Is green steel getting closer?

Summary: Norwegian company Blastr Green Steel is planning to establish a green steel plant with an integrated hydrogen production facility in Inkoo, Finland. Blastr has entered into a Letter of Intent with Nordic energy company Fortum that provides Blastr exclusive rights to utilise an existing industrial site located in Inkoo. The four-billion-euro investment is expected to create up to 1,200 direct jobs in the operations phase. The production is planned to start by end of 2026.

Why this is important: Steel is the biggest single "hard to decarbonise sector, so finding a solution that reduces its GHG emissions is important. It looks as if green hydrogen is part of the answer ... which raises some different questions about when this technology reaches cost parity.

The big theme: The steel industry is responsible for about 7% of all man made global carbon emissions. But, there is another way of producing steel, one that could end up making both financial value and environmental values sense. That way (grossly simplified) is to use green hydrogen instead of coal to chemically reduce the iron ore. Its not going to be easy, and it will probably require a green premium, but its clear that if net zero targets are to be achieved, this is a challenge that needs to be solved, and that we need to start working on it now.

The details

Summary of a story from Green Steel World:

Norwegian company Blastr Green Steel is planning to establish a green steel plant with an integrated hydrogen production facility in Inkoo, Finland. Blastr has entered into a Letter of Intent with Nordic energy company Fortum that provides Blastr exclusive rights to utilise an existing industrial site located in Inkoo. The €4bn investment is expected to create up to 1,200 direct jobs in the operations phase, with production planned to start by the end of 2026. This project appears to be more speculative and less advanced than the H2 Green Steel project, which announced in September 2022 that it had received support from leading European financial institutions for its €3.5 billion debt financing.

Blastr plans to replace coke and coal with hydrogen in the chemical reduction phase, as well as reduce the CO₂ footprint along the entire value chain, with the aim of achieving 95% lower CO₂ emissions, compared to conventional manufacturing processes. The steel plant is planned to produce two and a half million tons of high-quality hot and cold-rolled green steel annually.

Let's look at why this is important...

Steel is a fundamental building block of our modern economy. It is currently produced via two main routes: blast furnace-basic oxygen furnaces (BF-BOF) & electric arc furnaces (EAF). The key difference between the two is the type of raw materials they consume. BF-BOF's predominantly use iron ore, coal, and recycled steel, while EAF's use mainly recycled steel and electricity. Put simply, the EAF technology is seen as better for the environment as it produces less GHG emissions. But, there is not enough recycled steel to meet growing demand using the EAF steel making method alone. This is why some 70 -75% of global steel production comes from the BF-BOF method.

Steel is used extensively in many sectors, including construction (50%), automobiles, shipping, aviation, machinery and countless metallic consumer goods –there are currently no scalable substitutes for steel. Manufacturing primary steel requires highly energy intensive processes to extract iron from iron ore and turn iron into steel – more than 85% of the energy used comes from fossil fuels. The steel industry generates about 7% of all man-made emissions –it is the largest emitting manufacturing sector. Plus steel demand is projected to rise 30% by 2050, so the challenge gets bigger rather than smaller.

Secondary steel production using EAF's can be nearly carbon-neutral, if powered by renewable electricity. But, its tough to decarbonise BF-BOF primary steel production. And a report by the NGO Global Energy Monitor, says the shift from traditional blast furnaces to electric arc furnaces is “stagnant”. It goes on to say that while 31% of current steel making capacity uses electric furnaces, only 28% of capacity under construction will use the technology.

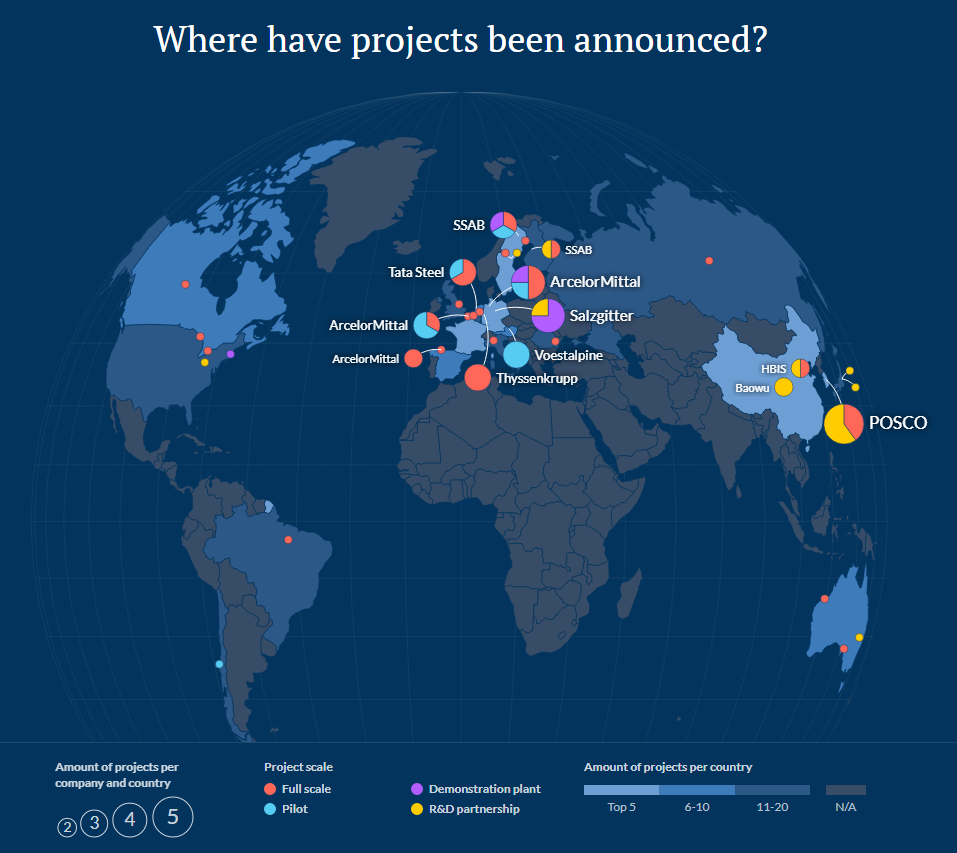

Two main pathways to deliver primary steel production decarbonisation have been identified - carbon capture and the use of green hydrogen as a coal replacement in the reduction process. Of the two, steel making using green hydrogen is seeing the most substantial momentum, with multiple projects under development worldwide, now including the Blastr project highlighted in the article. Green steel is being pushed very hard in Europe, as the graphic below, from the Green Steel Tracker, highlights.

Costs for both carbon capture and hydrogen use are expected to decrease over the decade but should remain at least 25-50% higher than traditional routes by 2025. The good news is that it appears that many steel end users, especially in the automotive sector, seem willing to pay the premium required. In part this is because they estimate that the impact on the cost to the end customer will be small (with some sources suggesting a figure as low as around €200 per car).

There are however a number of complications in this transition. Green steel production at scale is going to need a lot of green hydrogen (and we mean a lot), which in turn is going to need a lot of (cheap) green electricity. Plus, some of the technologies, such as direct reduced iron-electric arc furnaces (DRI-EAF), which we wrote about back in September last year, need specialist inputs. Putting all of this together might mean that some green steel production is best located in the Middle East & North Africa region. So, potentially not great for existing European steel producers (although less of a threat to those located in North America and China). This is something that the European Union hasn't fully factored in to its proposed carbon border adjustment mechanism, which we wrote about in December.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.