Some renewables getting cheaper, storage needs for a 100% renewable grid & finance and ethics in food

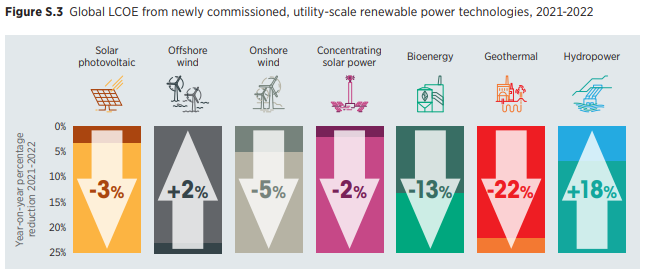

Renewables continue to get cheaper, but not everywhere.

According to recently published IRENA research renewables are continuing to get cheaper. That is good news yes? But, before you celebrate, it's worth digging some more into the data. China is doing well, but Europe clearly has some issues to sort out. These problems are not reasons to stop investing in renewables, but it's really worth trying to understand what the cause is, what we can do to reverse them, and how long it may last.

I am sure many of you will have seen this highlight from the report:

"After decades of falling costs and improving performance in solar and wind technologies, the economic benefits of renewable power generation – in addition to its environmental benefits – are now compelling. Indeed, due to soaring fossil fuel prices, the 2021 to 2022 period saw one of the largest improvements in the competitiveness of renewable power in the last two decades."

(Renewable Power Generation Costs in 2022, Executive Summary, IRENA)

The chart below from the report looks compelling:

So, how does this all fit in with the narrative we have seen over the last year or so, of increasing costs? If you look at solar, probably the most important renewable technology on a global basis, the main driver of the levelised cost of energy (LCOE) decline was a 4% decline in the total installed cost. Put simply the kit needed got cheaper. So far so good.

And then we get to the regional differences. As expected China saw costs down, and it's global deployment market share up (from 38% to 45%). This skewed the global data. By contrast Europe saw massive cost increases, with IRENA reporting prices up 34% in France and Germany, and 51% in Greece. They attribute this, at least partly, to commodity and labour cost inflation. Is this a one off that will reverse over time? We don't know, but if you are investing in renewables in Europe, this is a report you need to read in detail. Don't just skim the headlines.

Just 30 days of storage needed for 100% renewable energy system in the UK?

The debate about renewables seems to most revolve around their variable nature, they only generate electricity when the sun shines and the wind blows. And critics say but what about times when we get long periods of low sunshine and no wind.

Let’s be honest, these times do exist. It’s not really viable to have an electricity generation system that works most of the time. Part of the answer is to use interconnectors, to bring electricity in from adjacent regions who have a surplus, when we have a shortfall. But, this cannot be all of the answer.

So, the question remains, how much storage would we need to cover these low generation periods, if we had 100% renewables?

The UK has a particular challenge, as it relies mainly on wind - which means solutions found here will have a good read across to other countries.

Modelling work led by researchers from the University of Central Lancashire, the University of Southampton and Czech Technical University suggests that a 100% renewable energy system could be delivered indefinitely in the UK with just 30 days’ worth of storage. However, the trick is that there would need to be a significant overbuild – about 115% – of renewable energy capacity in order to achieve this. Lower levels of overbuilding would necessitate much larger amounts of storage.

This of course raises the question of cost. Renewables can often provide the cheapest electricity, but this is based on the LCOE, which excludes the system costs. A topic to come back to …..

Finance and ethics - climate transition plans of the big 3 consumer goods companies.

Sustainability is both an ethics and a financial issue. Sometimes they overlap - as the recent analysis by Planet Tracker of the climate transition plans of the big 3 consumer goods companies shows.

Much of the report highlights progress (or a lack of it) on the companies alignment with the 1.5 degree targets. But they also show that future change, specifically around carbon pricing and climate change impacts, will likely impose a financial cost.

All three companies acknowledge two material risks:

- an evolving regulatory landscape (especially carbon pricing); and

- an exposure to climate and weather patterns.

Planet Tracker estimates that, just looking at scope 3 emissions, if current trends are not further mitigated, the three companies could face a potential financial impact of over $9 billion (2030). To give context to this number, it equates to c. 30% of current combined operating profits.

We want a company’s financial strategy to anticipate future change. We want it to reflect the fact that enhancing the outcomes for stakeholders can also be long term value enhancing (Grow The Pie). New supply chains, new raw material processes, and new sources of competitive advantage can take years to build. It’s better to start now than wait for change to ‘hit us in the face’.

When there is an earnings impact, it can really grab the attention of the board. Back in January we discussed a PwC Global CEO survey in a Perspective that had this attention grabbing finding:

"...nearly 40% of CEOs think their company will no longer be economically viable a decade from now, if it continues on its current path."

(PwC Global CEO Survey)

Link to blog 👇🏾

Please read: important legal stuff.