Sunday Brunch: what is important for food producers

The key issues for food companies - healthier diets and climate resilient supply changes. Do you really understand where the food companies you are invested in, or involved with, stand on these key issues.

“You gotta make a change. Its time for us as a people to start making some changes, lets change the way we eat". Tupac Shakur

Last week I talked about how little we really need to know about a company to make a good investment decision. And how it's pretty similar on sustainability as well. Once we understand how a company can be financially successful in the long run, we will have made a good start on identifying how it can be made more sustainable.

I have had a couple of pushbacks on this. The first is that there is a long list of things a company has to deliver on to be successful. We cannot focus on just a couple of issues. Attention to detail and execution matters.

And yes, this is true. For instance, if you are a branded food manufacturing company you need to have good cost control, a strong route to market/distribution system, and consistent investment in branding and marketing. All very important.

My argument is that delivering on these issues is a must have just to be in the 'middle of the pack'. Most companies operate in highly competitive segments, and they need to be better than average if they are to deliver superior long term financial and corporate success. Our small number of key issues are what turns an average company into a long term outperformer.

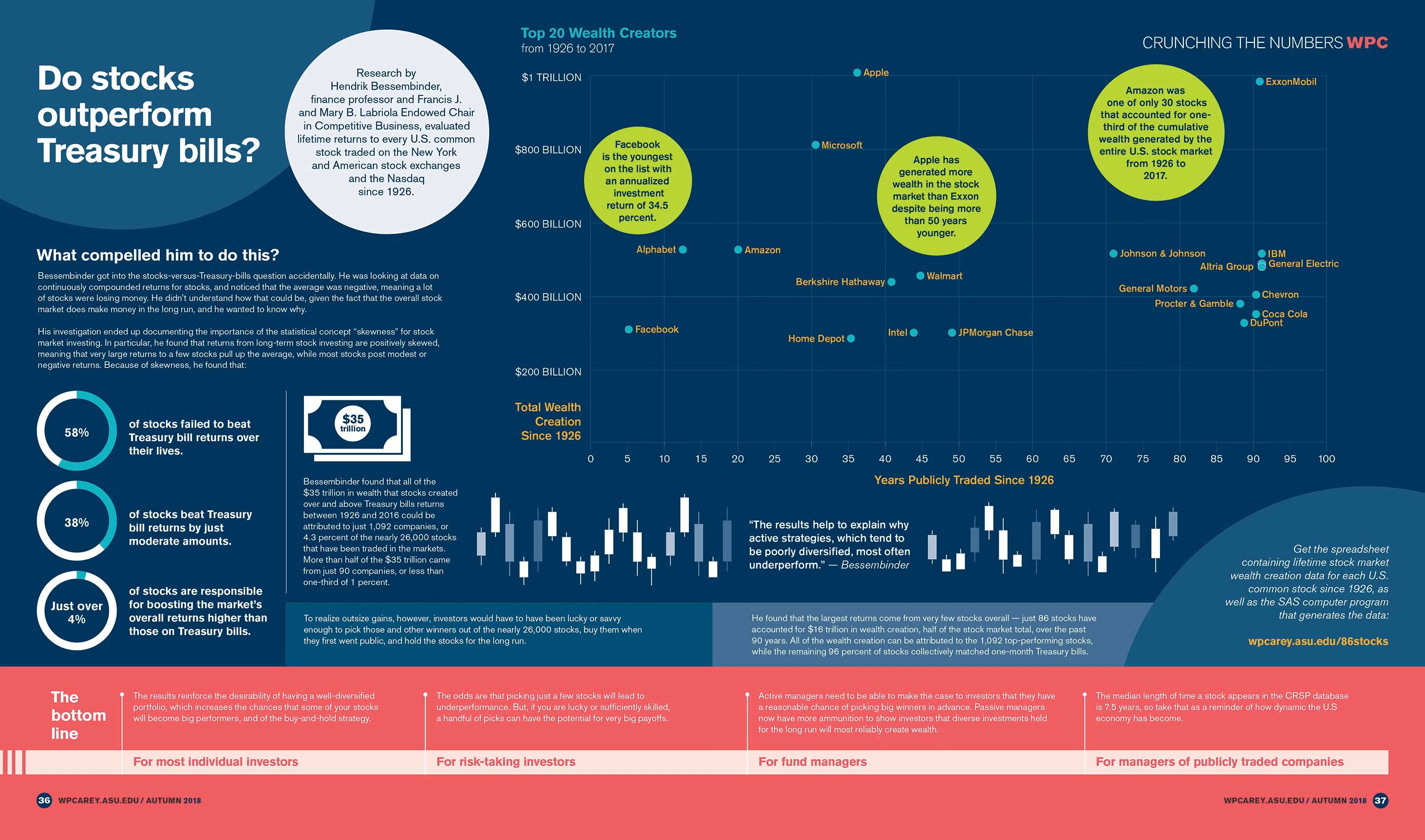

The second is that being an excellent company (strong moat/barriers to entry etc) doesn't mean that the company will be a good investment. I will come back to this in a future blog. But in the meantime you might want to read some research from Hendrik Bessembinder at ASU’s W. P. Carey School of Business. He has identified that:

"the largest share price returns come from very few stocks — just 86 stocks have accounted for $16 trillion in wealth creation, half of the stock market total. And all of the wealth creation can be attributed to the thousand top-performing stocks, while the remaining 96 percent of stocks collectively matched one-month T-bills."

And for those coming from a non financial background, this means that if you invested in the 96% of stocks that only collectively matched 1 month T-bills, you will have got a very low risk adjusted return. Basically you would have done just as well putting your money in short term government bonds. But with an equity risk.

Long term success factors for branded food companies

I argue that two issues will dominate the future for food companies. And both of them have strong sustainability links.

The first is healthier food. While we can debate the precise definition of what makes food healthier (as an example have a look at the debate around how to define ultra-processed food), the direction of travel is clear. Consumers are seeking food with less sugar, fat, salt and additives. Plus, there is a shift toward plant based alternatives, and functional foods.

This shift is both an opportunity and a challenge for food companies. The opportunity is sector growth. Estimates suggest that demand for plant based foods could rise in low double digits % pa, and so this is a good category to be exposed to.

The challenges however also exist. For many consumers 'some processed foods can be convenient and affordable'. Healthier foods can be more expensive, which is important at a time when consumer budgets are already stressed. Food producers and supermarkets face the risk that if they shift to selling healthier options, and their competitors stay with processed foods that consumers currently 'like', they could lose market share. And market share really matters to branded food companies and retailers.

The sustainability link is clear. According to a 2016 study from the Oxford Martin School, a global switch to diets that rely less on meat and more on fruit and vegetables could save up to 8 million lives by 2050, reduce greenhouse gas emissions by two thirds, and lead to healthcare-related savings and avoided climate damages of $1.5 trillion.

The second key issue is supply chains. Where companies source their materials from is becoming more and more important. Part of this is supply chain resilience and part is regulation. As investors we tend to talk more about regulation (and the social pressure that drives it). I argue we need to think more about resilience. Disrupted or broken supply chains, especially for key product lines, should be a key topic of discussion.

Do you really understand where the food companies you are invested in, or involved with, stand on these key issues. And what they are doing to adapt and mitigate the risks? In many cases a failure to prepare could turn them from good investments to middle of the pack.

Life is what happens to you while you're busy making other plans

Some of you may have noticed that I have published a bit less over the last couple of months. To misquote John Lennon, life happened and it was messy. As a result I am taking a bit of time out, and so I will be publishing a bit less through March and into April. All going well, I will be back to full steam ahead by later in our spring.

One last thought

Climate change is going to alter what can be grown where, and the yields that farmers can deliver. This is very likely to lead to higher prices. And yet current financial reporting by companies in the agricultural and food value chain doesn't really talk about this. This needs to change.

Some obvious examples include coffee, cocoa and grapes, but in reality, this is just the tip of the iceberg.

Please read: important legal stuff.