Sunday Brunch: Financial markets are weighing machines

We all know that stock markets (in fact all financial markets) are partly driven by sentiment. But this only tells part of the story. Accounting fundamentals also matter.

“In the short run, the stock market is a voting machine. But, in the long run it's a weighing machine" Ben Graham

We all know that stock markets (in fact all financial markets) are partly driven by sentiment. At the moment there is a debate about the US stock market, is it in a bubble, or is it just reflecting better times ahead?

But this only tells part of the story. While sentiment (the voting machine) helps us understand what might happen to financial markets in the short term, in the longer term it's fundamentals (the weighing machine) that matter. By fundamentals we mean future cashflows and profits. And one of our best guides to future profits is via a company's accounting reports.

Joachim Klement, in his excellent blog Klement on Investing, recently highlighted a piece of research from Paul Geertsema and Helen Lu on this very topic. They looked at how well accounting based variables forecast future equity returns (pretty well as it turned out).

Why it caught our eye was that it neatly ties into some thinking we have been doing about the new sustainability linked accounting standards and interpretations, and why they are important in helping investors identify the fundamental financial value of companies.

Voting machines vs. weighing machines

Joachim highlighted in his blog (it's really good, have a look and subscribe) a new study by Paul Geertsema and Helen Lu.

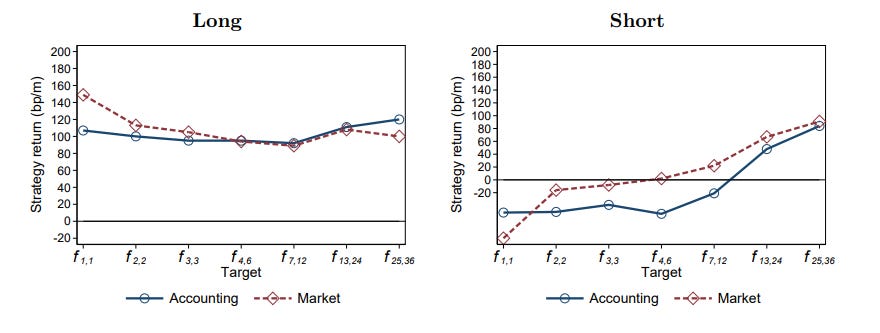

To quote his blog - "the researchers wanted to know whether accounting variables like changes in assets and liabilities, profitability, or even simple measures like the change in outstanding stocks can predict stock market returns better than market-based measures like price momentum, size of the company, share price seasonality, etc."

This really matters. If accounting variables are useful in this way, then investors should really care about them (spoiler alert - we think they should). Which means they should continue to read a company's report and accounts carefully, and in detail.

And equally importantly, they should pay attention to the new accounting standards. Some of these relate to sustainability, including IFRS S1 & S2. They will be coming to a financial market near you shortly.

Back to Joachim's blog, and the Geertsema and Lu study. They found that over longer time frames (year two and year three after the forecast) accounting-based variables do just as good a job as market-based variables at forecasting future share price movements.

Which means that as we look further out, to the years beyond the short term, a company's underlying financial and accounting fundamentals matter, and they matter more. To those of us brought up on fundamental valuation, this makes perfect sense.

So what does this mean for sustainability?

That's easy. We know that the external sustainability environment for many companies is changing. Regulation is getting tougher, as are social pressures. Customer demands are changing, as is their willingness to pay a sustainability premium. And a company's ability to recruit and retain the best employees, supporting innovation and better customer service, is becoming more linked to softer issues such as sustainability practices.

So building and maintaining brands and other intangibles needs new skills. Or putting this in financial terms, the levers for creating long term competitive advantage are changing.

What a company reports in their accounts reflects these pressures. Some of this appears in the traditional financial reporting. Sales and margin trends, capex, returns on capital, and free cashflow. Plus, we see it in the notes to the accounts. In their provisions, asset impairments, and liabilities.

Going forward we will also see it in the company's sustainability reporting. Under IFRS S1 and S2, they will need to cover what key risks and opportunities are they facing, how are they building it into their long term financial strategy, and what are the potential financial implications.

And this new information will add to the factors that investors will use in evaluating a company's long term prospects, in building an investment case, and in identifying the fundamental value of their shares (or bonds). In a way, this will bridge sustainability and investing in a way that is not really possible using traditional ESG related reporting techniques.

And it's not just S1 and S2 that will matter. There are other accounting changes in the pipeline.

Another important change hides under the boring title of a 'rule clarification in relation to International Accounting Standard 37" - also known as IAS 37. Charlotte O'Leary and the team at Pensions for Purpose wrote about this recently.

And we wrote a blog on the topic.

IAS 37 deals with events in the future that will probably result in the company having to spend money or receive a benefit, but they don't know exactly how much and exactly when.

Some of you will have spotted that targets to reduce greenhouse gas emissions involve a future event. And for most companies their climate related plans involve a degree of uncertainty. We know that the impact will happen, but we don't know exactly when, or how much companies will need to spend. And we don't know exactly what benefits might come from them.

Why is this important? Because IAS 37 covers what are known as contingent assets. We should think about this as positive investments by a company that may add future value. And if cutting greenhouse gas emissions fits this bill, then we should treat it in a similar way to a new factory, it's not a cost, it's an investment.

And that could materially change the accounting reporting by some companies. And as the Geertsema and Lu study showed, accounting based variables are useful for forecasting future share price movements.

One last thought - not everything is material

As Alex Edmans pointed out in his important article 'The end of ESG', not all sustainability factors are relevant to the long term value creating efforts of a company. Part of our job is to identify what is important, as far as financial value is concerned, and what is not.

And in case the title puts you off reading it, he is not saying ESG is dead, it's just it should be dead as a separate investing topic. Where it's material, it should be part of the investment appraisal analysis of all investors, not just ESG specialists. I think Geertsema and Lu would approve.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.