Sunday Brunch: investible diversity

Diversity matters, but not the diversity you might think. It has become an accepted fact that there is a strong link between demographic diversity and financial returns. But it's not actually supported by rigorous analysis.

“If everyone is moving forward together, then success takes care of itself.” Henry Ford

It has become an accepted fact that there is a strong link between demographic diversity and financial returns. By demographic diversity we mean the percentages of women and ethnic minorities on the board, and in senior management, CEO positions, and among the wider workforce.

If this was true, then investing would be easier. We would find companies that have high demographic diversity (fairly easy to measure), and then we either buy a portfolio of the best performers, or we go what in my industry is called long/short - we buy the best diversity performers and sell the worst.

Regular readers will know that sadly this is not a viable investment strategy. Why? Because the evidence for the link between demographic diversity and financial performance is weak.

Let's be clear, diversity is really important. Better diversity is really important for our society. And there are links between diversity in an organisation and its long term financial performance. But they are not the links that you might think. They are about things that are harder to measure. But that are really important.

If we want investors to get behind diversity improvement, we need to start by talking about the right issues. Maybe, instead of calling it diversity (or DEI) we should call it enhancing and developing human capital (EDHC) ?

Measuring a Human Capital Index - Just Capital

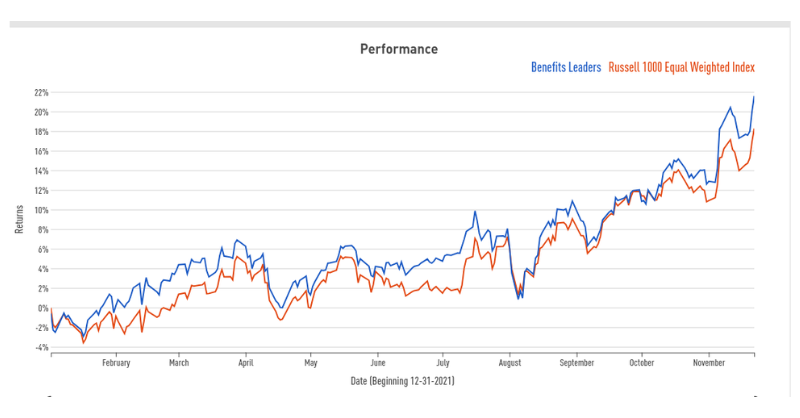

Just Capital recently released its latest Human Capital Index. This index tracks the performance of companies scoring in the top 20% of JUST Capital products and compares performance against Russell 1000 benchmarks. Put simply, how does the share price performance of the 'best' 20% of companies compare with the financial performance of the wider US equity market.

Before talking about what this showed, a caveat. The link between being a top human capital company and better financial performance does not prove a causation ie it doesn't follow that the better financial performance is caused by better human capital. But from an investing perspective, we don't really care. We just need to know that it works.

What did the latest Just Capital human capital index show? The chart is for what they describe as the benefits leaders, and it covers the period from the end of 2023. This highlights the performance and impact of investing in companies that prioritise key workplace benefits. This covers Dependent Care policies, Days of Paid Time Off, Days of Sick Leave, Paid Parental Leave for Primary and Secondary Caregivers and Parity in Parental Leave.

This index was up 21.6% since the end of 2023, while the Russell 1000 index was up 18.6% over the same time period. The Hiring and Stability leaders were up 22.7% and the Employee Wellness leaders were up nearly 20% (so still beating the index).

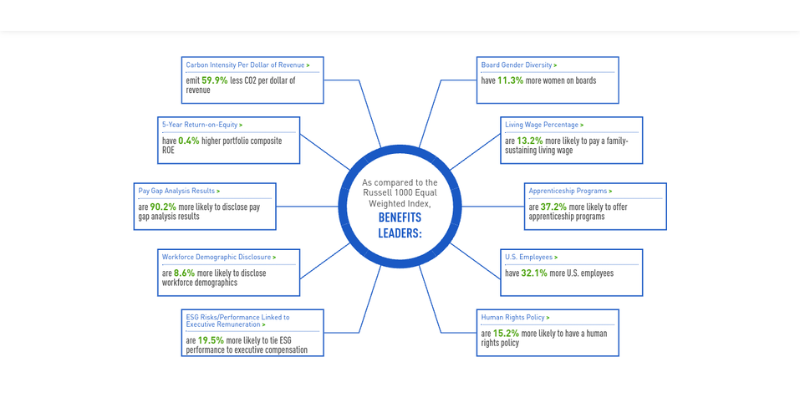

A few things strike us about these measures. The first is that they don't directly measure the things, such as percentages of women or minorities, that we see in traditional DEI metrics. The second is that this is not easy data to collect. And third, companies that score well in say employee benefits, also score well in other factors, such as living wages and lower carbon emissions.

This is a topic that Alex Edmans, Caroline Flammer & Simon Glossner explored in a recent blog for the PRI. They used a similar dataset, this time from the Great Place to Work® (GPTW) analysis used to compile the list of the 100 Best Companies to Work For in America.

Via a confidentiality agreement with GPTW, they obtained the individual responses to all 58 questions from 2006 to 2021. From this they identified 13 questions that cover DEI, such as “This is a psychologically and emotionally healthy place to work”, “I can be myself around here”, and “Managers avoid playing favorites.”

You will spot straight away that these are measures that would be really hard to measure using traditional DEI surveys.

They then aggregated the employee responses to form a measure that they called DEI. It's a ’grassroots’ indicator of actual DEI, as perceived by the responses of 250-5,000 employees in a company, in contrast to more superficial measures such as whether a company has a DEI policy.

And what did they find? That their measure of DEI is positively associated with one- and three-year sales growth, positively associated with three-year but not one-year stock returns, negatively associated with leverage, and positively associated with dividends. This suggested to them that a strong financial position frees a company from having to focus on short-term pressures and instead allows it to address longer-term challenges.

We wrote about their research when it was first published, back in May 2023. The lesson we took from this is that if we want investors to engage with positive DEI actions, we need to start measuring what really matters, not just what is easy to measure. Oh, and to be critical when 'research' confirms what we want to believe.

To quote the Edmans, Flammer & Glossner work ...

DEI initiatives have been justified by papers claiming a strong link between demographic diversity and financial returns, but they are deeply flawed. For example, numerous McKinsey studies claim a positive link between ethnic diversity and firm performance, but the results cannot be replicated even with their chosen performance measure (EBIT) and preferred methodology.

Moreover, there is no link with other performance measures – gross margin, return on assets, return on equity, sales growth, or total shareholder return – or when using more established methodologies.

The UK’s Financial Reporting Council published a study claiming that “Higher levels of gender diversity of FTSE 350 boards positively correlate with better future financial performance (as measured by EBITDA margin)”. Yet out of their 90 regressions linking diversity to the EBITDA margin, zero are significant.

One last thought

Having more minorities and women in senior management positions, and on company boards is almost certainly a good thing, but not everything needs to link back to financial performance. Sometimes it's just the right thing to do.

Please read: important legal stuff.