Electricity demand management, jargon and investor communication

We often use too much jargon, and as a result instead of informing investors, we just end up confusing them. This is not a good thing at a time when we want more money to come into sustainability solutions.

"When I use a word… it means just what I choose it to mean – neither more nor less." Humpty Dumpty to Alice (Alice in Wonderland)

Jargon can be essential in discussing complex concepts with other technical people, but we need to abandon it when we talk to investors.

I have been a big fan of electricity demand side management (sometimes called demand response) for a while now. Aside from the obvious benefit of helping to keep the grid stable when electricity supply 'drops out unexpectedly', trimming the demand peaks can save us a lot of money. It's meeting the peaks that is one of the really expensive elements of providing electricity, and so if we can persuade the consumer to shift demand to periods when we have a lot of cheap (surplus) electricity, everyone gains.

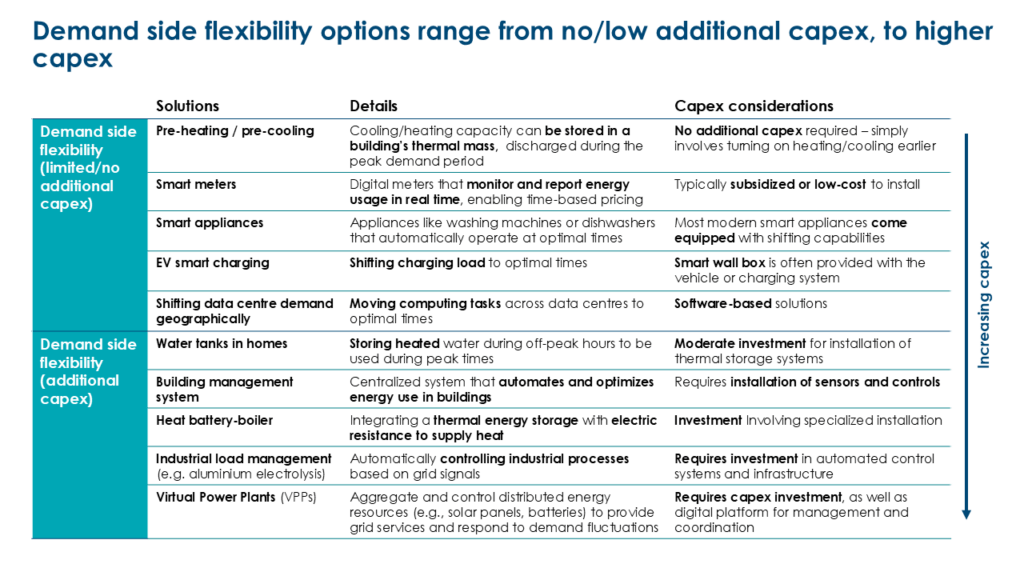

And it gets better. Some demand side management tools are low cost options, requiring limited upfront capex. A good example is supermarket fridges (hence the image above), which can be easily dialled down when electricity demand is stretched (ie expensive). And even when new capex is needed, such as for Virtual Power Plants or VPP's, the payback period can be short.

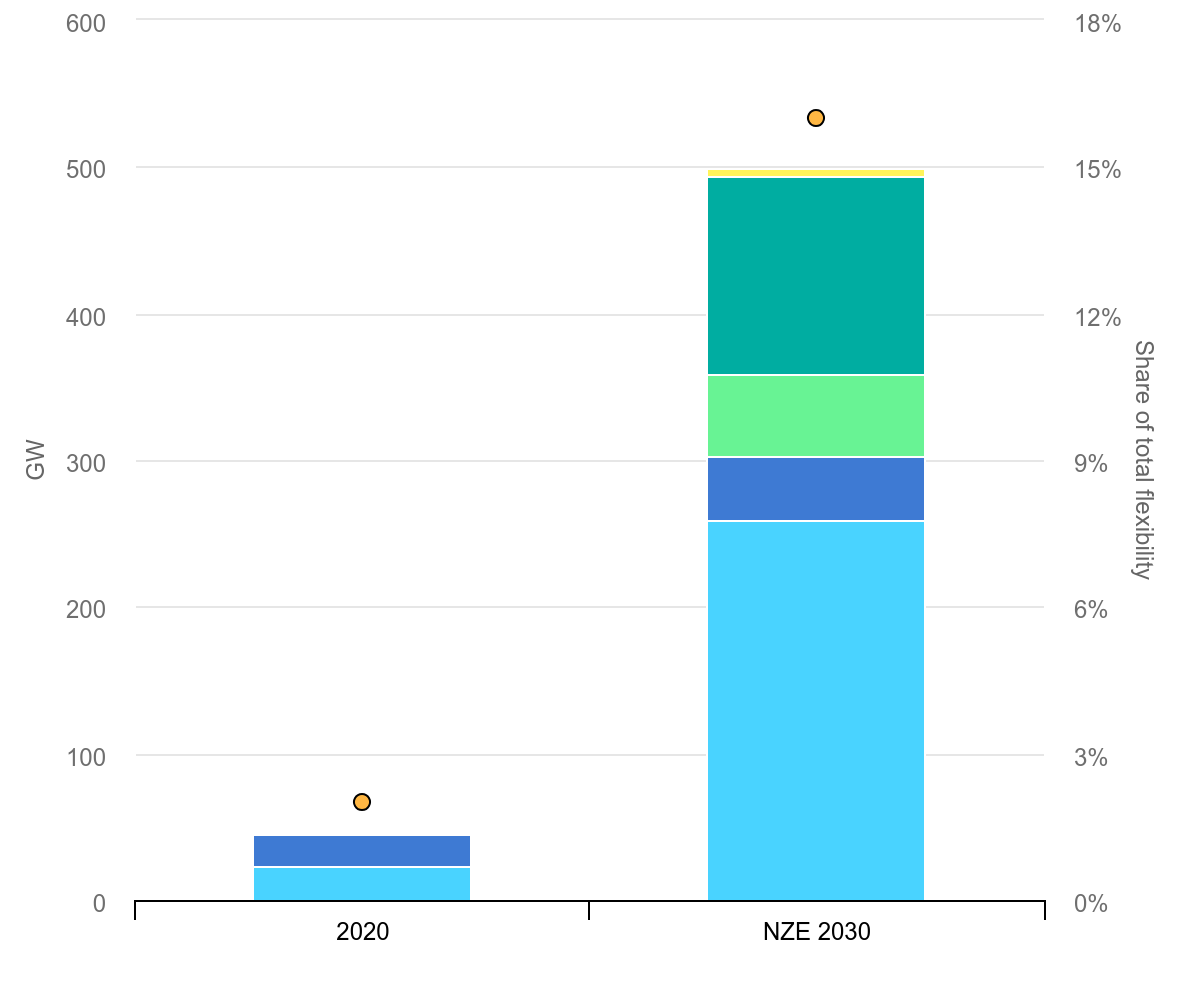

So why is electricity demand management not roaring away? According to the IEA we seem to be well short of where we need to be to meet their NZE 2030 targets.

Can part of the problem be too much jargon?

One interesting explanation is that as an industry we don't explain how demand response works, and the benefits it produces, in simple terms that a generalist fund manager and investor can understand.

In other words we use too much jargon, and when we do so many investors just switch off.

And this doesn't seem to be a problem limited to electricity demand management. We are getting better at explaining the important role that battery storage can play, but we still make the whole issue of grid stability too complicated. And similar situations exist around more sustainable agriculture, buildings and industrial electrification.

Most investors are smart people, but they have to analyse a wide range of industries, and helping them understand our opportunities better also helps us raise capital more easily. Plus it can also help in the important political lobbying process.

And this is not limited to sustainability. As the FT recently argued, we often make the whole corporate earnings reporting process way to compex. But that is a debate for a different blog.

Coming back to demand side response, we need to find a better way to communicate what we can do now, what the benefits are, and where we need to focus research for the future.

Demystifying flex

The Association for Decentralised Energy (ade research) has recently published an interesting report on the use of jargon in describing "the complex and often opaque language used" in describing how demand management works, and the benefits it provides. They focus on how well (or badly) the consumer is informed, but similar conclusions can be drawn about how well the industry communicates with investors.

As they say in the report "while jargon can facilitate efficient communication among experts by condensing complex ideas into shorthand terms, it often becomes a barrier when used outside of its intended audience. Individuals who use jargon frequently overestimate how well others comprehend it, leading to miscommunication as it is less often used or understood by individuals outside these groups. "

What they did was look at the terms used in the various industry communications, and divided them into jargon and non jargon, with the implication being that jargon terms are only really properly understood by industry insiders. The situation was not too bad in consumer focused communication, but when it came to technical and regulatory discussions, jargon dominated.

Of the 259 terms they identified as being used across Grid Operations and Management, DSO/DNO Specific Terms (Distribution System Operator and Distribution Network Operator - yes I know more jargon) , Market Mechanisms, and Financial Terms, 174 were identified as jargon.

Yes, I understand that many of these are very technical subjects. And that the terms used have very specific meanings that aid in discussions between industry insiders. But, at a time when we need more finance not less, we need to find a way to make the industry more understandable.

Why is this important? Because demand response can make it easier to roll out more renewables. A recent blog from the Energy Transitions Commission sets out the range of actions we can take with regard to demand management, and splits them out by their upfront capex needs. Actions at the top of the table are cheap, and frequently easy, to implement, while those toward the bottom need more up front investment. We do not lack technically viable solutions.

One last thought

As we build more variable renewable electricity generation the way our electricity grid works will need to change and change dramatically. This will be a massive disruption to the existing system. While some of it will involve building new hardware, there is a major role for smart software solutions. It's not a change that we can let happen in the background, both investment and sustainability professionals need to be actively involved.

Please read: important legal stuff.