Sunday Brunch: the values-behaviour gap

Understanding human behaviour is critical to all aspects of sustainable investing. If we don't know why people do things, we cannot get them to change. And if they are not going to change, we will need to rethink how we make company business model's sustainable and financially viable.

Understanding human behaviour is critical to all aspects of sustainable investing. If we don't know why people do things, we cannot get them to change. And if they are not going to change, we will need to rethink how we make company business model's sustainable and financially viable.

One of the things that has always fascinated me is why people behave the way they do. I don't mean what they say, but what they do. This distinction is really important, as many people express one view, and then act in a totally different way. Examples are the people who care about the environment, but still buy fast fashion. Or those who say they want healthier food, but actually mostly buy cheap or ultra processed products. Or those who smoke, despite all of the evidence around harm to their health.

This is what is known as the values-behaviour gap. And it's more common than you might think.

If you are not a member yet, to read this and all of our blogs in full...

Actual behaviour is often driven by practicalities not principles. And it's why you should retain a degree of scepticism about surveys that say things like ... nearly 90% of Gen X consumers said that they would be willing to spend an extra 10% or more for sustainable products, compared to just over 34% two years ago. Or being even more cynical, you should be careful of accepting survey's that confirm your view of the world.

Plus, from a sustainability perspective, we have the ongoing debate around how do we best communicate the need for action on climate, biodiversity and a just society, in a way that actually drives concrete change rather than apathy, opposition or despair (or lots of talking but no action). This is intrinsically linked to the financial issue above. As we frequently point out, if we cannot finance the sustainability transitions, they will just not happen - at least not at the pace and scale we need.

Why are Values important?

To quote Steven Johnson and the team at BCW Movatory....

Our values define us. They shape our identities, and influence everything we think, feel, and do. The importance of values has been hardwired through evolution. Shared values were essential for building collaboration and the social groups that have defined the success of human beings as a species.

Our values are a good (but not perfect) predictor of how we will behave in certain situations. Putting this in a financial context. It's our values that lie at the heart of most financial decisions we make. Who we vote for (and hence the economic and regulatory framework that companies have to operate in), the food and clothes we buy, and even how we heat and cool our homes. Plus, our collective values define the social license to operate. And, of course, they define where we would like our money to be invested. Our values are a good (but not perfect) predictor of our behaviour.

The good news here is that the recently published research from Steven Johnson and the team at BCW Movatory suggests that values that are consistent with supporting sustainability are high on most peoples priorities. Their research sampled more than 36,000 people across 30 markets. To quote the report:

"people around the world care not just about preserving and protecting their own wellbeing but also the people around them. 57% of global respondents told us it is important to be loyal to their friends and almost the same proportion, 56% said they strongly believe that everyone should be treated equally and have access to the same opportunities".

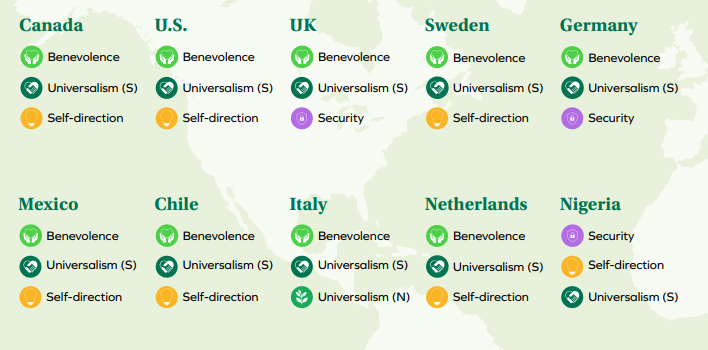

This is reflected in the results from a variety of countries that show that values such as Benevolence (which promotes the welfare of people we are in frequent contact with) and Universalism Societal (which motivates us to promote understanding, appreciation, tolerance, and protection of all people in society) score highly.

Now the not so good news.

The reality is that while our values might predispose us to certain behaviours, other factors can mean we end up doing something completely different (the values-behaviour gap we highlighted earlier). This includes how we feel economically, but also how time and opportunity limited we are.

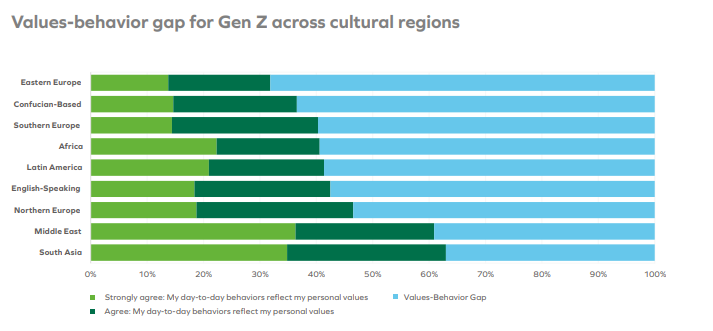

While this is an issue across all generations, it's especially the case for Gen Z's. They are an important group, making up 30% of the global population, contributing close to 27% of the workforce (by 2025) and having a combined purchasing power of over $100 billion. The blue bars in the chart below show what percentage of Gen Z's feel they are not living their lives according to their values.

Some analysts I have spoken to about Gen Z's suggest this sense of 'disappointment' is something all generations go through. That it will reduce as they get older. Maybe this is true. But, when you combine this data with the survey finding that only a quarter of all people globally (not just Gen Z's) believe that their government does not share their values - you can see a big disconnect.

The other value that comes high up the list, especially in countries such as Japan, Russia and China, plus the UK, is Security. It has various attributes, but one we need to watch is a desire for stability - or putting it another way, a reluctance to change. Change, even if your logic brain knows it is the right thing to do, is hard.

What does this mean for Sustainable Finance?

- First, we suggest we are due a rethink as to how we communicate sustainable finance. We have to accept that we are speaking to a very skeptical audience. Reports such as this recent one from Bloomberg, suggesting that just 5% of passive ESG fund investments actually make a climate impact, are feeding this skepticism. We argue that we need to present people with the full picture, warts and all.

- Second, we have to factor into our discussion the very real risk that change does not happen, or if it does, it's not as fast as we want or need. This raises some interesting questions about what is the best investment path. Do we continue to invest as if the Paris Agreement targets will be met, even if this reduces financial returns. If this is our plan, then we need an honest and robust discussion with our investors.

- Thirdly, and more positively. We need to broaden the discussion about how companies acting with purpose also create financial value. It's something that Alex Edmans (of Grow the Pie fame) and Rebecca Henderson (author of Reimaging Capitalism in a World on Fire) have been researching and speaking on for a while now. More of us need to listen.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.