Sunday Brunch: Why investors need companies to have a vision

Companies make strategies, investors just critique them. And to do this well, we need companies to have a clearly set out vision for how their industry will look in the future, and how they will fit in it.

As an investor I own a part of a company, but I don't run it. That is the job of management and the board of directors. If I don't like how the company is run, I look to the directors to implement the required fixes. And if they don't, I look to replace them.

How do I decide if they are doing a good job? Partly it's about financial return and the share price, but it's also about the strategy they set. Because investing is about the future, and a company's strategy is key to its future success.

As an investor, I don't make the strategy. Again, that is the job of management and the board of directors. All I can reasonably do is critique and if required challenge, the strategy. Do I think it positions the company in the right way, does it add value, or does it expose the company to unnecessary risks?

How can a company 'help me' do this? By providing a meaningful vision of their future. How they think their industry will change, what this will do to their sources of competitive advantage, and how they will invest to position the company for this new future.

And this applies as much to the sustainability transitions as it does to other long term changes and trends.

Strategy understanding is not the same as strategy creation

I have only been involved in actually creating a company strategy a couple of times. But over my finance career I have evaluated hundreds of different examples. Some were easy to evaluate (from an investor perspective), while some were frankly almost impossible.

The difference often came down to how well the company had set out it's vision of the future.

By vision I don't mean some wonderful sounding but ultimately meaningless dream. Richard Rumelt, author of Good Strategy/Bad Strategy, calls this problem "fluff." Fluff is a superficial restatement of the obvious combined with a generous sprinkling of buzz-words. Fluff masquerades as expertise, thought, and analysis.

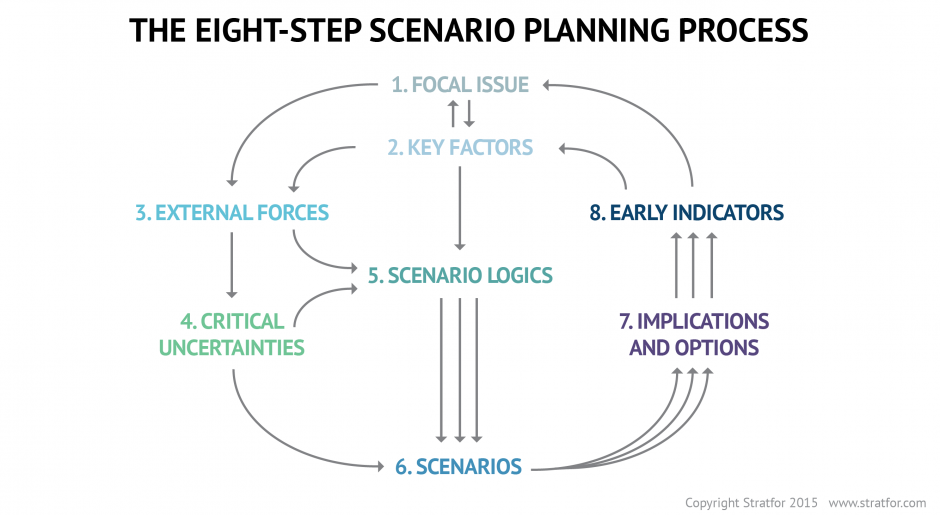

Many company strategies start with scenarios. As Jay Ogilvy stated in his 2015 Forbes article on scenarios and strategy, " each scenario should contain enough detail to assess the likelihood of success or failure of different strategic options".

Each industry will have its own examples. Again quoting Jay Ogilvy, "in education, the spread of massive online open courses. For energy, new technologies for decarbonisation. And for entertainment, oscillating paradigms between big screen blockbusters and fare that fits on mobile screens." And more recently, automotive companies are having to consider the impact of the rise of EV's.

My first question as an investor is 'are the scenarios representative of possible futures'? I don't want a company to cherry pick scenarios that justify 'business as usual'. I also want them to test scenarios where the future is different from the present, and where they need to adapt and invest.

A good example of this can be found in the mining sector. For some companies, iron ore and metallurgical coal are very important market segments. Both are currently used at scale in traditional steel making, using what is known as the Blast Furnace - Basic Oxygen Furnace (BF-BOF) process.

While this process can sometimes be the cheapest option, it produces a lot of GHG emissions. And so there is increasing pressure on steel companies to invest in lower carbon emitting technologies. Some of these are fairly new, and as yet unproven at commercial scale. But the technologies are advancing rapidly.

One issue for mining companies is that some of the new technologies require higher grades of ore. Which can be a problem if most of the ore you currently mine 'doesn't make the cut'. Or if it needs further processing to make it suitable - which requires investment. Plus many of the future solutions will not need metallurgical coal.

These are no longer impossible scenarios, and mining companies need to take them seriously. Some are already doing this, but others are not.

As investors we need the scenarios used by these companies to also include possible future outcomes where current production is no longer viable, or where it will need material investment to make it viable.

To be clear, this is not about saying "this technology will definitely win out". What we are saying is that we need companies to consider a range of viable outcomes or visions, not just the ones that work best for them. And disclose to us what the financial implications will be, the bad news as well as the good.

This enables us as investors to make informed choices. And it gives us a practical platform for engaging with the companies management and board of directors.

One last thought

Are company directors properly discharging their fiduciary duty if they don't take into account the changing landscape in which they operate? In other words are they taking account of future risks and opportunities in their decision making. Including climate and systemic risks. Are they using appropriate foresight?

Some directors may have taken a degree of comfort from a recent case involving Client Earth and Shell, where the court declined to allow the case to proceed. But as The Commonwealth Climate and Law Initiative (CCLI) pointed out,"directors will want to consider climate-related risk to avoid potential costs to the company."

They go on to say "since derivative claims can also be made against former directors, decisions that directors make today could lead to future liability once loss has crystallised. The court will consider whether, based on the knowledge that was reasonably available at the time of the decision, directors failed to give due consideration to early warning signs."

This is a very real issue for the Polish energy company Enea, who greenlighted the construction of the Ostrołęka C coal fired power plant in 2018. ClientEarth took legal action against the project in 2018 and won their case in 2019. A couple of years later Najwyższa Izba Kontroli, Poland's Supreme Audit Office, recommended action against former board members of Enea.

Now the current management of Polish energy company Enea, with the backing of 87% of Enea's shareholders, are suing the company's former directors and insurers for lack of due diligence over the project and investment decision which has ended up losing the company PLN 650m (USD 160m).

Please read: important legal stuff.