Sunday Brunch: why do we have equity markets?

Financial markets exist to provide liquidity, and to enable companies to raise new financial capital. Or do they? Are they more a mechanism to generate financial returns. If so, what might this mean for sustainability.

“Capital markets allow traders to buy and sell stocks and bonds, and enable businesses to raise financial capital to grow."Federal Reserve Bank of St Louis

I think if you asked most economists and politicians why we have capital markets (such as Nasdaq and the London Stock Exchange) many would talk about efficiently allocating finance to activities and firms. And as the St Louis Fed quote above illustrates they would also probably talk about raising financial capital to grow. And this seems to be a view implicitly shared by many sustainability professionals.

But is this correct, and if it's not, how might it change how we deal with many of our biggest sustainability challenges?

Let's start at the beginning. Efficient capital allocation sits at the heart of how many sustainability organisations think about equity markets. And it impacts how we think our actions will drive change.

A good example is the European Union green taxonomy. This is a classification system that defines criteria for economic activities that are aligned with a net zero trajectory by 2050 and the broader environmental goals other than climate. What is its purpose ....

The EU taxonomy is a cornerstone of the EU’s sustainable finance framework and an important market transparency tool. It helps direct investments to the economic activities most needed for the transition, in line with the European Green Deal objectives - European Commission website

The taxonomy is a good thing, but to believe that it will, on it's own, make a material difference, we need to agree that financial markets care about directing investments efficiently. All they need is the 'right' information and analysis.

Here is an alternative view, one that I suggest is shared by many people in the investing industry (especially those who work for asset managers - those who manage other people's money for them). As an industry, we don't really care about the efficient allocation of financial resources.

To us, the capital markets are a mechanism to deliver financial returns. We buy those stocks or bonds that we think are cheap, and sell those we think are expensive. And most of the time, at least in equity markets, we are trading with other investors. Very little of the trading is related to enabling businesses to raise financial capital to grow.

It's largely different in the bond (debt markets) but for today I want to stick with equity markets - which is where much of the attention of sustainability professionals is currently focused.

It's also worth pointing out that this is not a view shared by all asset owners (the pension funds etc whose money it is that asset managers invest). There are issues such as universal ownership which mean that the efficient allocation of capital can (and should) be a real concern for them.

The implications for sustainable investing

If this alternate approach is correct, many investors are not really that concerned about an efficient allocation of financial resources to 'economic activities needed for the transition'. What they mainly consider is 'is the share that I can buy cheap or expensive?'.

This in turn can impact how asset managers engage, and on what topics, with the companies that they are invested in. And how they vote - although pass through voting is starting to change that. And more importantly, it impacts what sustainability issues they analyse and worry about.

If they think that a sustainability issue can create a future risk or opportunity, that is not currently well understood (and hence is not already in the share price), then this will be something that they will give a lot of attention to. This could cover everything from future regulation, emerging technologies and process, and changing end customer demands.

It's worth repeating, this concern is often not because investing that way will aid the transition. It's because identifying this type of mis-pricing is a good way to deliver financial returns.

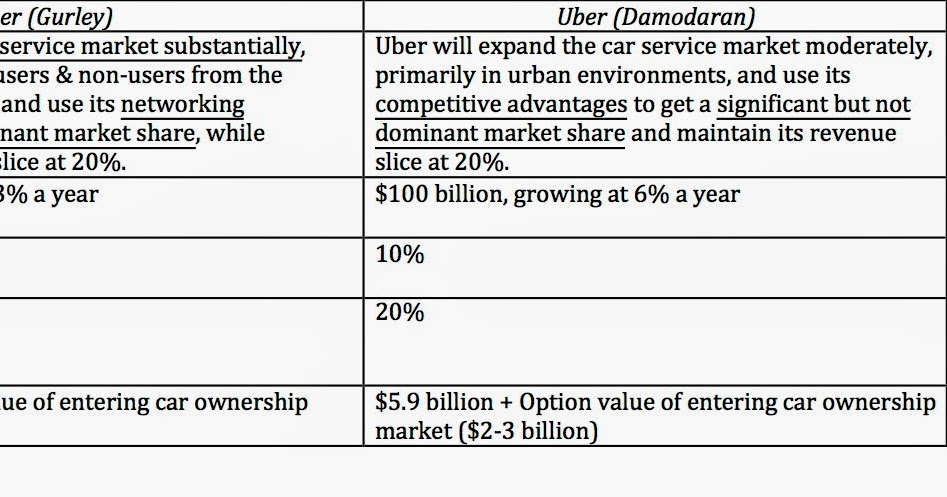

If this is true, then one important focus of our engagement and lobbying should be on the possible financial implications of the sustainability transitions. And in thinking about this it's worth considering the distinction made by Aswath Damodaran on the difference between what is possible, what is plausible, and what is probable. As he puts it ....

"the difference in the narratives boils down to a simple calculus of what is probable, what is plausible and what is possible, a distinction that to me is at the center of value."

For asset managers, an event doesn't have to be probable/certain - if it's just possible or plausible, and the financial consequences would be material, then it's something they will seek to analyse, and to get the company to better manage.

One last thought

A good example of plausible and material events is the impact of rising sea levels. These are not just a threat to people. They also could create material financial risks, from what we call asset impairment. And given the long asset lives of most infrastructure, the risk is getting closer than you might think. We talk a fair bit about peoples homes (via not being able to obtain flood or fire insurance). But the same issues apply to businesses - risks in raw material supplies, failure of supporting infrastructure , and (again) insurance.

Please read: important legal stuff.