Sunday Brunch: Innovation & why investing is forward looking

Yes, investing is about the future. Future profits and future cashflows. But the value of a company is also impacted by historic innovation shortfalls. Nespresso shows it can work - will Nestle work out how to repeat the wins this brings?

“Forecasts create the mirage that the future is knowable.” Peter Bernstein

Innovation, sustainability and future profits are intrinsically linked.

It might seem trite to say it but investing is about the future. Future profits and future cashflows.

But it's not always just about future investment - as important as this is. Sometimes the foundation for a firm's success or failure is based on what it invested in over the last 3 to 5 years (or even longer). This is especially true when we consider innovation. We all know that companies should not plan for what they see now. They need to invest for what the future customer will want and be willing to pay for. And if this doesn't happen they can falter from being market leading to the middle of the pack. Or even worse.

And nowhere is this more true than in consumer goods, that broad sector covering everything from food, through household cleaning products, to personal care such as shampoo. This a brutally competitive industry. And so if you want to grow faster than the industry, and deliver higher operating margins and profits, you need to invest in innovation.

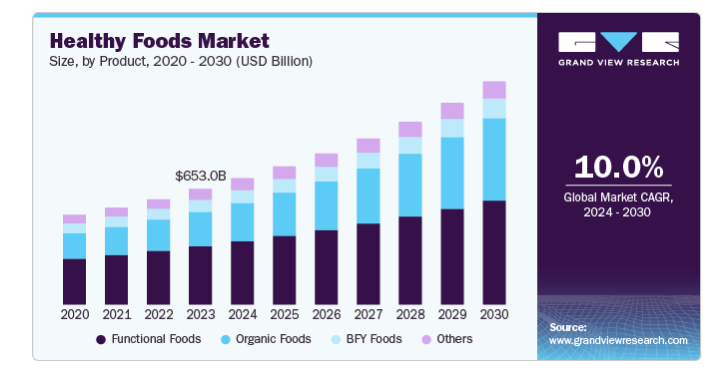

What does this have to do with sustainable investing? I was thinking about this as I recently rewatched the recent Nestle capital markets day. Nestle had been a great investment for decades, until the last few years, when it faltered. The old growth model seems to have broken down. But, on the positive side, I could also see some real potential coming from a shift to producing healthier food, driven by innovation. This could be a massive opportunity for Nestle and its shareholders. One that they are potentially well placed for.

It's a reminder that sustainability transitions are not always about risks, they can also be about opportunities. But these are often not easy to translate from concepts (healthy food is a growing category) to brand investments and innovation (exactly what do consumers what from their healthy food?).

Hopefully Nestle can revisit the spirit that created nespresso, and create a new healthier category that reinvigorates their growth model and makes them a great investment again. And remember, nothing in this blog constitutes investment advice.

Time to build the Nestle of the future ?

I have followed Nestle fairly closely for over three decades now. It was a core holding for investment funds that I was involved in managing. And for most of that time it's been a good investment, on the back of anticipating and investing in changing consumer demands. Until recently.

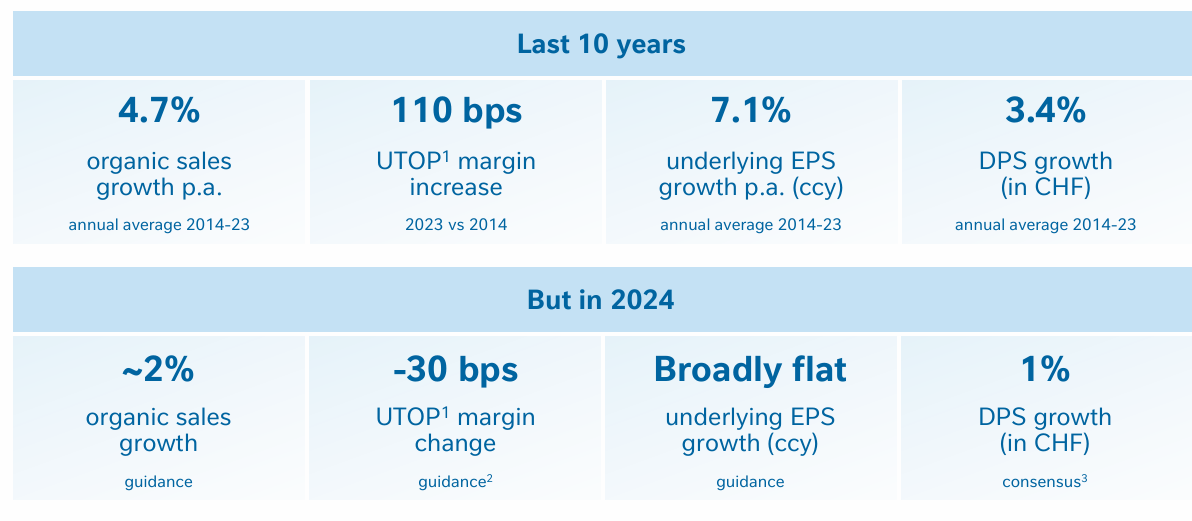

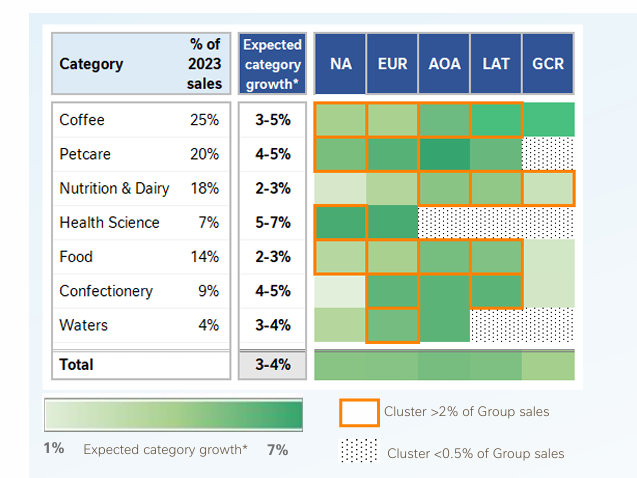

To understand what has driven the historic share price growth we need to start with what became known as the 'Nestle model'. In simple terms this was 4-5% sales growth, and a small annual uptick in operating margins, leading to high single digit earnings/profit growth. This all took place against a food market that was growing at c. 2-3% pa.

So Nestle was growing faster than the market and still holding operating margins at a good level, or even growing them.

More recently though this has turned into a model where sales only grew at c. 2%, margins eased up a bit, but earnings/profit stayed flat. And as a result, the share price has begun to fall back, rather than grow.

So, what is the plan to reverse this, and how might it relate to sustainability? I can do no better than to quote the CEO who said in the capital markets day press release....

"Nestlé’s action plan presented today will allow the company to drive category growth and improve market share performance. Actions will include targeted investments in winning brands and growth platforms, more focused innovation activities to drive greater impact, and systematically addressing underperformers."

Applying this to sustainability investing

One way to grow faster than the wider food market is to be active in fast growing categories. Obviously it's not that simple as they also need to be categories where Nestle's strengths allow them to maintain higher margins, but you get my drift.

One fast growing category is healthier food. The challenge here is complex. First, some of the growth is in unprocessed food, such as fruit, nuts and vegetables. This is outside of Nestle's scope of operations.

And even when we consider processed food, it's not totally clear what healthier food means, at least to a food producing company. We know what a healthier diet means, more fruit and vegetables; less salt, sugar and fat; less ultra processed food, and less meat (especially red meat). And probably, at least in western countries, fewer calories.

What is less clear is how this applies to Nestle's portfolio of categories and brands. Would making their existing food healthier on its own drive extra growth ? Or does it need more than that?

But then no one said this would be easy. If it was every food processing company would have cracked it already. But what it does show is a possible direction of travel for this new & improved Nestle.

One that they are able to explore - because innovation in new markets should be in their DNA! And as a company they have been researching and exploring some of the different aspects of healthy food for many decades now.

Why invoke the spirit of nespresso ?

I can still clearly remember when Nestle presented nespresso to the investment community. For many of us it seemed like an unlikely winner (although I am sure many of my colleagues will use the benefit of hindsight to say they always knew it would be a success).

Being slightly cynical, you had to buy a relatively expensive dedicated machine to use the nespresso pods. And it made a product that most people in cities could buy on nearly all street corners (even then coffee shops were everywhere). And it was sold outside of the traditional Nestle distribution system. At first glance it looked like an odd product, even for a company that knew the coffee market well.

But it worked, and worked really really well. It's now a core Nestle product. And I clearly recall the team who worked on it being very confident of its success - they had done the work to show that there was a demand, even at a premium price point.

It's hard as an outsider to know what made it such a success. It could have been the quality of the coffee produced using the pods (really good - even for a coffee geek like me). Or it could have been the marketing and product positioning, or maybe the supply chain ethics, or maybe it was like the smart phone, consumers were crying out for good coffee at home, they just didn't know it. Probably it was a combination of all of these.

Which is why I invoke the spirit of nespresso in relation to healthy food. Nestle is well placed to create real value for consumers and shareholders in challenging and less obvious categories. They have done it before.

One last thought

Finding a way to profitably shift to healthier food is not just potentially a financially good thing for Nestle. If they do it properly, thinking about the end to end supply, production and distribution value chain, it can also be a good thing for society and the planet.

Evidence from around the world has shown that agroecological transitions result in a cascade of positive results, from stable yields, crop resilience and higher incomes for farmers, fishers, and food producers to improved nutrition and food security and enhanced biodiversity

So a double win.

Please read: important legal stuff.