Sunday Brunch - who decides the topics for engagement?

Unless you have been living off grid, you will know that one of the defining debates around ESG and Sustainability relates to engagement - by which we mean interacting with companies to get them to change their behaviour.

"I don't use the word ESG any more, because it's been entirely weaponised ... by the far left and weaponised by the far right," Larry Fink CEO Blackrock

Our view - Unless you have been living off grid, you will know that one of the defining debates around ESG and Sustainability relates to engagement - by which we mean interacting with companies to get them to change their behaviour.

This has often been defined in terms of fiduciary duty. Should asset managers only care about delivering the 'best' financial return for their investors/clients, or should their role be wider (and if so how much wider)?

Many people argue that asset managers, such as say Blackrock, should be engaging with the companies that they are invested in on a broad range of Environmental, Social and Governance issues. But a key question that remains largely unanswered in this debate so far is how does the asset manager decide what topics to engage on, and how do they decide what changes they want to see happen? The answer is not as obvious as it might seem.

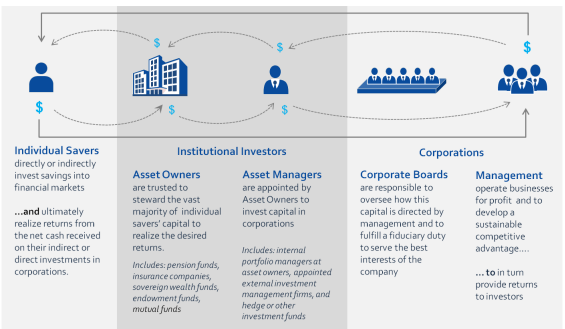

We don't think it's for the asset manager alone to decide this. This is something that their clients, the asset owners and the individual savers in the investment value chain chart below, should also be heavily involved with. We need to find a way that this can happen, so that the choices and tradeoffs implicit in sustainable investing are well understood upfront. This goes beyond voting.

One final point before digging down into this topic - there is absolutely nothing in this debate that impacts the ability of asset managers to offer sustainable products to their clients. Or to make engagement on specific issues part of their mandate. This is simply about the best way to deal with issues that have both financial and societal dimensions.

If you are not yet a member, to read this and all of our blogs in full...

Who decides the topics for corporate engagement?

This week's Sunday brunch is a bit denser than normal. Sorry about that - but we think this is an issue that is worth exploring.

We are often told by investing professionals that the answer to the engagement question is that asset managers should work with companies on any topic that 'can impact the financial value of the company'. But what does this mean, and where do we draw the line? Does it mean that asset managers shouldn't engage on societal values related questions?

Surely many societal issues can also impact financial value - even if it's only in the longer term.

This is not as clear cut as you might first think.

I recently watched an interesting interview that Tom Gosling did for the European Corporate Governance Institute (yes, it's an exciting life we lead). He spoke with Professor Jill Fisch from the University of Pennsylvania Law School. The interview got deeply into the detail of corporate governance and engagement.

At its heart there is a simple point.

And we would suggest that this blurring will increase as the investment community, both asset owners and asset managers, become more aware of how much what used to be called non financial issues actually have financial implications.

Financial value and societal value in agriculture

Let's take an easy example. Agriculture and it's impact on deforestation. Thinking specifically about palm oil. Is this a financial value or a societal values issue?

If you were a believer in the old definition of fiduciary duty, you might argue that it's not a financial issue at all. After all, no laws have been broken, and it's for individual countries (such as Indonesia) to decide if they want to protect their forests or not. And if asset owners and individual savers want to lobby governments and companies to protect the rain forests, that is their choice. But it's not really a matter for the asset manager to engage with companies on, unless of course they (the asset managers) are marketing themselves as sustainable investors.

But, many people (including us) think this approach to financial value is too narrow, too short term. The scale of many of the societal value issues is such that they are going to financially impact companies. If not now, then in the future. And these future changes impact financial value. Put simply, companies that anticipate these changes, and that prepare for them, will often be better placed to keep on creating value for all of their stakeholders, including shareholders.

How might this happen? Lobbying might cause Indonesia to change its approach to deforestation. Or consumers might decide to boycott companies whose palm oil products destroy virgin forests. Or Europe might adopt a new law that obliges companies to ensure products sold in the EU have not led to deforestation and forest degradation (oh yes, that has already happened).

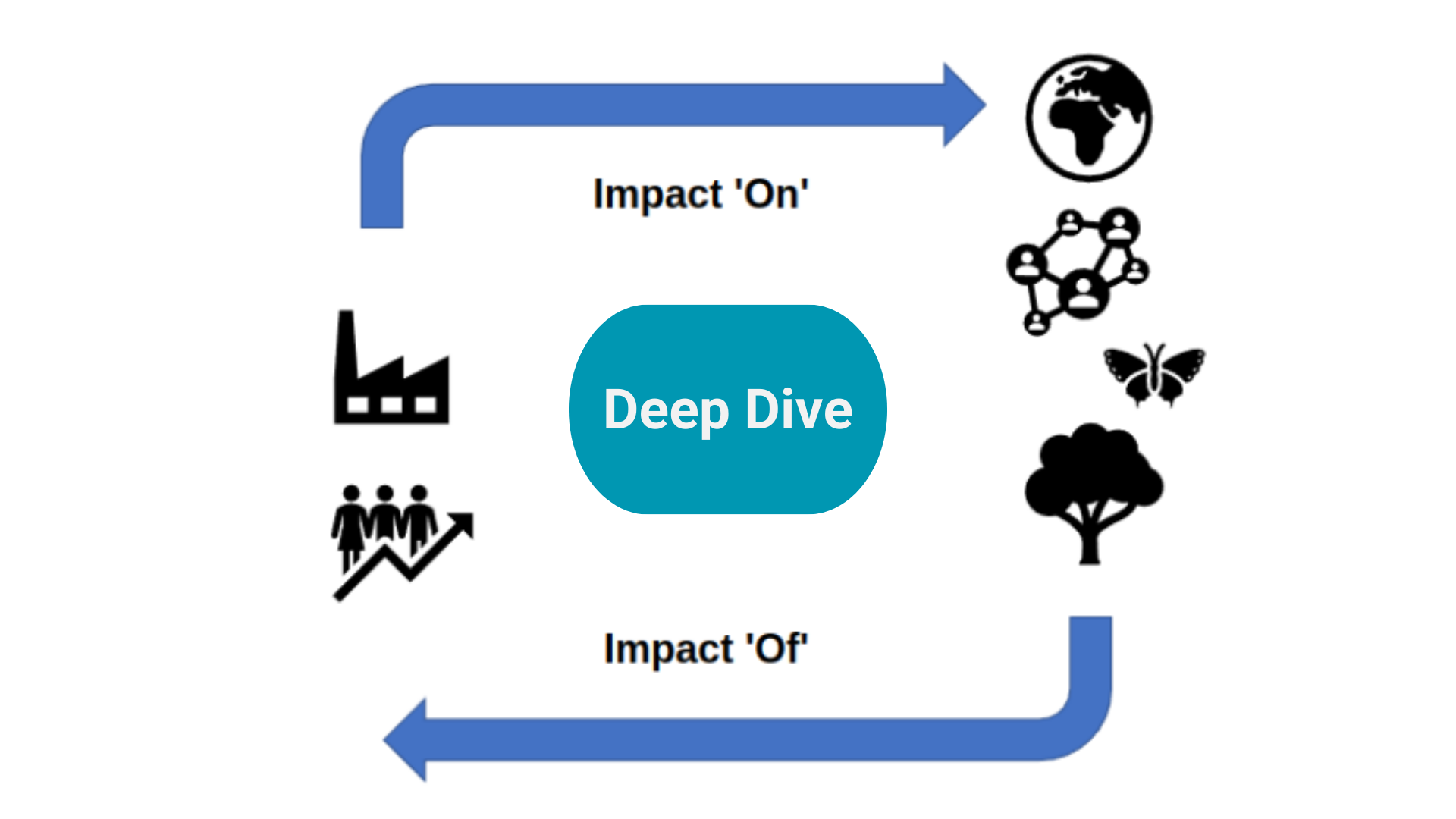

It's important to recognise that this discussion is subtly different from the debate about single materially vs double materially.

That distinction is related to the difference between external changes due to environmental and social issues impacting the company (single materiality), as opposed to the impact that a companies actions have on the wider environment (double materiality).

The engagement debate is more about how we identify the dividing line between a social and a financial issue, and (most importantly) who makes that decision.

The Universal Owner cares about wider society as well as financial return

One final piece of the jigsaw. The concept of the Universal Owner. This started as a recognition that very large institutional investors with diversified portfolios (such as sovereign wealth funds) own a representative share of the entire economy. So their interests should be aligned with those of the wider public and society. Costs to society are costs to the universal owner.

Many people, including us, have widened this out to argue that many smaller institutional asset owners and retail investors are in a similar position. Their long term financial returns are driven more by the value created in the wider economy rather than by their 'stock picking' abilities. So, any action that materially damages the long term value of the wider society, also impacts them and thier stakeholders.

If this is a topic that you are interested in, I highly recommend a book by Jon Lukomnik and James Hawley. It's a tough read, but really worth it. And of course, other book sellers are available.

So - who should decide and how should this happen?

We argue that asset managers are actually really poorly placed to do this. They just don't have the required information to decide. After all, it's not their money.

But, there is a solution - they can ask their clients, the original providers of the capital they mange. They do this already with some large institutional clients, but we think they should be consulting with all of their clients, everyone from retail investors through family offices to smaller pension funds and endowments.

But, this cannot we a simple 'what do you think on this topic' question. There needs to be a lot of preparation before the question is asked (highlighting both the pro's and con's). And the trade offs between values and financial value need to be made as clear as possible.

Once they have this information, it's very possible that some asset owners will accept a tradeoff between financial and societal value. This is something that Netspar has been investigating via stated and revealed preferences (something I used in transport planning a few decades ago). They have recently published a study that looked at the preferences of a large UK pension scheme.

The point is - we don't know what is important to asset owners, including retail investors, unless we ask them.

The obvious follow on question to this is 'how do we ask', and what educational material do we need to provide in advance, so that informed choices are made. This is going to be the subject of a future Sunday Brunch.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.