africa (MCFA) which aims to provide up to 4 million Africans with access to clean cooking solutions by the end of 2027, will be providing €2 million of results-based funding to UpEnergy Tanzania in order to scale up the replacement of biomass stoves with electric ones (provided by Ugandan-based PowerUP) for households in urban and peri-urban areas of Tanzania.

This funding is also expected to bring additional co-funding in to at least double the total capital invested by the end of the project. The aim is to implement over 123,000 new e-cookers, working with households that have a grid connection - in a country where nearly 80% of electricity is sourced from renewable energy - but still rely on biomass for their cooking. The initiative is expected to benefit over 600,000 Tanzanians by the end of 2027.

The PowerUP e-cookers being deployed not only reduce cooking times by up to 60% compared to traditional biomass stoves but are also customised for local cooking habits, featuring a bespoke user display tailored to local cuisine and equipped with in-built metering for accurate usage monitoring. For the families this means less disruption, an elimination of indoor air pollution and financially they will benefit from lower annual fuel costs.

The MCFA recently closed a second round of funding for clean cooking providers in the Democratic Republic of the Congo (DRC), Kenya, Malawi, Mozambique, Tanzania, Zambia and Zimbabwe with total available funding of up to €16 million. 👇🏾

An important consideration with the switch to electric is the effectiveness of the supporting infrastructure. Electric cooking would increase electricity demand by 10% by 2030, which could place strains on electricity networks at the distribution level if not paired with effective electricity planning. In addition some countries do not have extensive electricity grids.

This is where the development of micro grids can be beneficial. We previously reported on developments in Nigeria where the end of fuel subsidies was driving the adoption of rooftop solar and providing electric power to households with little to no grid access.

Link to blog 👇🏾

The implications for sustainability of falling gas prices

Energy Source (from the FT - so behind the paywall) recently highlighted just how much gas prices have fallen in many regions around the world. As they say, the Russian invasion of the Ukraine triggered disarray in the energy markets. And one consequence was a massive spike in gas prices.

But since the peak in c. late 2022 gas prices have fallen sharply. The European benchmark (Dutch TTF) is now close to levels last seen pre the latest energy crisis. And East Asian spot LNG has shown a similar trend. Why is this? It's supply and demand. As Ademiju Allen, senior analyst at Rystad Energy says “We have too much gas. There’s not enough storage, and so prices have to go to a point where they curtail supply.”

The analysis of what happens next to gas prices is beyond my scope of expertise. But I do note that many analysts are suggesting that a surge of LNG production scheduled to come on stream later this decade might keep some downward pressure on gas prices. If this is correct, then what might it mean for the sustainability transitions?

The obvious linkages are around electricity prices, where gas (often via CCGTs) is the marginal price setter in many countries, and the shift from coal to gas as an energy source.

First, electricity prices. All other things being equal, lower gas prices will make electricity cheaper for the consumer. But they will also act to close the price gap between gas and renewables. So, we need to watch for a (short term) slowing of new renewable build outs.

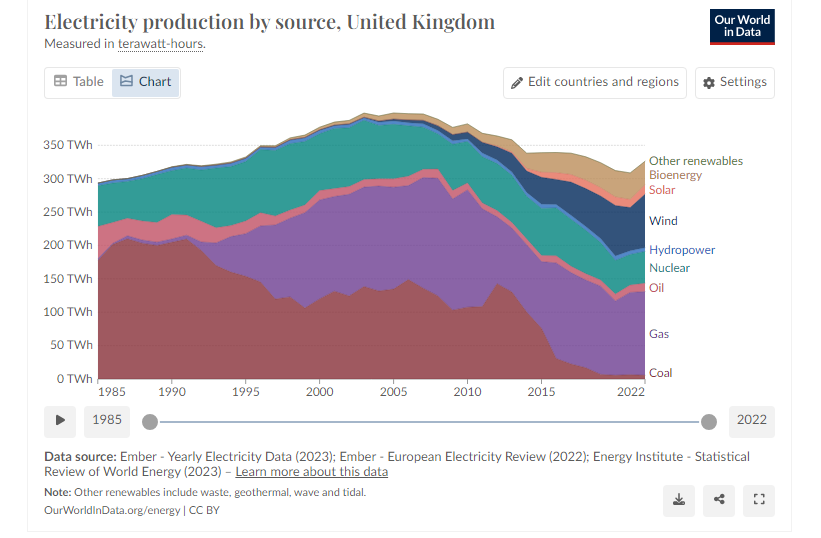

Second cheaper gas as a substitute for coal. This is better news. If gas prices remain low, then we should see a continuing shift away from coal. But then this was already happening in many countries (but not China). The example below is from the UK.

So net net both of these impacts could be thought of as possible short term blips and surges in what is an already well established trend (more renewables and less coal).

But, the gas price also has a material impact on fertiliser prices, as highlighted in a June 2022 article in The Conversation. This could have two implications for the sustainability transitions in agriculture. The first is that cheaper gas could lead to a recovery in fertiliser use - not something we really want as we already use too much fertiliser.

And second, cheaper nitrogen based fertilisers could discourage farmers from trying more environmentally friendly alternatives. In the absence of subsidies this could make the transition harder. We have noted before that farmers are understandably cautious about change. And cheaper gas might add to this.

Link to blog 👇🏾

A more sustainable shift to EVs

The shift to electric vehicles (EVs) is an essential element in our efforts to decarbonise transport. But just building more EVs is only part of the answer. How the vehicles are manufactured is also important.

For many a ‘clean car’ is about more than just what powers the engine. It also encompasses a fossil-free supply chain that has the lowest possible negative impact on human health, biodiversity, resource depletion, and ecosystem resilience. And a supply chain that respects the rights of Indigenous Peoples, workers, and local communities.

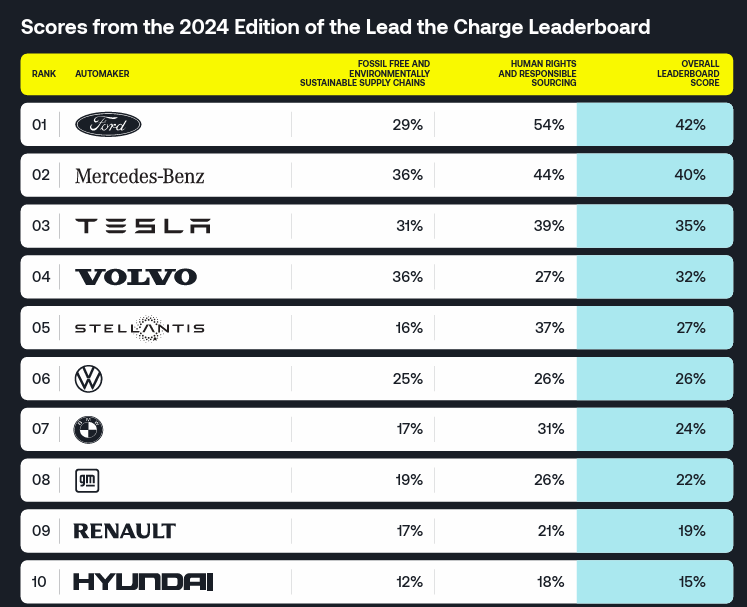

The Lead the Charge Leaderboard measures these aspects, and tracks the work of the various global automotive Original Equipment Suppliers (OEMs). The 2024 scoreboard was recently published, and it reveals a mixed picture. Some good progress, but still a lot of work to do.

The big highlight was the material improvement by the US OEMs. To quote from the report ...

“with notable improvements from US automakers coupled with inertia from some European automakers (particularly VW, Renault and Volvo), this year saw US auto companies overtaking their European peers: scoring 31% on average compared to 28% (European automakers scored an average of 26% last year, and US automakers 21%).

If relative improvements are replicated next year, other European automakers risk being overtaken by peers like GM and Geely that are making faster progress.”

The top scoring Automotive OEM was Ford, followed by Mercedes Benz, Tesla, Volvo and Stellantis. But, as the table below shows (from the report), none of the OEMs are scoring highly, and some are scoring quite poorly. This seems to especially be the case for sustainable supply chains.

This is not just about sustainability as a values and ethics issue. Over time, having a more sustainable product offering could become a material competitive advantage. One obvious lever is regulation. For instance, as Human Rights and Supply Chain rules get tightened up, these will become increasingly important issues for OEMs

But it's not just about the stick of regulation. There is a carrot element as well. We are starting to see that some consumers are either taking sustainability issues into account when they make purchase decisions and/or are willing to pay a (small) premium for a greener and more sustainable product.

A recent Boston Consulting group report suggested that "57% of respondents said that they would “definitely” or “probably” consider net zero production when purchasing their next new passenger vehicle or home appliance. And some 88% of respondents stated they are willing to pay at least a 0.4% green premium for net zero production of passenger vehicles and appliances."

In many cases, their analysis shows that even this low level of price premium would be enough to cover the increased costs faced by the OEMs.

This is not just an Automotive OEM issue. We wrote a blog recently on how premiumisation could be a mechanism for ensuring that coffee growers get paid a fair return.

Link to blog 👇🏾

Please read: important legal stuff.