The beauty of simplification

Sustainable investing evangelist Nawar Alsaadi had a really interesting post on LinkedIn comparing the internet portals of the 1990s to the ESG and sustainability data companies of today.

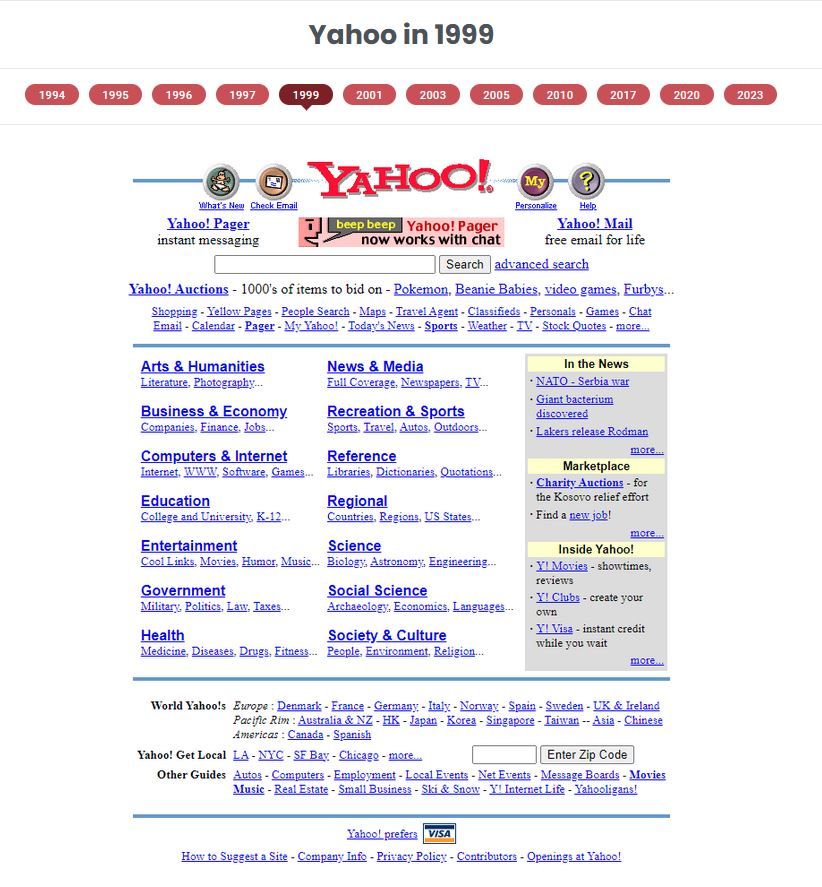

I certainly remember the days of Lycos, Yahoo!, Altavista etc and as Nawar points out they built themselves on being one stop shops with EVERYTHING you might ever need on the one page, classifying and categorising so you were 'one click away'. Here is the Yahoo! home page from 1999:

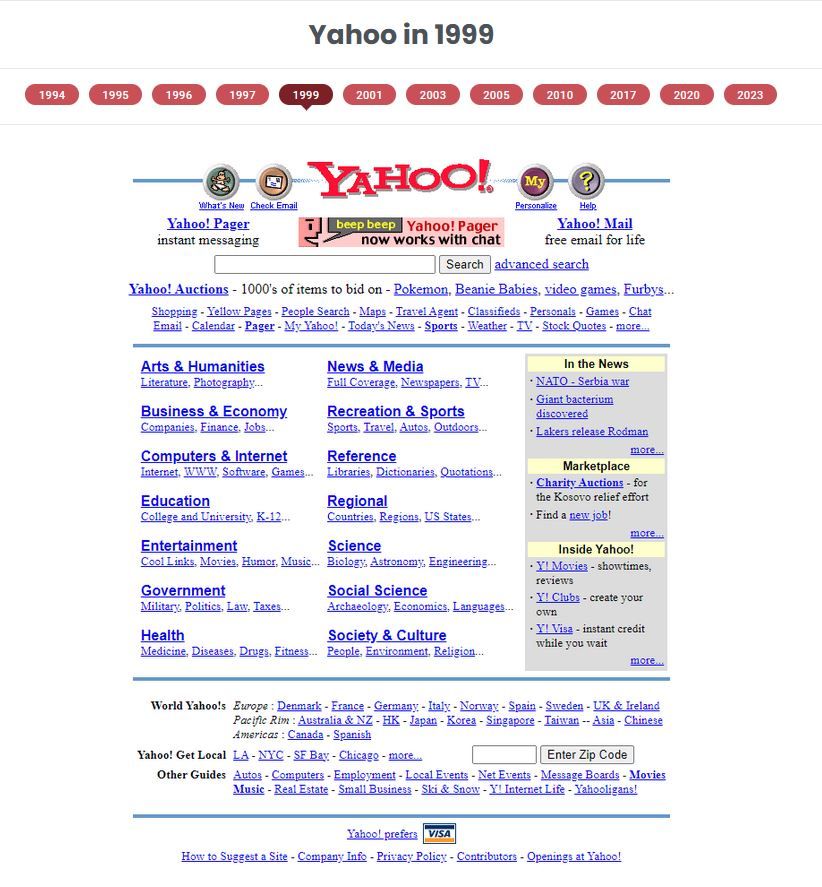

Then Google came along and got rid of all categories and classifications and, as Nawar puts it, offered "a singular, highly accurate search function."

By contrast, here is the Google home page today:

Nawar believes that "ESG and Sustainability companies need to heed up the 1990s lesson of needless complexity and understand that less is more."

In a product offering, "[c]omplexity creates the illusion of value, but in reality it takes away from value."

Now given that last point, it may seem strange for me to be highlighting a blog by Steven on how the ESG debate has become too simplistic.

My understanding of the point Nawar is making is that the product offerings should be simple in their delivery allowing investors, capital allocators and project managers to focus on what is important. As Nawar says, "it is very important to distinguish between audit level sustainability data, and decision useful sustainability data. The former requires accounting-like precision of hundreds, or even thousands, of data points, but the latter requires, the capture of a handful, of pertinent data points."

The sustainability and ESG finance debate overall has been oversimplified to the point where many have inadvertently over promised (and under delivered). Investors have somehow been given the impression that by investing in positive ESG scoring companies they can have it all - good financial returns, alignment with their values, and at the same time saving the world. All at no cost. That has also given ammunition to those who want to slow the process. Knowing the ‘what’ and ‘why’ of the requirement for investment helps one avoid green washing and green wishing (hoping that an easy and cheap solution makes the problem go away). Put simply, it allows us to better allocate our capital to projects that make a real difference.

For the decision makers though there is no substitute for doing the work and understanding the real world complexity (actually that has always been the case!) Otherwise we end up investing our capital in projects that make little or no difference, other than to make us feel good - what economists would call a mis-allocation of capital on a grand scale. That is where the integration of sustainability professionals into the process can help greatly.

Link to blog 👇🏾

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Please read: important legal stuff.