Will Europe hit its EV targets, or do fines beckon? Who really knows?

Estimates of the fines the European automotive companies might need to pay for missing emissions targets vary massively. Understanding the company strategies is key, but for this we need better disclosure.

"Registrations of new plug-in electric cars in Germany fell by more than a quarter in 2024 compared to the previous year, while the average CO2 emissions of newly registered combustion passenger vehicles rose 4.2 percent, according to the Federal Motor Transport Authority. " Clean Energy Wire Jan 2025

If we don't have at least some visibility about a company's financial future, how can we make sensible investment decisions? And that logic applies as much to sustainability related issues as it does to other strategic challenges and opportunities.

One of the big issues dominating the European automotive sector investment debate relates to the regions 2025 and 2030 EV sales targets, and the question of possible fines if they are not met.

But the implications go beyond the next few years. They also impact the long term future of some of Europe's largest industrial companies, not just automotive OEM's but also their suppliers. How will the transition to EV's in Europe develop, and how well placed are the European automotive companies to beat their Chinese, Asian, and US competitors?

Despite the importance of these issues, shareholders have fairly limited visibility on how this will pan out financially for the companies involved. 2025 has already started and 2030 is close, at least in new car sales terms.

We bash on a lot about the importance of appropriate financial disclosure by companies on sustainability issues. This is partly about enabling shareholders to make more informed investment decisions. But it's also about providing shareholders with the information they need to analyse decisions made by management, and if necessary, challenge them.

EU kicks off auto support plan

It's hardly a secret that the European automotive industry is facing a whole range of challenges. The European Union has started its investigation into what can be done. This kicked off with an industry roundtable, where much of the feedback from the car company's seemed to be about relief from the threat of tightening CO2 emissions rules and the fines that could follow.

But it's possible that any relief from the fines may just end up being temporary. If underlying demand for EV's continues to grow, the region's politicians face two almost equally unpalatable options. They can wait for the European OEM's to ramp up supply, at a price that is acceptable to consumers, or they can let Chinese (and other) suppliers fill the void. And of course if demand does not grow, one of the key planks in the regions net zero plans becomes defunct.

As a recent Forbes article said "Europeans automakers are struggling to meet the (reduced emissions) requirements but Chinese manufacturers are ready, willing and able to meet demand for electric vehicles. This is an outcome EU regulators surely didn’t plan."

The background to the fines the industry may face goes back to c. 2021, when the European Union set the latest targets to reduce CO2 emissions from passenger cars and vans. The current EU-wide targets require a 15% emission reduction by the end of 2025. And the 2030 target is for a reduction of new car emissions by 55%, and new van emissions by 50%, all relative to a 2021 baseline.

Each automotive OEM has a separate target, based on the average mass of its registered new vehicles. Strictly speaking, the targets do not relate to the number of EV's sold, they are based on average emissions.

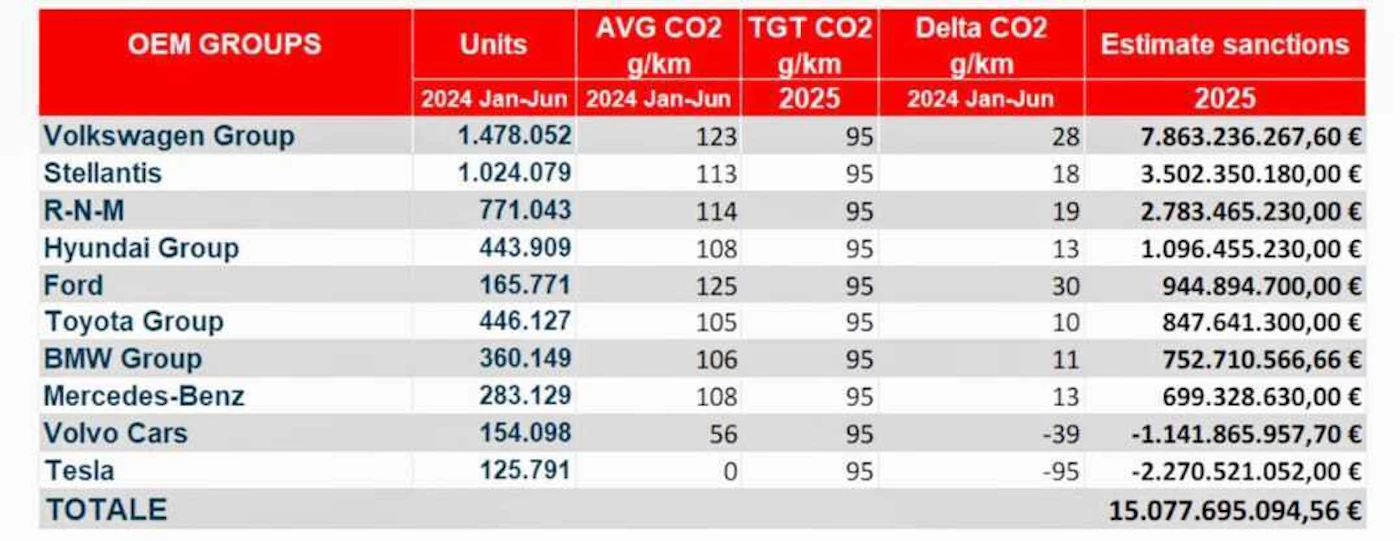

Toward the end of last year there was talk that the total industry could face fines of up to E15bn. And that roughly half of this would be paid by VW. The source of this 'analysis' is not known, but the transport lobby group T&E posted a table of the forecast fines in a blog Why the car industry will not pay €15 billion in penalties in 2025

The table is apparently based on industry sales in the first half of 2024, so before the FY 2024 data was known. T&E pointed out some basic flaws in the table, including the fact that it assumes that each OEM has the same emissions target (they don't - Kia and Stellantis have a higher target and Volvo has the most demanding one).

But their big criticism is that this is a re-run of the 2019 situation. To quote the blog, what happened then was that "OEMs improved CO2 performance by up to 20 gCO2/km in a single year. Privately, carmakers have since acknowledged they were holding back sales in the year before new targets to shift volumes into the compliance year."

I don't know who is correct. I have some sympathy for the OEM's in that sales of EV's in Europe at least partly depend on a series of actions by governments, including subsidy levels, and charging infrastructure being in place. But as T&E pointed out, the industry has been preparing for the 2025 target since 2017, when it was first announced.

My point is a simple one. It's not been clear for a while now how well the automotive company plans and strategies are aligned with the EU targets. And how the measures being taken (or not being taken) by the various governments provide the support needed.

This is not a trivial point for investors. The European companies, along with their global competitors, have invested heavily in the technology. According to a 2024 report from T&E ...

"Total global investment announcements in EVs, battery cells and charging by the 19 carmakers analysed in this study have increased almost six fold between 2021 and 2023, reaching €150 billion in 2023 alone. In total €265 billion of investments were announced during this period".

If we cannot identify what returns the companies expect on these investments, it's hard as investors to make rational investment choices. And it's equally tough for NGO's and other interested stakeholders to judge if the companies, and the respective governments, are doing enough.

We recently wrote about how sustainability targets are pretty meaningless if they are not backed up by financial analysis. As we said back in April 2024, sustainability targets without a meaningful delivery strategy are just goals. And without good disclosure we cannot judge if they are deliverable (or not).

This is too important an issue to be left to backroom deals. We need better disclosure and visibility.

One last thought

Strategy is an area where sustainability professionals have the most to add to the long term success of their organisation. But, strategy is not what most people imagine it to be. It's not about what we would like to happen.

To misquote Richard Rumelt, it's an insightful diagnosis and reframing of a situation, often warts and all, that we use as a starting point to coherently focus our organisations resources, actions and policies.

At its most basic it's about deciding where, and how, we will allocate capital to deliver our target returns. How we get from where we are now, to where we need to be. Does the European automotive industry really have a long term strategy or are they just stumbling from one crisis to another ?

Please read: important legal stuff.