Are green buildings more valuable?

Apparently buildings with better sustainability credentials are achieving markedly higher capital values and rents

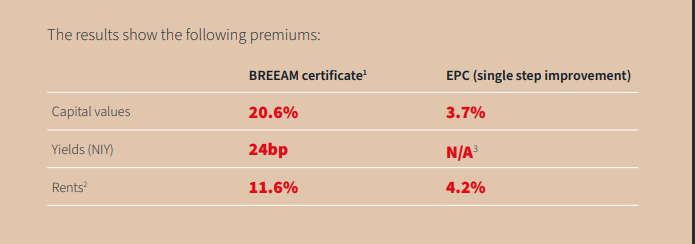

Summary: Buildings with better sustainability credentials are achieving markedly higher capital values and rents - that is the conclusion of a study by global real estate consultant JLL. Their analysis of almost 600 central London transactions in a five-year period, seems to demonstrate that the market is increasingly attaching higher prices to more sustainable assets, in anticipation of higher returns and lower risks. The data also apparently shows that this is resulting in improvements being made to the environmental performance of London’s office stock.

Why this is important: When it comes to decarbonisation in the built environment, regulations ('the stick') can only go so far. The 'carrot' of financial value being created from refurbishing to improve efficiency and sustainability will be a powerful motivator.

The big theme: Our buildings, commercial and residential, are estimated to contribute just under 40% of global emissions, if we include both building materials and building operation. Decarbonising our buildings is tough. While new buildings can be made a lot more energy efficient, and be designed to use lower carbon inputs, this still leaves the challenge of refurbishment of existing buildings. Some studies suggest that by 2040, around 2/3 of the building stock will still be buildings that already exist today. And our refurbishment rate of existing buildings is well below where it needs to be.

The details

Summary of a story from JLL

JLL examined 592 ‘pure’ office investment deals that took place in Central London between January 2017 and December 2021. Development, refurbishment and portfolio deals were excluded. Deals were matched for age, size and location, and both BREEAM and EPC status. A ‘hedonic pricing’ model was used to isolate the impact of environmental certification.

Their research indicates that the market is increasingly attaching higher prices to more sustainable assets, in anticipation of higher returns and lower risks. The data also shows that this investment is resulting in improvements being made to the environmental performance of London’s office stock.

Let's look at why this is important...

Why this is important

Let's start with Europe. Buildings account for around 40% of the regions energy use and 36% of CO2 emissions. Tackling the European Unions inefficient building stock is seen as key to achieving the bloc’s climate targets and to reducing fossil fuel consumption, something they are trying to achieve via a recast of its Energy Performance of Buildings Directive (EPBD).

One focus is on building refurbishment. To meet Europe’s 2030 climate targets the buildings sector must cut its emissions by 60%. That means annual renovations need to jump by an order of magnitude; at the moment it’s crawling at 1% per year. And the deep refurbishment rate, the measure of work that makes a real difference to emissions, is even lower, at only 0.3%.

Part of the solution will be regulation (the stick). The European Commission has proposed the introduction of minimum energy performance standards for the 15% worst performing buildings. Under the proposal, by January 2027, all commercial or public buildings would need to reach at least class “F” on the EU’s energy efficiency scale, and then class “E” by January 2030.

And there is talk that funding, potentially a lot of funding, will be made available. European officials suggested that “up to €150 billion” could become available from the EU budget to implement minimum energy performance standards between now and 2030. EU public money would come from sources such as the European Regional Development Fund, the Cohesion Fund, and the EU’s €800 billion coronavirus recovery fund. The official also cited soon-to-be-updated EU state aid rules that will allow national governments to finance building renovation efforts.

But the stick can only go so far. The carrot is also very important - building owners will need to carry out (expensive) refurbishment work to make their buildings more efficient. While some, with very inefficient buildings, will be caught in the regulation net, for the rest, it has to make financial sense. Which is where the JLL report is a good start. Yes, its not exactly peer reviewed, but the data is a good start. If its possible to extrapolate say the rent uplift from EPC (+4.2%) and BREEAM (+11.6%) (see chart below), to other cities, then we have the beginning of a financial argument to put to building owners.

Globally, there is so much more that needs to be done. According to a report prepared for COP 27, the sector’s operational energy-related CO2 emissions reached ten gigatonnes of CO2 equivalent – 5% over 2020 levels and 2% over the pre-pandemic peak in 2019. In 2021, operational energy demand for heating, cooling, lighting and equipment in buildings increased by around 4% compared with 2020 and 3% against 2019. And that doesn't include building construction of refurbishment impacts. These are estimated to be roughly 1/3 of the emissions, so put simply, add 50% to the COP 27 report numbers.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.