Sunday Brunch: DEI and the importance of the swim leg

We previously discussed some excellent research by Alex Edmans (London Business School), Caroline Flammer (Columbia University) and Simon Glossner (Federal Reserve Board) looking at Diversity, Equity and Inclusion (DEI).

They sought to identify what the determinants of a DEI environment in the workplace are and then looked at the consequences of that environment on performance, valuation and stock returns. We discussed their findings in this Quick Insight 👇🏾

They found, for example, that there was a positive association between high DEI and all but one of the eight measures of future profitability studied and a positive link to future earnings surprises. However, they found no evidence of a link between DEI in a firm and its stock returns, all else being equal. We'll come back to that in a moment.

That is not what I found most interesting.

They challenge the common view on what DEI actually is. That's a good thing. It means we can focus on the right actions. It means we can design workplace policies and approaches to improve DEI in the workplace. I discussed that in a Perspective 👇🏾

Their piece stimulated some other thoughts for me. This is where we come back to their finding on stock returns. If there is no link between DEI and stock returns, from a purely investing perspective, should we care whether a firm has a culture of DEI?

Let's look at that...

The important foundation of the swim leg

A triathlon comprises three legs - a swim, a cycle and a run with the transition between each leg often seen as the 'fourth leg'.

I learnt a pretty important lesson about cold water shock doing my first triathlon back in 2012. It was in St. Neots during the first week of May with the swim leg in the River Ouse. It was a brisk 9 degrees Celsius (48 degrees Fahrenheit). I reasoned that the water would be f-f-fairly cold too and that the least time I spent in there the better, so I decided to get in the water just before the gun went off. I never made that mistake again. The cold water shock meant that after the first nine strokes (with no breathing) I was essentially a bobbing mass and the swim leg took me more than double the time it should have. For half of the following cycle leg, I had numb lumps for legs.

So the swim leg is important. Is it what determines overall success in the event?

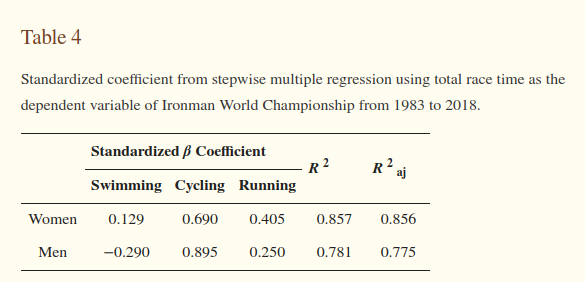

A study of Ironman triathlons over the competition's first 40 years found that the biggest improvements for elite competitors came during the cycling stage. That was the biggest correlation to the overall result.

However, I can tell you from my own experience that your approach to all components is important. A steady disciplined approach to the swim can really set you up for the cycle leg with your body warmed up and the mind in a zen-like state. That can sometimes mean avoiding the 'washing machine' at the start (see the main image) and ultimately letting the eager swimmers come out of the water ahead of you. Of course, the cycle leg being the longest from a time perspective, is where I could make the most difference, but the swim, for me, was pivotal to get right to ensure I was best prepared for the other legs. A solid foundation.

I haven't found any studies that show a direct correlation between swim leg performance and final triathlon result. However one thing I do know. It is extremely difficult to do a triathlon if you don't know how to swim.

There are some parallels here with how we consider stock returns and the link (or apparent lack of it) with DEI.

Stock returns - what determines the price of a stock?

When we had new summer interns on the desk I would always ask them early on what they thought determined the price of a stock. I would typically receive answers such as "it is the present value of future cashflows discounted to today using an appropriate discount rate" or "it is the earnings times an appropriate earnings multiple" etc. My reply, which was often met with the kind of look you give your worst enemy was "it is whatever the next person is prepared to pay for it." In many cases that is based on discounted cashflow methodologies but sometimes the focus is on other things.

When I was a technology specialist salesman back in the mid-2000s, the semiconductor stocks were 'easy to trade'. It was just a case of looking at the Book-to-Bill ratio - how much bigger or smaller was the dollar value of orders relative to what had been effectively invoiced). A move above one was a good indicator that forward looking demand was good and the stock would trade up. Similarly in the media space (I was also a media specialist salesman), to gauge the moves in the advertising stocks we would look for the second derivative in advertising revenue growth to pass through zero - i.e. that when the rate of growth in advertising revenue growth starts to accelerate or decelerate.

Of course the above was quite simplistic and whilst it seemed to hold at the time for short term moves, there were many other things that determined a stock price move and ultimately stock returns.

What does any of this have to do with DEI?

Whilst Edmans's, Flammer's and Glossner's research found no evidence of a link between DEI in a firm and its stock returns (all else being equal), they did find a positive association between high DEI and measures of future profitability. Ultimately that is one of the building blocks and components. So creating an environment or culture of DEI can bring future profitability which in turn acts as a foundation for potential future stock performance.

We have been through an unprecedented period of liquidity following the quantitative easing that started post the global financial crisis. This has meant that stocks have been able to perform on sentiment even if some of the more traditional accounting metrics are not being met, such as profitability. With an increasing focus on sustainability more generally, fundamental measures could become more important. Business longevity requires a solid foundation - just as a successful triathlon is built on a solid swim leg.

So maybe DEI is key for financial performance? Well one more caveat. It may need to be material.

A masters thesis from Palmaro and Alami at EDHEC Business School, found that a study of returns from a portfolio of the best companies for diversity from 2001 to 2021 tended to have a lower return-on-equity growth rate than an equally-weighted S&P500 portfolio. In other words, those 'best companies for diversity' had a lower ability to generate profits from the money that shareholders had invested in them.

Palmaro commented that:

"... our research suggests that diversity might not have the impact previously thought. This result should encourage us to take a critical look at how we're valuing companies and whether we're accounting only for the factors that are material to the firm."

Not all diversity matters to financial performance, although it matters for other reasons as we have mentioned. What really matters from a financial perspective is "material diversity".

Edmans's, Flammer's and Glossner's work highlights the difficulties in identifying those factors. Indeed, and this ties in with the data set used in research such as Alami's and Palmaro's, traditional measures of diversity may not accurately demonstrate a culture of DEI.

In any case, just adding diversity to a company doesn't mean you end up with a culture of DEI. That implies that culture of a firm is the sum of its parts.

A firm's culture is the weighted-average of the values that its people actually follow.

In a future Sunday Brunch we shall look at whether DEI is as important with the investor as it is with the investment. As fund managers look towards potential investments to embrace DEI, have they done the same with their own firms?

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.