Insurance industry creating impact and risk-adjusted returns

There are a number of ways in which insurance companies can have a positive impact - and make money at the same time.

Summary: QBE's Premiums4Good programme, now extended to Asia, is an example of how money can be put to work creating positive impact whilst earning a fair return.

Why this is important: Insurance companies can create impact by choosing not to underwrite projects that could adversely impact the transition, invest in impactful projects that generate a return or by reducing their own underwriting risk by directing capital to projects mitigating the harmful effects of climate change.

The big theme: The finance industry can play an important role in the transition through its funding and investing activities. Insurance companies can play a triple role through their choice of projects to underwrite, their choice of investments and activities in the sustainability space that ultimately reduce the risk they are underwriting.

The details

Summary of a story from Asiaone:

QBE Asia has extended the Premiums4Good programme (originally launched in selected regions in 2015) to the Asia Pacific region. At no extra cost to the customer, a proportion of their premiums are invested in projects that create social and environmental impact whilst making a financial return. Chief Underwriting Officer for QBE Asia commented that "Premiums4Good demonstrates … how social value can integrate perfectly with business value to deliver both attractive risk-adjusted returns and positive social and environmental impact."

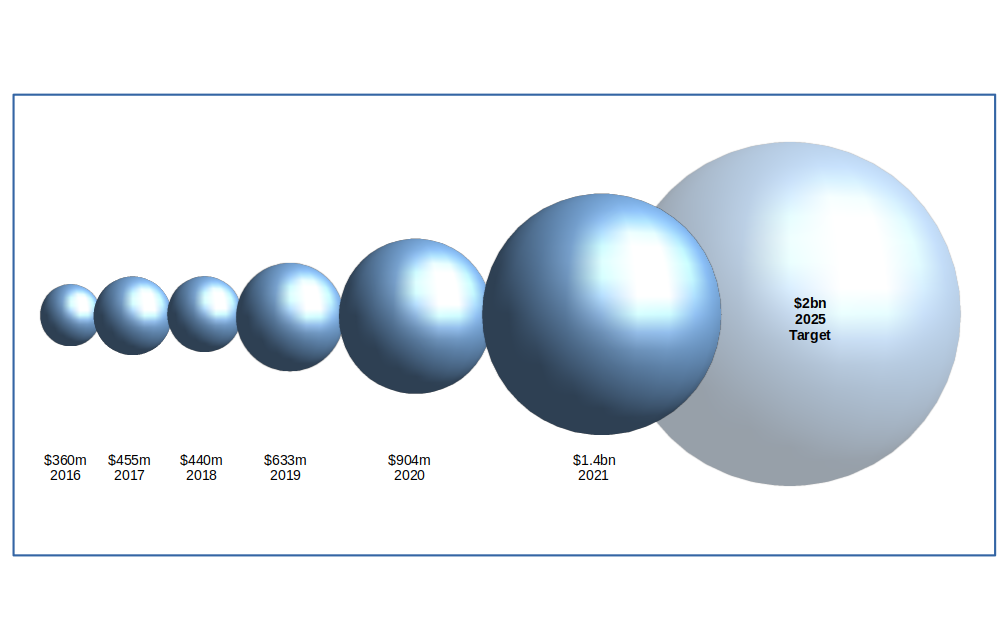

As of 31 December 2021, QBE has invested US$1.4 billion through the Premiums4Good programme with a target of investing US$2 billion by 2025. An example of such an investment is in the Asian Development Bank’s Gender Thematic Bond allowing communities to fund social protection and health programmes to support prevention and response to gender-based violence.

Let's take a look at why this is important...

Why this is important

I am sure you will have seen and possibly participated in the well documented debate about whether fiduciary duty would be breached by actors in the financial system. There were some prescient insights from Tom Gosling on GFANZ in particular. At a broader level, Alex Edmans has also commented that “...Finance 101 has always stressed how a company’s worth is the present value of all its cash flows, including those in the very distant future, and must take into account any factor that affects future cash flows. A company’s relationships with its employees, customers, communities, suppliers, and the environment are highly value-relevant."

Extending that last point to insurance companies, there are three ways insurance companies can create impact. Firstly through choosing not to underwrite projects that adversely impact the transition, for example insurance companies walking away from the Adani Carmichael coal mine project or Canada’s Trans Mountain pipeline. From a pure returns point of view such action may result in better or worse returns over the lifetime of the project to the insurance company. It depends on the project.

However, secondly and thirdly, programmes such as QBE’s Premiums4Good aim to generate both returns (good for the investment side of the business) and impact to help with the sustainability transition can also help reduce their underwriting risk too by, for example, investing in sustainable energy to reduce the risk of outages. This is not necessarily new. Look at the gamification of fitness by health insurance companies offering discounts for activity (as measured by your fitness tracker) or telematics enabling insurance companies to reward safer drivers with lower insurance premiums. In both cases, their aims are to reduce the likelihood of a payout event occurring. So perhaps risk, reward and impact are more common bedfellows than at first glance.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.