Obesity increasing, green fertiliser (or not), and the dawn of an industrial heat pump age ?

Obesity increasing, green fertiliser (or not), and the dawn of an industrial heat pump age ?

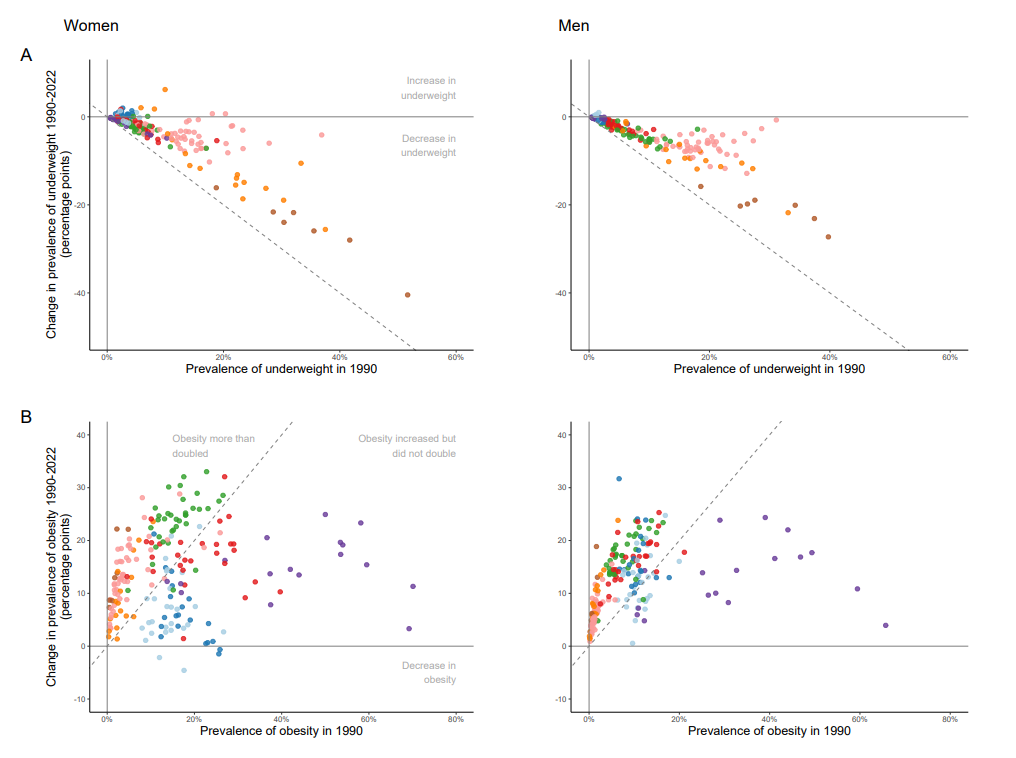

The combined burden of underweight and obesity has risen in most countries

In 2022, over a billion people globally were living with obesity with 160 million of them aged 5-19.

A study published in The Lancet used data from 3663 population-based studies that measured the height and weight in representative samples of the general population between 1990 and 2022. There were 222 million participants spanning all age groups and covering 200 countries and territories.

They found that over that timescale the combined burden of underweight and obesity had increased in most countries driven by an increase in obesity. Whilst the proportion of adults classed as underweight had fallen by 50%, it still remains a real problem, particularly in poorer communities in south Asia and parts of Africa.

There are significant health risks with being obese. In addition to cardiovascular disease which we have already mentioned, there are also links to type 2 diabetes, cancer, dementia, psychological distress and infertility.

Significantly the problem is on the rise in low- and middle-income countries, particularly in towns and cities. This can be exacerbated as these countries may not have the same access to healthcare.

The authors of The Lancet study called for a "healthy nutrition transition that enhances access to nutritious foods... to address the remaining burden of underweight while curbing and reversing the increase in obesity."

One nutritional 'villain' is ultra-processed foods (UPFs). Across high income countries, the share of dietary energy derived from UPFs ranges from 10% in Italy to 58% in the United States. In low and middle income countries, it can still be material from 16% in Colombia to 30% in Mexico, for example.

A recent meta-analysis published in the BMJ found that consumption of UPFs were directly linked to 32 harmful health conditions including the health risks linked to obesity mentioned above.

We have previously written about the food industry itself starting to get onboard with the need to improve the healthiness of foods to reduce and ultimately reverse incidents of obesity and the associated diseases and conditions. As consumer attitudes change, the shift from the old world dominated by convenience to a new more sustainably and healthy conscious market could happen faster than expected meaning that those food and beverage companies that are not ready will be competitively disadvantaged.

You can read that blog here which also includes some words of caution about BMI as a measure of obesity and that not all UPFs are the same. It is really the High Fat, High Sugar, High Salt (HFSS) foods that are most worrisome 👇🏾

Fertiliser is going green. Or is it?

About 80% of ammonia produced is used to make fertiliser. In terms of direct emissions, it is almost 2x as emissions intensive as crude steel production and 4x that of cement at approximately 2.4 t CO2 per tonne of production.

In this blog back in March 2023, we discussed what can be done to make it greener 👇🏾

In the blog we highlighted that one way of making nitrogen based fertilisers more sustainable is to replace methane with green hydrogen as the feedstock for the ammonia production process.

Given this, at first glance the news that a fertiliser giant has signed a binding offtake agreement for 100,000 tonnes of renewable (green) ammonia per year sounds positive for reducing the GHG emissions from fertiliser production.

Yara has done just that with Indian developer ACME Group's wholly owned subsidiary GHC SAOC from a project in Oman.

However a couple of 'red flags':

Firstly and perhaps most importantly, Magnus Ankarstrand, president of Yara Clean Ammonia had this to say in a press release:

“Yara Clean Ammonia is a frontrunner in enabling the hydrogen economy across the shipping, food, power, and industrial sectors. The renewable ammonia from Oman will be part of our scalable distribution system, developing a reliable, safe, and cost-efficient supply chain for low emission ammonia across different market segments."

So... not necessarily to be used for making fertilisers then?

Secondly, to put the offtake agreement into perspective, in 2023, Yara's urea production capacity was 5.3 million tonnes per year. A tonne of ammonia is needed to produce 1.72 tonnes of urea, so even if the full offtake from GHC SAOC were used in urea production it would still only represent 3% of Yara's annual production of one fertiliser and feedstock.

So a positive spin would be 'a good start'.

There are examples of onsite green hydrogen-to-fertiliser plants - we wrote about one such example previously in Kenya. It's small scale so costs are challenging, but there is also an energy and feedstock security benefit of not having to rely on, for example, Russian gas. 👇🏾

And on the cost issue, all of this is before, as Paul Martin points out, "there'd be the sticky problem of finding a way to force farmers to pay more for green than for black ammonia, i.e. Yara's normal product."

This might not be a totally insurmountable issue. We know that, even in the absence of such supply security concerns, there may be a willingness for customers to pay a green premium in some products. Steel is a good example.

There have been some great advances in green steel production and in scaling up solutions but there remains a gap in price between traditionally produced steel and green steel. However a driver for adoption could be carbon pricing. The carbon price in Europe (ETS) was €60/t CO2e at the beginning of March 2024.

The EU's Carbon Border Adjustment Mechanism (CBAM) is likely to help bridge the gap between traditional steel pricing and even premium priced green steel. In January 2024, ArcelorMittal priced hot-dip galvanised coils, used in automotive, at €920/t, which implies a 'breakeven' with green steel at a 13% premium at current carbon prices.

In the automotive industry, there has been a clear willingness to pay a premium with several major automotive manufacturers signing offtake agreements - for example, GM and Mercedes-Benz signing agreements with ArcelorMittal and H2 Green Steel respectively.

As production of green steel scales helped by CBAM in Europe and IRA, IIJA and Buy American Act in the US, incorporating green steel would increase the cost of an average car by around $100-200, according to ArcelorMittal CEO Aditya Mittal - an immaterial cost. With about 900 kg of steel going into a car and green premiums at €200-€300/t, that seems reasonable.

The dawn of the industrial heat pump age?

There has been a lot of coverage (including from us) on the development of heat pump technologies for home heating. And it's not impossible to see residential heat pumps overtaking gas fired boilers in say the next decade. One approach that might accelerate this is heat as a service. Which is where companies such as the start up Aira are positioning themselves.

But, in some ways the bigger long term win is in industrial heat pumps. Which is why funding from the US Department of Energy caught our eye. The Industrial Efficiency and Decarbonization Office is supporting 49 different projects that help reduce greenhouse gas emissions from industrial sources, with part of the funding aimed specifically at industrial-scale heat pumps.

But what we wanted to really highlight this week is a European report presented at the recent High Temperature Heat Pump Symposium in Copenhagen.

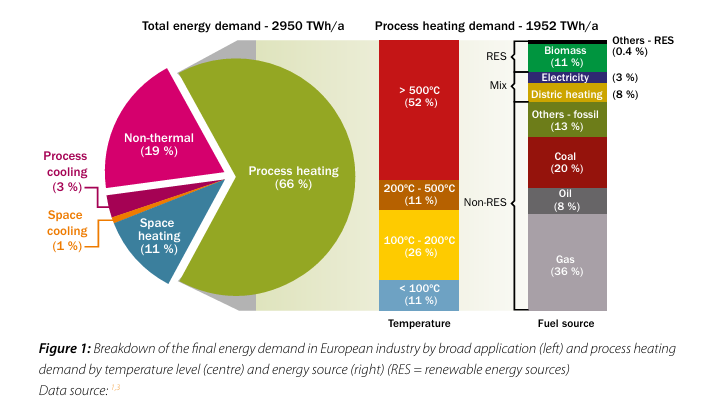

As they say in the report, industrial processes are currently responsible for 20 % of total greenhouse gas emissions in Europe. And industrial heat pumps are a key electrification technology which can replace a large share of fossil fueled industrial process heating.

First the caveat. Heat pumps are seen as a realistic replacement in processes requiring heat up to 200 degrees C. This is c. 37% of Europe's total process heating requirement, which is the yellow and the blue in the chart below. Not yet a total solution. But a really good start.

Within this processes needing heat up to 100 degrees C can already be covered by mature heat pump technologies. But above 100 degrees C, there are only a limited number of suppliers able to provide proven systems. And so governments will need to support R&D efforts to get pilot/demonstration projects up and running, with the aim of breaking down application barriers, and solving problems related to upscaling.

This looks like a potentially really interesting technology. And one where Europe and the US are already well placed. But, there is an additional factor we need to consider. The cost of electricity.

In general, industrial heat pumps will be an attractive option in scenarios where the electricity price is low relative to the cost of the alternative energy source (e.g. natural gas). And this could be a problem.

The research report shows that the price ratio varies significantly across Europe, from less than 2x in the case of Norway, Finland and Sweden to over 4x in the case of Belgium, the UK, Italy and Germany. This variation in electricity and gas prices can be a significant barrier to industrial heat pump uptake.

For instance, applications which have a payback period of 1 year in Norway, may have a payback period which exceeds 10 years in Germany under the current conditions.

Back in August last year, we wrote a longer blog on the global potential for industrial heat pumps. In this we highlighted that a recent World Business Council for Sustainable Development report identified that c. 45% of global industrial heat use is either classified as ultra low (below 100 degrees C) or low (between 100 and 200 degrees C). So the potential market is material but there are challenges to overcome if the potential is to be realised.

Link to blog 👇🏾

Please read: important legal stuff.