Sunday Brunch: sustainable finance and the innovation curve

Sustainability is a massive strategic challenge, using the innovation curve can help our preparation. The sustainability transitions will bring change, and executing change is tough. A good strategy is key. Sustainability professionals have a key role in preparing organisations for a new future.

“People just aren’t naturally oriented towards innovation or change” Loran Nordgren - Kellogg Business School

The sustainability transitions are one of the biggest challenges that many organisations will face over the coming decades. They will require a massive change in business models. This type of change is difficult, and it's doubly difficult for finance people if the benefits are not explained to them in concepts they understand. This failure can result in roadblocks and delays, to the long term detriment of the organisation - both socially and financially.

If we are to actually make the sustainability transitions happen on the ground, we need to mobilise vast amounts of private sector finance. And to enable this, we need to find ways to use the language and culture of finance to drive change. The concept of the innovation curve can help in this. And not just in the way you may think. Yes, its a great tool for marketing. Explaining how with the right sort of focus we can grow a market, with different messages targeting different groups.

But it's application is much more powerful than that. It can also set out what actions, what investment, we need to make to get the market to grow. And this can be incredibly useful for sustainability professionals in their discussions with their finance colleagues.

"Innovation is one-percent inspiration and ninety-nine-percent perspiration" - Thomas Edison.

Innovation doesn't blossom on it's own, it needs planning. It's a bit like strategy. The high level aim is easy, it's the hard, detailed work that precedes and follows the inspiration that actually delivers the real change.

The innovation curve is a useful tool in explaining to finance professionals where we are as an organisation now, where we are aiming to get to (our strategy), and perhaps most importantly, what we need to invest in to make our planned future a reality.

A good example in the sustainability transition world is electric vehicles. All of the best policies and targets will not deliver more electric vehicles. What will ? Investment in everything from production plants, vehicle design, battery technology, supply chains, new materials, charging systems and vehicle servicing. Yes, good policy can really help get us over the hump, but on it's own it's not enough.

If you are not a member yet, to read this and all of our blogs in full...

Most people support sustainability until .....

We know that the majority of people, in companies and in the wider public, support the general idea of sustainability. And this support continues right up until it comes to making the required sacrifice, either financially or one that requires major changes to their lifestyle or how they work.

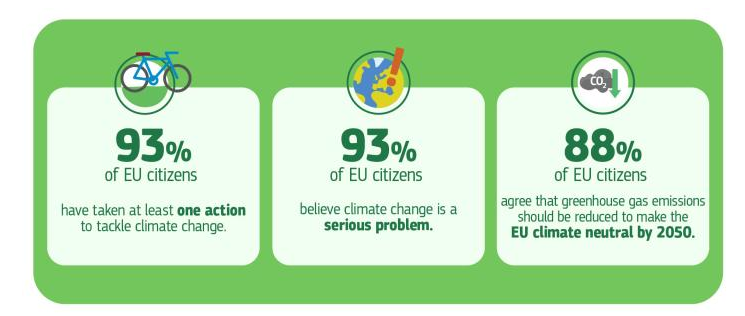

Looking across Europe, measures to reduce greenhouse gas emissions get widespread support. In a recent survey for the European Union 93% of citizens think climate change is a serious problem, and 88% agree that greenhouse gas emissions should be reduced to make the EU climate neutral by 2050.

So why such limited change?

If there is so much public support, why are we seeing governments scaling back, or even reversing their climate and social action commitments? And why do so many sustainability professionals express frustration about how hard it is to really drive change.

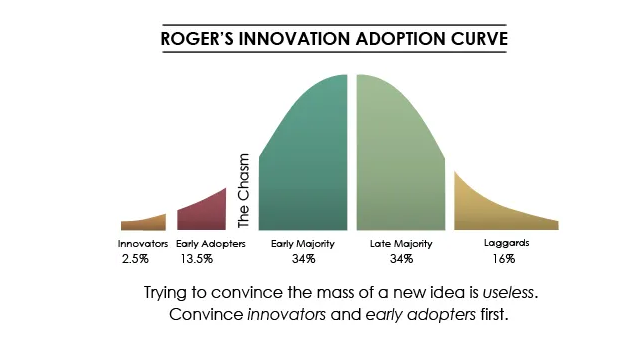

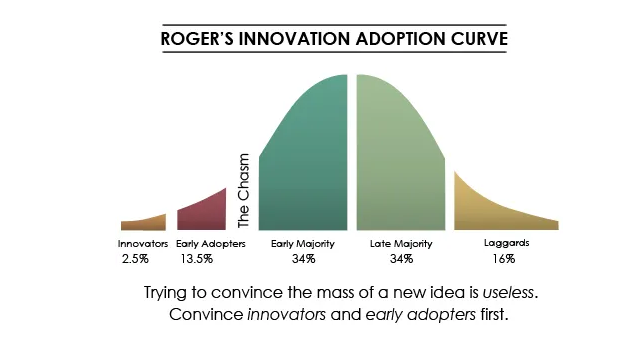

To me, it's mainly a communication gap. Or putting it in the language of tech entrepreneurs', we are failing to cross 'the chasm' between the early adaptors and the early majority. Remember you, as a sustainability professional, are most probably an early adaptor. And you are trying to persuade finance people, who mostly are either early, or even late majority.

What is the major barrier. It's finance ! We need to invest more in new ways of delivering the goods and service's that society needs. In a way that is socially, environmentally and financially sustainable. Investing is about long term value creation. The concept of investing now for a future return is well embedded and well understood. So, if we are not delivering enough investment, perhaps part of the problem is in how we pitch the changes.

Finance people think about the world very differently from sustainability professionals. They see sustainability decisions in the context of their own experience, as financial decision makers, and as consumers. And regardless of how we feel about this, it's largely finance people that make investment decisions. Deciding what factory to build, what new product or service to launch, what company to invest in or what new technology to try. These are all financial investment decisions.

Let's start by building a better understanding the innovation curve, and then use a real world example, electric vehicles, to explore how sustainability professionals can best contribute to the strategy process, obtain the investment we need, and make change on the ground very real.

What is Roger's innovation adaption curve

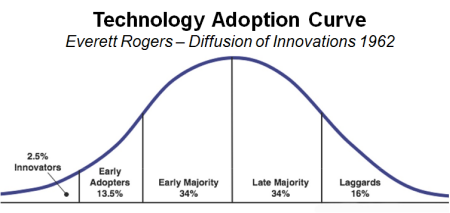

Over my investing career I found this a really useful template for analysing industries in change. Although most people talk about it in the context of technology driven innovation, it applies to all sorts of situations where the outcome we want is different from what we have now. The chart below is the innovation curve that you will probably be most familiar with. And you can see, this is not a new investment concept (dating back to the early 1960's), it's one that has stood the test of time in many very different industries.

The model is that new ideas or products are first taken up by innovators, who are attracted by the fact that it's different, that it's new and exciting. From there, the idea is next taken up by the early adaptors. They are less 'out there' than the innovators, less willing to take risk but still wanting to be ahead of the crowd.

From there the innovation makes the jump into the mainstream. First the early majority, these are more cautious again, so they need to see evidence of the innovation working before they jump in. And then the late majority, skeptical of change and only really willing to try it if it's worked for the majority. And finally, the laggards, they are very conservative and the hardest to motivate.

You can see from the chart above, once the innovation has reached the early middle, a market share of 50% plus is in sight. Success is so near (and yet so far - as many new ideas die before reaching this).

The innovation curve mark 2

A really useful way of expressing this challenge is to redraw the chart - but with a chasm between the early adaptors and the early majority. These two groups are very different. What works with one, does not even begin to work with the other. To get over this chasm, we need to change the message. Early adaptors work more on belief, the early majority needs to see concrete benefits. Remember, you are probably an early adaptor, and your finance people are probably early majority.

Electric Vehicles and the innovation curve

Let's take a real world example. If we go back a decade or so, electric vehicles were more science fiction than science fact. They were very expensive, they had poor operating characteristics and they were purchased by innovators. People who loved the fact that they were new and cutting edge. And developing them was going to cost $billion's.

As a pitch to investors and finance people this would probably have been doomed to failure. Except for one thing - it was possible to create a narrative that at some point in the medium term all of these problems would be solved. That EV's would become cheaper than traditional internal combustion vehicles, that they would have superior operating characteristics, and on top of this, they would offer a way of solving one of our biggest environmental challenges - green house gas emissions.

At this point, most popular narratives about electric vehicles skip to the present and the future. Look how well they have taken market share and begun to build a financially viable future.

But the finance people see the story differently. This was not some vague dream. Yes, you had to believe the medium term narrative of growing market share, that achieving scale would make EV's profitable. But there was actually a whole lot of detail in the plan that made it credible. You can read how the finance world perceived Tesla back in 2013 by reading a blog from Aswath Damodaran at NYU Stern School of Business.

Starting at the beginning of the production process ... supply chains were being built at scale that would allow the EV OEM's (such as Tesla) to obtain the raw materials they needed. Battery R&D was in full swing, finding new battery materials that would make them perform better and become cheaper. New vehicle production processes (islands rather than the traditional production line) had been developed. New routes to market (direct to consumer) were available, bypassing the old dealer network. EV charging infrastructure was being rolled out. Specialists were being trained to service and maintain these new vehicles.

And in most cases this investment took place well in advance of EV sales taking off. In fact, that was a prerequisite. All of that infrastructure needed to be build ahead of growing production, not after.

Yes, there was a different message for the consumer. One that started with an appeal to the innovators, and then to the early adaptors, before moving onto the early majority (where we are now).

But, in the background there was a different narrative, one focused on the finance people. One that talked about all of the detailed work, and the investment, that was being done to make the 'dream' happen. You could argue that Tesla worked not just because of the dream, but because the message for the people later in the innovation curve was being crafted right from the start.

As Aswath Damodaran says in his influential book, Narrative & Numbers, we need to find a way of bridging the gap between the story tellers and the number crunchers. And, the innovation curve gives us a really useful starting framework.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.