Ageism in the workplace; what to do with our natural gas networks?; closer to using EVs to power the grid?

When DEI isn't inclusive - discrimination against the 50 plus workforce

As individuals north of 50 years old, a LinkedIn post from the founder of recruitment service the Cleeve Partnership, Natasha Cleeve really caught our eye.

Natasha highlighted that there is discrimination against the 50+ workforce even as a skills shortage persists.

According to a WHO/UN report ageism is costing the global economy billions of dollars. A 2020 US study estimated excess annual costs of US$63 billion for the eight most expensive health conditions for those aged 60+. An Australian study suggested that if just 5% more people aged 55+ were employed there would be a positive impact of AUD$48 billion to the Australian economy annually.

Age discrimination in the workplace is one of the areas where individuals should have protection by the Equality Act 2010, however a study by Age Without Limits found that 37% of workers aged 51 to 70 felt badly treated in the workplace over the past year. One third of workers aged over 50 believe they have been turned down for a job because of their age whilst 20% of the employers surveyed believed that age discrimination takes place in their organisation.

As Natasha puts it, "the DEI agenda was introduced to right historical discrimination and has created lasting opportunity for generations of people whom without it, would have been excluded from the type of roles and opportunities we now take for granted. [That's] a good thing until it starts to exclude and discriminate - and it is, against older workers."

You can read Natasha's post here 👇🏾

In our former industries of investment banking and asset management there has been a juniorisation of employees in the last couple of years led by various factors including the impact of MiFID2 on investment advisory revenues putting pressure on costs. In some cases 'creating space' for younger employees to grow, and providing opportunities for them has been one reason cited for older employees being made redundant or passed over for promotions.

We agree with Natasha that EDI is an important thing. Having diverse experiences and ideas can be hugely beneficial for both an organisation and its stakeholders including development of both younger and older employees.

However, execution is key. Too often 'diversity' is seen as the 'method' rather than the 'outcome'. Creating an inclusive culture is the method to achieving diverse skills and viewpoints.

Including the experience and wisdom of older workers alongside that of younger ones is a trick that firms could be missing for short term profitability at the expense of long term sustainability.

We have written extensively on this subject before. Here is one example.

Link to blog 👇🏾

What to do with our natural gas networks?

This is about the pipes that currently move our natural gas around. And the answer is not as simple as you might first think. Carbon Tracker has recently published a series of research reports on the three main European gas transmission network operators, Snam, Italgas (both Italy) and Enagas (Spain). As they point out in their reports, "the energy transition is rendering future cash flows from (natural) gas transport and distribution increasingly uncertain."

One focus of the report is on Paris alignment, and the companies' Scope 1,2 & 3 reporting/reduction. For instance Snam is targeting carbon neutrality, including offsets, by 2040 and net zero by 2050.

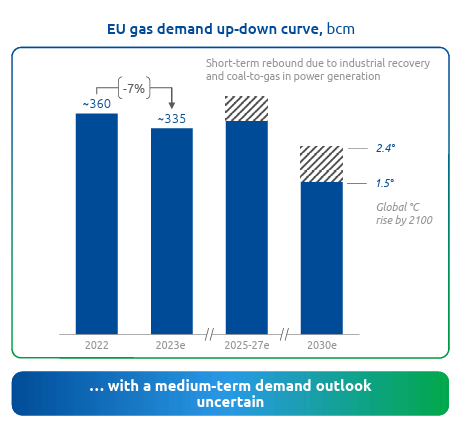

But a material part of the analysis also looks at what happens next. How do the companies respond to the expected decline in demand for natural gas? Sticking with the Italian examples - "Snam & Terna scenarios are for a fall in gas demand in Italy from 62 bcm in 2023 to 53-64 bcm by 2030 and 46-58 bcm by 2040". And as the chart below shows, this is an issue of concern across Europe.

In the case of Snam, they are transitioning fairly 'quickly' (for utilities) from being a mover of gas, to also being a major player in green hydrogen transmission.

Will the gas grids become stranded assets? Some people might start with the position that our gas networks are similar to coal and O&G production - over time demand will fall to zero - and that this is just a necessary consequence of our moves to deliver net zero. In the absence of a viable green hydrogen market, gas networks in this scenario are a future example of stranded assets.

But, is it that simple? As the analysis highlights, we are going to need gas transmission for a number of decades. To heat our homes and power some of our electricity generation (such as the efficient Combined Cycle Gas Turbines or CCGTs). Given that these are highly regulated utilities, how does the regulator ensure that basic services continue to be provided (energy security), and how do they decide who pays (energy price)? As the amount of gas transported reduces, the cost per user rises.

One 'answer' that gets talked about a lot is to transition the existing gas networks to transport green hydrogen. Regular readers will know that while we can see a possible future for green hydrogen as a replacement for existing hydrogen demand, we are sceptics when it comes to many new applications. This outlook could be wrong if governments are prepared to step up, providing material levels of financial support. But, based on what we can see, the most likely financially viable green hydrogen applications will be what are known as co-located. This is where the green hydrogen production takes place along side the customer's processing facility. In which case, how much transmission will we really need? And can we do it at a reasonable cost?

Link to blog 👇🏾

Are we finally getting closer to using your EV to 'power' the electricity grid?

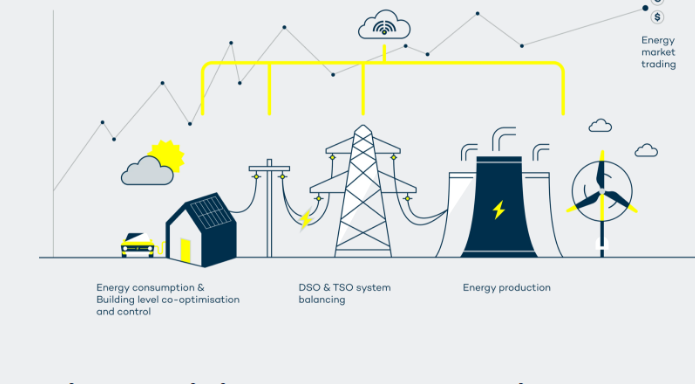

Octopus Energy has launched the UK’s first mass market vehicle-to-grid (V2G) tariff (called the Octopus Power Pack), which they say guarantees free charging for electric vehicle (EV) drivers. The tariff, which is still in beta, uses V2G technology and Octopus Energy’s tech platform, Kraken, to balance charging and discharging when it’s best for the grid – charging up the car with cheap, green electricity during off peak times and exporting back to the grid when it needs it most.

Octopus Power Pack is available to drivers with V2G compatible electric cars and chargers available in the UK. Currently, there are only a limited number of models that have this capability.

The idea behind V2G is simple in concept, but a bit tougher to apply in practice. In simple terms, your EV becomes a battery storage system when it's parked up. It's a technology that could be a positive enabler for improved grid stability.

We have written about EV charging before, but we have been reluctant to talk too much about V2G. There were a number of trials being undertaken, and countries such as Australia had undertaken detailed studies (this is a good one if you want to understand how V2G works). But it felt as if it was still a reasonable distance away from commercialisation.

In part, the challenge was the "chicken & egg situation".....

But that seems to be changing. Most of the global automotive OEMs have got behind the technology (at least in principle). And the most important laggard, Tesla, has recently indicated its support. Their Cybertruck (targeted launch 2025) is apparently aimed to be their first launch vehicle for the technology.

So maybe it's time for investors and sustainability professionals to start taking a more active interest. If you do, remember that EV charging is unlikely to be a 'one for one' replacement, taking out petrol (gas) stations and replacing them with public EV chargers.

Link to blog 👇🏾

Please read: important legal stuff.