Sunday Brunch: It's not only banks that lend money to coal

The private credit market is both large, and something that sustainability investors need to learn about.

If you want to raise money for the greenfield Carmichael thermal coal mine in Australia, it seems you should go to the private credit market - Ulf G Erlandsson

The news that the Adani Group unit that controls a major Australian coal port has apparently obtained a loan of about A$500 million ($333 million) has brought the private credit market into focus for sustainable investors. Why, because the funding is seen by some as reducing the cost-of-capital for the controversial Carmichael coal mega-mine.

In the financial markets, everything has a price. And private credit markets are good at making money from 'credit risks' that others will not touch.

Coal mines (and ports) can still raise debt

This is a bit of a complex story, involving a dive into the lessor known corners of the debt financing market. The private credit market is all totally legal, it's just not something that many sustainability investors come across on a regular basis. But, this might be the start of a trend.

Starting with the most recent news. According to various media sources, North Queensland Export Terminal Pty Ltd (NQXT), a unit of the Adani Group, raised a loan of about A$500 million ($333 million) from Farallon Capital Management and King Street Capital Management, via the private credit market.

Adani Group, via its Australian subsidiary Bravus Mining & Resources, is the owner of the Carmichael coal mine. That might ring a bell for sustainability investors. That's because some have described the mine (originally due to produce 60 million tonnes of coal a year but now scaled back to 10 million tonnes) as the world's most controversial coal mine.

The mine has had a troubled history with regard to its fund raising. An article in The Conversation detailed how Adani announced in 2018 that it will self-fund a significantly smaller coal mine in the Galilee Basin, after failing to secure finance for the much bigger project from more than 30 domestic and international banks and lenders.

CDP did an interesting case study on the mine, describing it as ...

"one of the most famous global examples of a current asset in the process of becoming stranded by the transition to a low-carbon economy and changing attitudes to coal as a source of energy."

But, what has a debt raising by a coal port company got to do with funding for Carmichael ? And what is the private credit market (and why should I care)?

On the first question, Ulf G. Erlandsson, the well regarded Founder/CEO of Anthropocene Fixed Income Institute put it this way ...

"For avoidance of doubt, the NQXT terminal is the lifeline of the Carmichael coal mine. It has been struggling to refinance a bond that matured in 2022 as investors have shied away from thermal coal."

The private credit market is one that most sustainable investors don't frequently come across. When I used to do debt origination (which sounds better than arranging lending for companies) the companies with good credit quality went either to the syndicated bank market (for Europeans) or the global investment grade bond market (for Americans). Those with credit issues went into the High Yield market, or if the credit was complex, the private credit market.

Back then private credit was niche, but no longer. The IMF recently estimated that the private credit market, in which specialised non-bank financial institutions such as investment funds lend to corporate borrowers, topped $2.1 trillion globally last year in assets and committed capital. About three-quarters of this was in the United States, where its market share is nearing that of syndicated bank loans and high-yield bonds. This could fund a lot of coal mines !

This market emerged about three decades ago as a financing source for companies too large or risky for commercial banks, and too small to raise debt in public markets. In the past few years, it has grown rapidly as features such as speed, flexibility, and attentiveness have proved valuable to borrowers. To that list we could also add discretion.

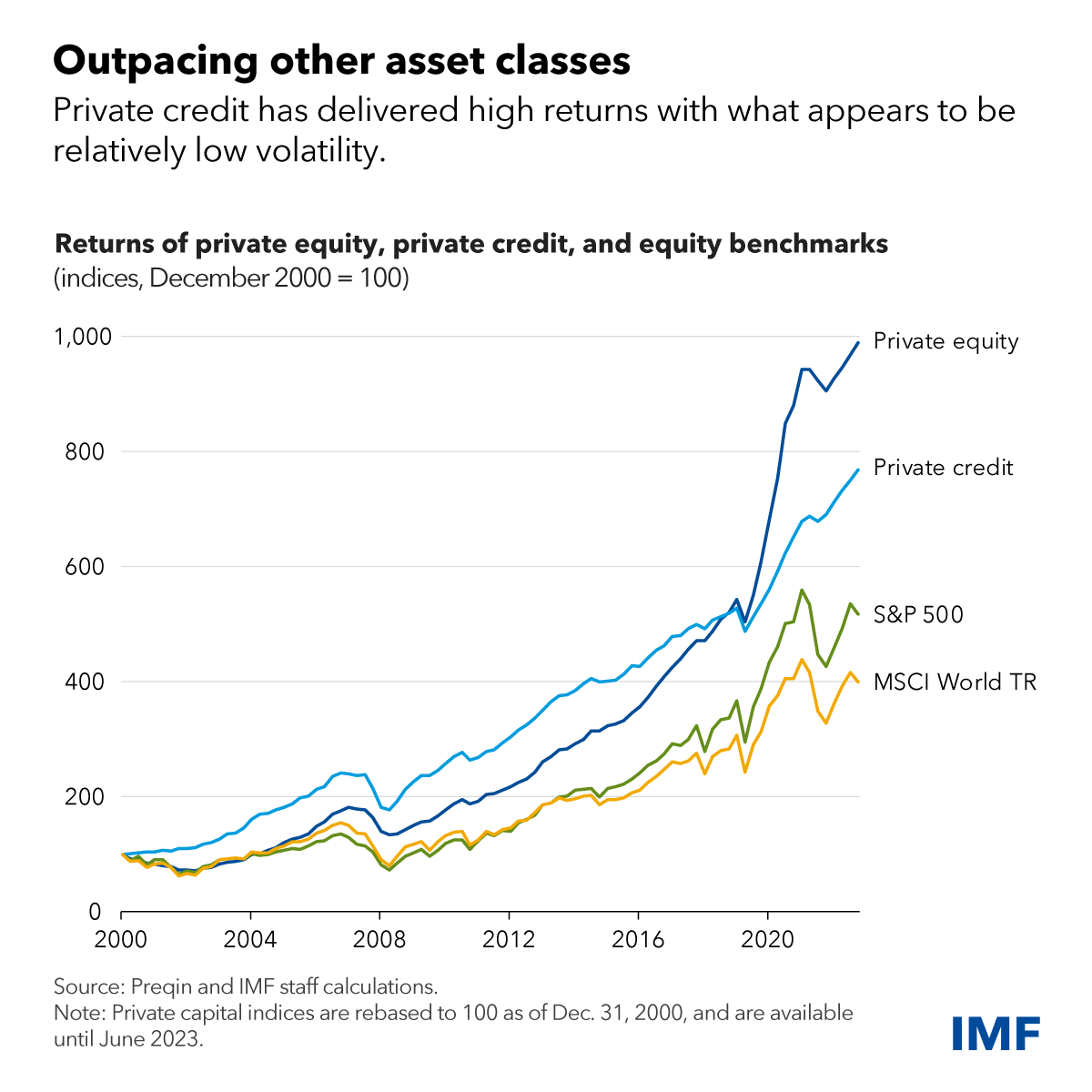

And it's had no problem attracting capital to lend, in a large part due to the attractive returns it offers. The IMF estimates that since 2000 it has offered higher returns than the S&P 500 and the MSCI World equity indices.

Why is this an issue for sustainability. Because private credit lending is much less transparent than bank or bond lending. Various organisations track the different forms of bank lending for projects such as coal, but it's much harder to do for private credit.

And private credit lenders might be happier with the political risk of lending to industries such as coal, providing the cash flows are predictable. And this opens up a good source of lending for asserts that traditional banks etc are increasingly less willing to touch. Although, as an aside, the credit risk they are taking on Australian coal ports might not be as good as they think.

And one last thing to think about. Where does the capital come from that allowed this surge in private credit lending? To quote the IMF blog referred to above ...

"Institutional investors such as pension funds and insurance companies have eagerly invested in funds that, though illiquid, offered higher returns and less volatility."

So, is your pension fund indirectly supporting the Carmichael mine ? Maybe, but they probably wouldn't know if they were.

Please read: important legal stuff.