A solar boom is coming

While solar is small now, its going to become a big deal pretty quickly, and probably a lot faster than you think.

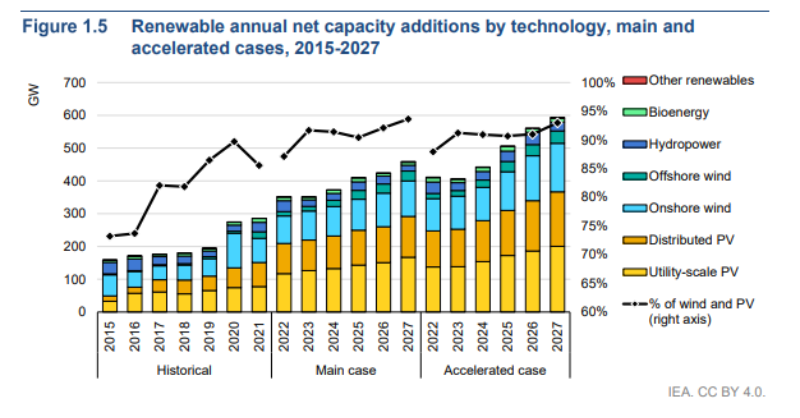

Summary: Contrary to concerns at the start of the year, 2022 is expected to have been another boom year for solar, with c. 200 GW of installed capacity, up from c. 150 GW in 2021. And this could just be the beginning. Organisations such as the IEA are forecasting that by 2027 annual net additions will be c. 300 GW pa, taking cumulative solar PV capacity to c. 1,500 GW. Other analysts are even more optimistic, expecting the 300 GW pa level to be hit sooner, and in some cases much sooner. While solar is small now, its going to become a big deal pretty quickly now.

Why this is important: Recent attention has been focused on the need to strengthen our electricity grids to accommodate variable sources of generation, such as renewables. But there are also ways of helping the electricity supply we have go further. This can postpone the need for extra spending AND reduce some of the transition risks.

The big theme: The global energy crisis, combined with the push to net zero, is leading to an acceleration of renewables installations. It is expected that together wind and solar will make up c. 95% of global renewable capacity additions over the next 5 years, with solar contributing an increasing share. By 2030, the two combined could contribute 30% of total generation, up from only just over 10% now. This acceleration in renewable installations is going to bring challenges, in supply chains, in (massive) grid investment, and potentially, in the dependence this exposes on China. These are all nice challenges to have, but one we need to be honest about and start to solve.

The details

Summary of a podcast from Redefining Energy:

It's perhaps a sign of the times that we are referencing a podcast (No 88), rather than a report or a magazine article. Redefining Energy is one of our "go to" podcasts, and this one, which features an interview with Finlay Colville, head of research at PV-Tech and Solar Media, is especially good. You can also read some of his commentary in a recent article he wrote for PVTech.

Organisations such as the IEA are forcasting that cumulative installed solar capacity will rise by c. 1,500 GW by 2027 (cf just over 1,000 GW now, so c. 2.5x growth in just 5 years). But Finlay is much more optimistic, expecting global supply to grow rapidly from the c. 300GW produced this year - as the mainly Chinese producers rush to meet demand, both at home and abroad. He believes that the industry will reach 1TW of production capacity this decade. This is roughly twice what the IEA is expecting !

Let's look at why this is important...

Why is it important?

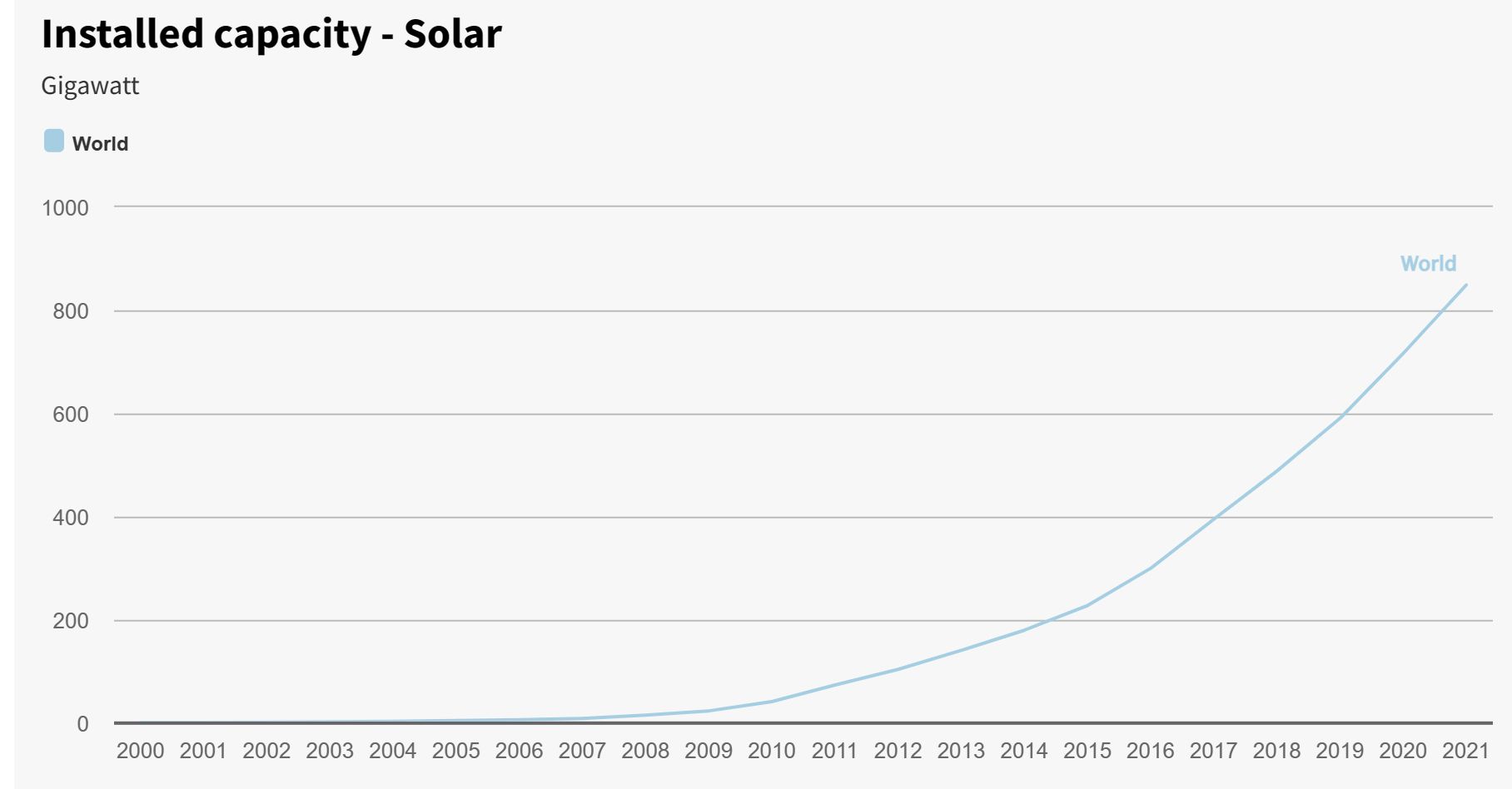

Lets start with market size. According to Ember, the installed global solar capacity in 2021 was c. 850 GW. This generated c. 3.7% of the worlds electricity, so relatively speaking fairly tiny. There were only two countries in the world (Chile & Australia) where solar was more than 10% of electricity production, although Spain was close. But before we look forward, lets take a peek at the shape of the installed capacity chart, again from Ember. Its doesn't take a mathematician (or in my case an engineer) to spot that the pace of growth is accelerating.

According to Finlay Colville, this year the industry will produce close to 300 GW of supply, most of it (over 75%) in China. Next year, this could be close to 400 GW. Supply keeps growing. Why? Some of it is the surging demand we discussed at the top of the blog. The other aspect is that to a large extent its due to an understanding in China that this is an industry of the future that they can dominate. Finlay believes we could see a 1TW supply year before the end of the decade. With production roughly doubling every 2-3 years, this looks a credible expectation.

So, surely this is a totally good news story. The world needs more renewables if damaging climate change is to be avoided. Yes, but ... for this to be "successful" we need more innovation, better supply chains, and more investment in grid stability/resilience. Of these we worry least about innovation. We have been writing about this topic for over 5 years now, and the pipeline for new innovation still looks really strong.

The issue with supply chains is partly the standard challenge for an industry growing this quickly - sourcing raw materials at the right scale and price. Which suggests that the growing pains will pass. But its also an ESG and traceability question. As Finlay put it, the PV module buyers (the last stage of the manufacturing process), are having to "peel off the layers of the module, all the way back to the raw materials that go into the polysilicon plants".

We have discussed the importance of investing in grid stability and resilience before, including in this recent long blog. Put simply, without this investment, we can build all the renewable supply we want, it just will not get connected, at least no where near as fast as we need. We think this is the sustainable investment opportunity of our generation.

Before leaving this topic, we need to touch on an over reliance on China. How much you worry about this depends on your point of view. For some, its in China's best interest to keep scaling up (& selling to us at ever lower prices). Plus, they point out that solar panels are different from Oil & Gas, which can be shut off in an instant (as Europe knows). And lets be honest, China has created the solar boom, without their investments we would still be talking about a tiny niche market.

So how might we diversify? Yes, its possible that Europe and the US could start to catch up. But unlike in China where decisions are made quickly, and new capacity is added in short order, we take too long to decide. To us, this suggests that we are still going to be talking about this "risk" in the late 2020's.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.