Vertical farms ahead of their time?; Better governance can lift valuations?; Limits of sequestration

Gloucestershire vertical farm is one of UK's 'most advanced'

The BBC (among other outlets) reported on a vertical farm in Gloucestershire, that they describe as one of the country's most technically advanced. The facility grows lettuce, basil and other herbs under special lights, in a warm humid atmosphere (27 degrees C and 75% humidity). They claim they can grow salad three times as fast as traditional outdoor agriculture thanks to its controlled, consistent climate. Their basil goes from seed to harvest in 18 days. 👇🏾

As the article points out, UK supermarkets sell salad leaves and herbs all year round, which means that in the winter they are imported. Hence the comparison in terms of carbon emission (and cost) that is often made between plants grown locally in controlled environments (like vertical farms), and those trucked or air freighted in from Spain or Morocco.

On that basis you can see the appeal. Especially when we think about all of the logistics miles that salad leaves and herbs clock up getting from traditional farms to our supermarket shelves. But, that might not be the right metric to focus on. Yes, farming locally is part of the answer, and it's something that we support. But we need to think beyond the headlines.

One other important aspect is cost. These farms use a lot of electricity. And this is expensive, at least in Europe. This has led to a number of vertical farm companies either closing down. And some have talked about moving to regions with cheaper electricity. But then that seems to defeat the purpose of growing locally.

One answer might be microgrids (using local renewables and battery storage). But we need to be aware of the scale of renewables needed. Kale Harbick, a USDA researcher who studies controlled-environment agriculture, is quoted as saying "in a typical cold climate, you would need about five acres of solar panels to grow one acre of lettuce".

Maybe we need to start thinking that this is a solution that is ahead of its time. That it might make sense at scale in say a decade or more in the future. When local renewable electricity is cheaper. Maybe we need to focus our capital instead on less glamorous answers, such as Precision Ag - growing more with less.

Link to blog 👇🏾

Can better governance improve stock valuations?

For listed companies, there are a number of choices that a board and executive management can make to increase the valuation of the shares in the company.

One example is choosing where to list. In my career I have seen many non-US companies running for US stock market listings in the hope that the greater liquidity of the US market would boost longer-term valuation.

In his excellent daily blog, Klement on Investing, Joachim Klement recently highlighted a meta analysis by Nguyen and Dao from Hanoi University, "Liquidity, corporate governance and firm performance: A meta-analysis" (2022) which compared the impact of improving share liquidity on company valuations with the impact of improved corporate governance.

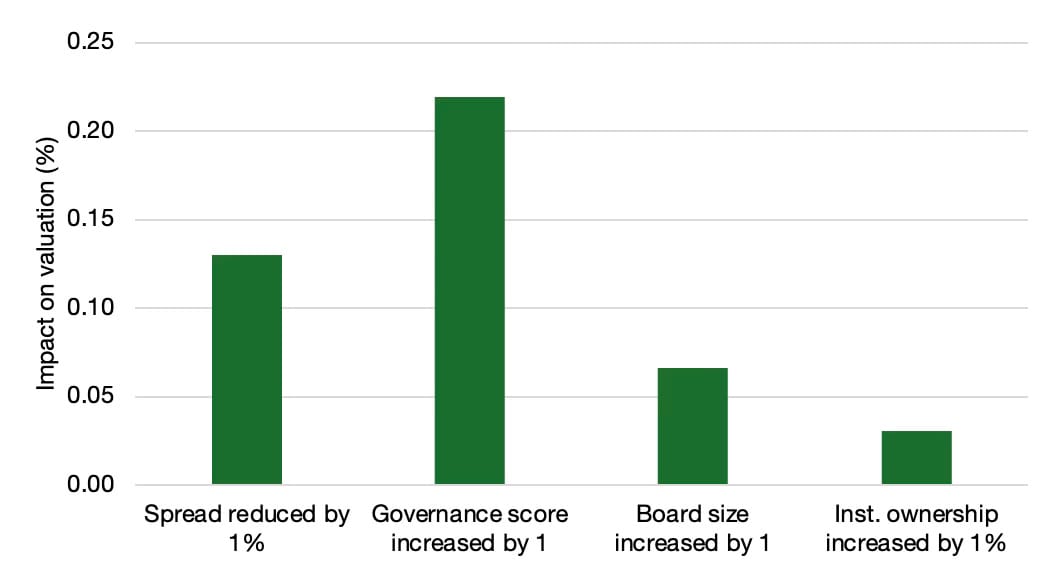

This chart by Joachim summarises Nguyen and Dao's results well

You can see clearly from the chart that improving overall governance has a much bigger impact on valuation than improving liquidity ('spread reduced by 1%')1

You can read Klement's article here 👇🏾

... and here is a link to Nguyen and Dao's research: https://www.tandfonline.com/doi/full/10.1080/23311975.2022.2137960

There were a number of things we found interesting.

- Simple governance measures alone, such as simply splitting the roles of CEO and chair of the board or just increasing the number of board members are not really going to help. The study authors used broad measures of overall governance - corporate governance indices such as ISS Board Quality scores. Bottom line, a culture of strong governance does the trick.

- As Klement pointed out "...unlike trying to increase liquidity, it [governance] is a measure that is entirely under the control of executives and their boards."

- It asks a broader question: how do we measure 'governance'? This will be the topic of an upcoming Sunday Brunch...

[note 1: The 'spread' is the difference between what you can buy a stock in the market and what you could sell it for. The narrower the spread, the more liquid a market is]

The limits of sequestration.

Farmland, and in particular its soil, has the potential to store large amounts of carbon to varying degrees depending on the type of land. The 3,378 hectare Jigsaw Farms, comprising lush pastures, gum tree plantations, wildlife corridors and wetlands about near the town of Hamilton in Victoria Australia made use of that potential, becoming carbon-neutral in the early 2010s.

However The Guardian highlighted a recent report (which is under peer review) showing that Jigsaw Farms has been emitting more greenhouse gases than it is capable of sequestering since about 2017. 👇🏾

This story highlights a couple of issues to think about with carbon sequestration projects, particularly where there are credits attached to them that are then used for offsetting. Firstly, there is a limit to the amount of carbon that can be stored and that limit is a theoretical one. In the case of Jigsaw Farms, they initially planted hundreds of thousands of trees and switched to perennial grasses, but with the trees having matured they will be absorbing less CO2 every year and the soil is now so carbon rich it can't sequester any additional CO2 either. The second issue is permanence. In the case of soil carbon, there is a trade-off for farmers of plant agricultural products between permanence of carbon sequestering with associated income derived from carbon credits and fertility with the ultimate improvements in crop productivity. We discussed this point in this blog 👇🏾

Separately the Council and European Parliament negotiators reached a provisional political agreement on a regulation to establish the first EU-level certification framework for permanent carbon removals, carbon farming and carbon storage in products. The agreement still needs formal adoption by both institutions and will be voluntary. The intention is that it helps to speed up the deployment of high-quality carbon removal and soil emission reduction activities in the EU.

The agreement will differentiate between permanent carbon removal (storing atmospheric or biogenic carbon for several centuries), temporary carbon storage in long-lasting products (such as wood-based construction products) for 35+ years that can be monitored on-site during the entire monitoring period, temporary carbon storage from carbon farming (e.g. restoring forests and soil, wetland management, seagrass meadows) and soil emission reduction (from carbon farming) which includes carbon and nitrous oxide reductions from soil management.

The last point about soil remission reduction is an area where what we grow and how we grow it could have big impacts. 👇🏾

Please read: important legal stuff.