More renewables are coming - but that's not the interesting bit.

As the percentage of renewable electricity generation on the grid increases, the way we store and use electricity will need to change and change dramatically. This will be a massive disruption to the existing system.

Summary: As the percentage of renewable electricity generation on the grid increases, the way we store and use electricity will need to change and change dramatically. This will be a massive disruption to the existing system.

Why this is important: This is our attempt to start to identify where the very real investment opportunities lie in the electricity systems of the future. We start with how you can invest in an electricity grid that enables more renewables to happen. Why? In part because this is where some really interesting investment opportunities can be found. But there is another reason - without these investments in the grid, we will never achieve our renewable targets. It's that simple.

The big theme: As the percentage of renewable electricity generation on the grid increases, the way we store and use electricity will need to change and change dramatically. This will be a massive disruption to the existing system. From an investing perspective, as well as the obvious question as to how big will wind and solar become, there is a much more interesting question - what supporting investments will we need to make to allow the electricity grid to run with a higher percentage of renewables. This is going to be a massive investment theme even if we don't hit 100% renewables.

The details

The renewable electricity known unknowns

I don't know about you, but when I think like an investor (a thought process I find you never lose) I get frustrated by the vagueness of much of the public discussion about decarbonising the electricity system. We see far too many headlines about 2030 net zero targets or a massive growth in wind/solar, and too little of the (boring?) detail of how the electricity grid of the future will actually work.

So, this is our attempt to start to identify where the very real investment opportunities lie. We want to start with how you can invest in an electricity grid that enables more renewables to happen. Why? In part because this is where some really interesting investment opportunities can be found. But there is another reason - without these investments in the grid, we will never achieve our renewable targets. It's that simple.

This blog has mainly US and European examples, simply because we have to start somewhere. In future blogs I will widen out the analysis.

When I started covering the world of energy, most investors thought of electricity companies as either being boring regulated utilities, or highly risky, low margin distributors of domestic electricity (& gas). And most analysis was carried out by industry specialists, who tracked the ebb and flow of how a Regulatory Asset Base (RAB) was defined, and what financial return the regulators allowed the companies to earn.

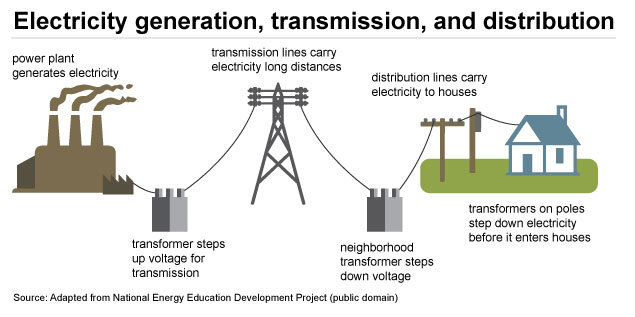

The standard view of the electricity system was similar to the graphic below, large centralised, mostly fossil fuel-based electricity generators produced the power, the grid operator handled transmission, and your local electricity utility handled distribution. So, a simple system, but one that had stood the test of time for the previous 100 years or so. Thomas Edison would have recognised most of it, and he died in 1931.

We argue that this mental model largely dominates much of the debate even now. Simply substitute renewables (wind & solar) for some of the fossil fuel power stations, but everything else stays pretty much the same. Which is why politicians mostly talk about building more renewables (to replace existing fossil fuel powered generation), and why sceptics talk about how renewables are too variable to support the grid - how often have you heard, "but what happens when the sun doesn't shine, and the wind doesn't blow". And both, in different ways, really miss the point.

This is a shame, as the real electricity grid of the future is actually a much more interesting place for investors. Not only are vast amounts of capital needed, but much of it will go into activities that could not be more different from the old boring grid utility model. Plus, if you are an investor who really wants to make a difference, there are a whole range of opportunities in making electricity access more equal.

Looking at the transition more widely, so including all of the required investment in the energy sector, BNEF reported in their New Energy Outlook 2021 that we will need an "investment in energy supply and infrastructure of between $92 trillion and $173 trillion over the next three decades. To achieve this, annual investment will need to more than double, from around $1.7 trillion per year today, to somewhere between $3.1 trillion and $5.8 trillion per year on average over the next three decades"

From a climate perspective, electricity and heat generation together contribute around 25% of global greenhouse gas emissions, of which the vast majority is due to the use of coal (still 36.5% of electricity generation - Ember 2022). Looking forward, electricity demand will continue to rise as many countries follow the electrify everything approach, led by EV's, and building heating/cooling. So, its importance as a theme increases over time.

The electricity grid of the future (and by this, I mean the near future) will look and work in a very different way from the old grid that Edison knew.

So, let's start looking at how this future grid might operate and where we need to invest.

Disruption is coming - and its going to be painful

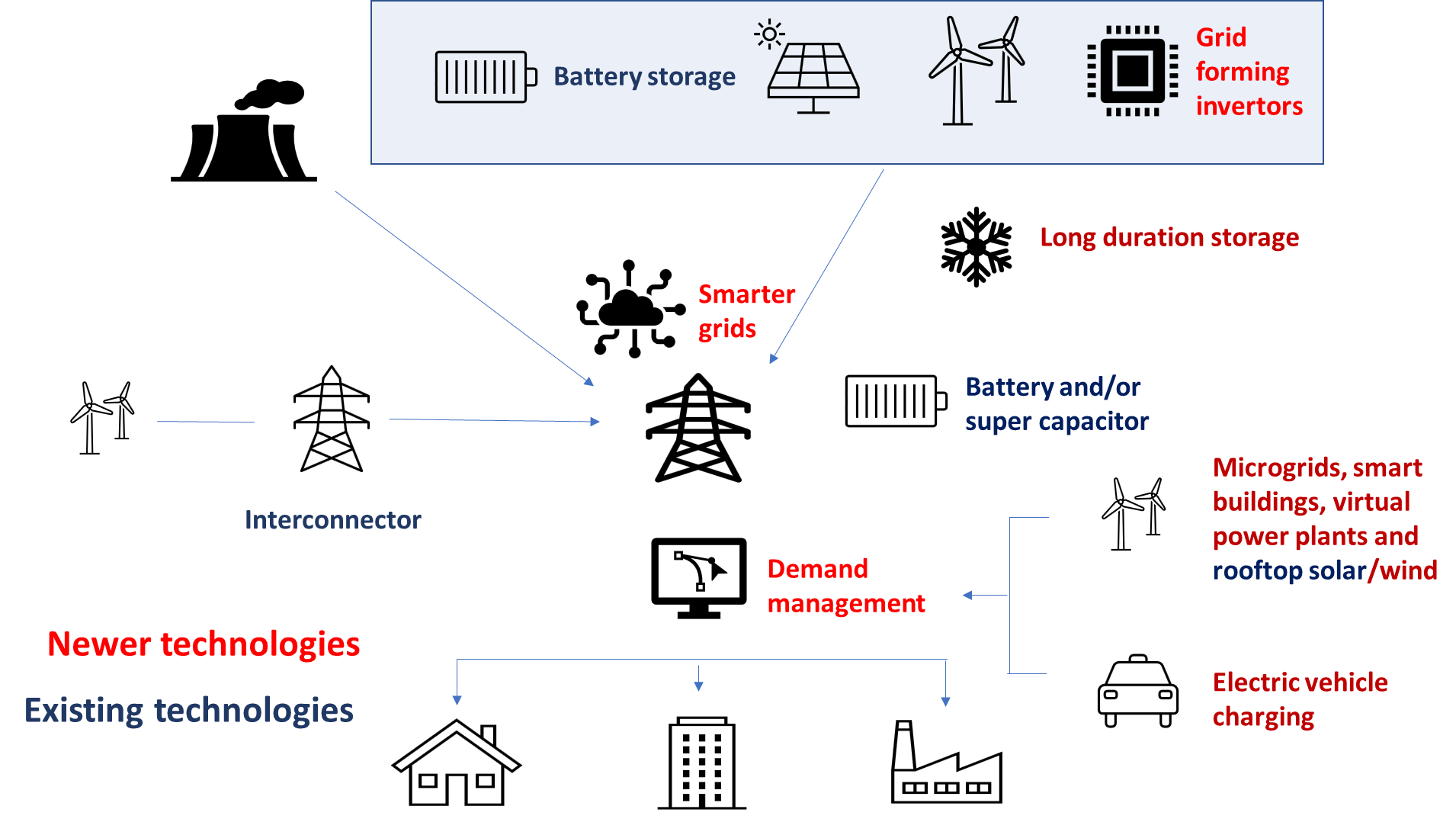

For now, we will dodge the debate about what percentage of wind and solar we will likely have in our electricity generation mix, and just stick with, it's going to be a lot, probably between c.50% and 70% for many countries. The good news is that the bulk of the solutions to get most countries or states to this level already exist. These include a combination of interconnectors, battery storage, transmission grid strengthening, new power electronics, distributed energy, and sophisticated demand management. You can see, this graphic looks very different from the current system, a lot more moving parts and as a result, more complex to run.

The keys to understanding this system are:

- The variability of renewables is only an issue when they are not complementary. In some regions solar and wind peaks do not overlap (more solar in the day, more wind at night). Plus, it's easy (but not cost free) to bring in renewable electricity from places where the sun is still shining, or the wind is blowing.

- We often only need to store electricity for short periods. Until we get high percentages of renewables on a grid, we normally do not need a lot of long duration storage. So, at least initially, Li Ion batteries will be the solution of choice.

- And perhaps most importantly, we need to think differently about demand. In some cases, the cheapest option is to move demand to match the peak of supply, and in others, we can use smart systems and local micro grids to manage our electricity use. The old model of supplying enough to match demand is no longer appropriate.

- Finally, we don't have to think about one technology (historically fossil fuels) providing all of the solutions. We can and should pick the best technology for each task. One example is grid inertia. This is currently provided by the mass in turbines such as for fossil fuel and hydro generation units, but it doesn't need to be in the future.

Most of the technologies we need are already proven and the rest are likely to be ready for full commercialisation within 3-5 years. We don't need a lot of brand-new innovation, expect perhaps around long-term storage.

We already have examples of countries/regions that are close to delivering 50% plus wind and solar. In Europe, Denmark is over 50% and Spain & Portugal are both over 30%. And some US states, such as Iowa, Kansas and South Dakota are there as well.

As highlighted at the start, rather than asking "can we have 100% renewable grids" we should instead be thinking about what we need to invest in to make grids dominated by variable renewables work.

What we will do over this series of blogs is to start quickly running through what technologies we already have to hand (either proven or close to roll out), what they do, how advanced they are, and how big the addressable market will likely get.

We start in this blog with the biggest of the current investment themes, so interconnectors, grid transmission upgrades and battery storage. In the next blog in this series, we will explore the newer technologies, so power electronics, distributed energy, and sophisticated demand management. Think of this as almost a hardware vs software divide.

Then in future blogs we will dig down into each topic and discuss the pro's & con's from an investing perspective. Where we quote market size, we are mostly referring to 2020 and CAGR is 2020-2030.

Interconnectors and distribution/transmission upgrades

Market size currently c. US$60bn to US$100bn, with a 4% CAGR.

Let's start with the easy one. Interconnectors are the massive, normally long-distance, power lines/cables that allow electricity to be transported from regions with a surplus to where there are shortfalls. This is already a well-established technology. For instance, Denmark imports a lot of Nordic hydro, French nuclear electricity (normally) makes it way to the UK, and wind generated electricity gets shifted from West Texas to the big demand centres in the east of the state. This fits in with the theme as often where its best to generate renewable electricity is distant for where we want to use it.

What is interesting about the existing interconnector networks, such as the one below covering Europe, is how patchy the coverage is. In some parts of the region, such as the Nordics, or the spine up from Greece to Poland and Austria, the cross-border links are fairly dense. However, some parts of Europe, such as the Iberia Peninsula, are effectively electricity islands, poorly connected into their neighbours.

And it's also interesting how little of the network is Direct Current or DC - shown in purple (by and large DC is better at carrying larger loads). You get a similar picture if you look at the US, with Texas almost totally separated from the rest of the system.

Getting more interconnectors built and upgrading the electricity grid, are the most important things we can invest in to deliver a lower carbon electricity system, while at the same time earning a fair financial reward.

Two of the biggest barriers to renewable roll out are the absence of a grid connection or being located where the grid is too weak to cope.

Given this, the role of interconnectors is expected to grow massively, as they can move cheap renewable electricity from remote areas where it is generated, into the cities. They already fulfil this role in markets such as China, where hydro, wind, and solar electricity is moved vast distances from the sparsely populated northwest out to the [populated east] coast. Plus, they can also be used to time shift, so for instance California solar could be used later in the day in the cities on the eastern seaboard of the US.

In many cases we also need to invest in upgrading the existing grid, removing what are known as weak grid points. These projects can range from adding capacity (to allow more renewables to be added or to give alternate routes) through to weather proofing (storms, floods and heat). From a grid operator perspective, having too much renewable generation around these weak points raises the risk of grid failure, something they want to avoid at almost all cost.

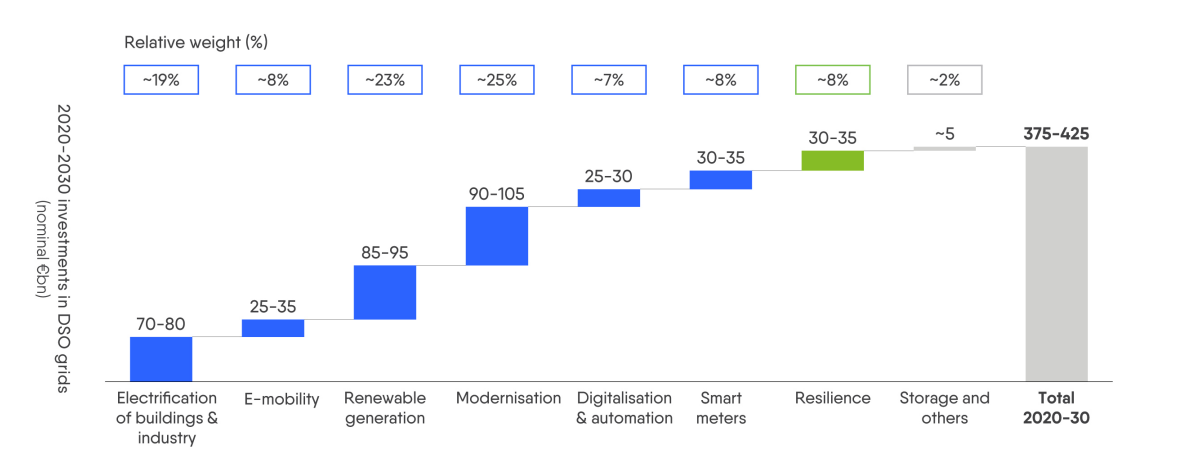

A recent study for the industry body Eurelectric identified that European distribution grids will need total investments of between €375bn and €425bn out to 2030 to make them fit for purpose. This is c. 50-70% higher than current levels of spending.

And similar studies in the US, including a big study by Princeton, estimate that to deliver a net zero carbon electricity system by 2050, the United States will need to expand its electricity transmission systems by 60% by 2030 and may need to triple it by 2050. This implies spending on the transmission network of c. $350 billion over the period to 2030, so averaging out at an extra c. $35 billion pa.

This will be a massive project, and it's not just the electricity utilities that will be involved. The cable providers, electrical contractors and software/digital specialists will all have a roll.

From an investor perspective, interconnectors and distribution/transmission upgrades are the largest, most proven, and most investable of the electricity grid technologies. This is already a big market, if you add up all grid spending in developed markets it comes to somewhere close to US$100bn pa. While the total cable market is likely to remain slow growing (low to mid single digits), fast growing segments include connections for off shore wind, and interconnectors (both double digit CAGR). Barriers to entry in this market means the incumbents are well positioned to retain value. And a number of the providers of these services are listed and relatively liquid.

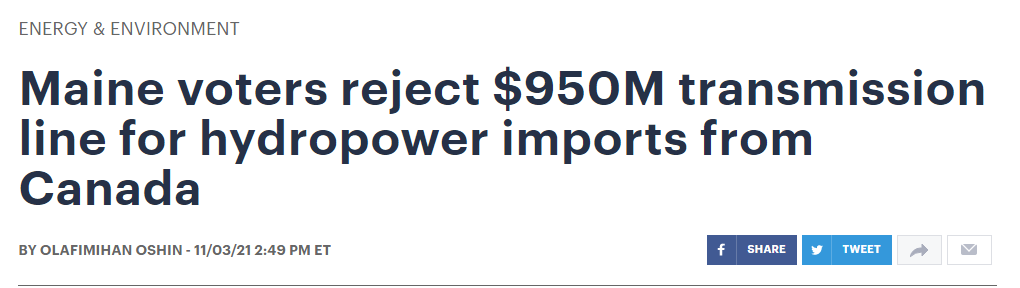

However, building new transmission lines (the big towers that cross the countryside) is controversial. We have written in the past on the battle to build the interconnector to bring cheap Canadian hydro down into the states of the US northeast.

And there has been similar opposition in other countries, including to the interconnector required to bring offshore wind into the national grid in Norfolk in the UK. Some of this is understandable concern regarding environmental impact, but it sometimes feels as if some of it is about protecting incumbents.

Regardless of the reason, it may be that buried and undersea cables get built a lot faster than those requiring above land routes where an existing corridor is not available. It means that while the market will growth, progress might be lumpy.

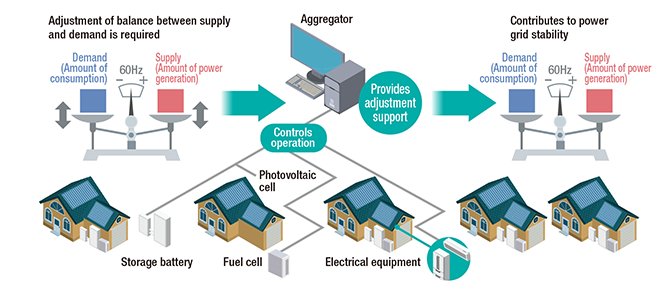

Mid and short duration battery storage

Currently a US$6bn market, with a 17x to 35x growth out to 2030.

While this is currently a smaller market than interconnectors and grid strengthing, it's probably the most exciting of the grid upgrading investment markets. The grid of the future is going to need a lot more electricity storage. Its currently a small market but it's growing very rapidly. BNEF forecasts that the global energy storage market will grow 15-Fold by 2030.

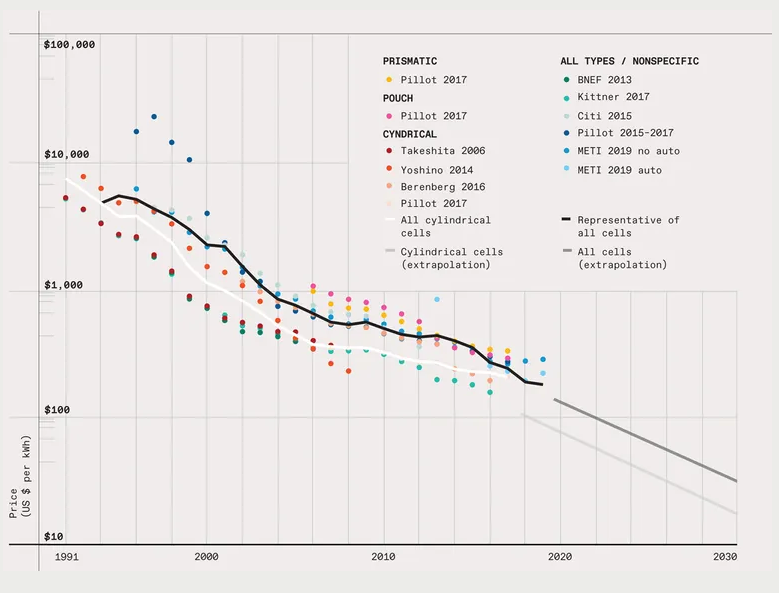

There are two underlying drivers of this growth. First, up until recently battery costs per kwh have been falling, meaning that their use made greater economic sense. An MIT study attributes this to a mixture of R&D into materials, battery chemistry advances and economies of scale. And while the rise of raw material costs seen recently has stalled this decline, the expectation is that this will be a short rather than long term challenge.

The second factor is that demand is growing. With more renewables we need to store surplus electricity for release later, when either demand is higher, or supply is lower. Putting this more simply, storing electricity for when the sun doesn't shine, and the wind isn't blowing. Some analysts estimate that this will be c. 2/3 of the battery market by 2030.

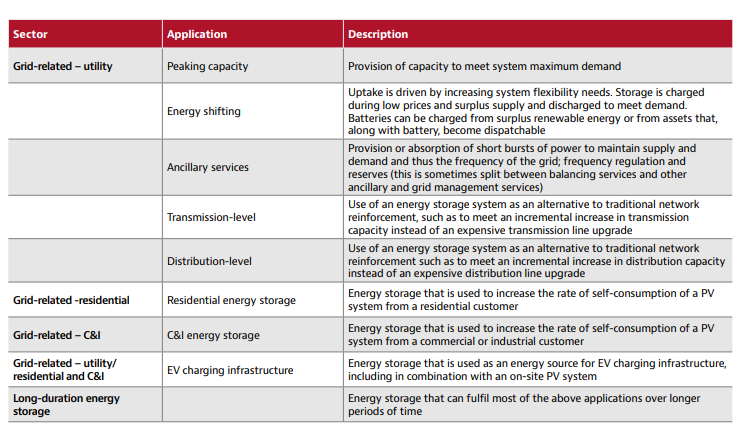

But the market is much more than this. As we get more renewables on the grid, the risk of grid instability rises. This means we will need to massively expand ancillary services which help the grid operator keep the system in balance. We will write on why this is in a future blog, for now let's just take it as a given. In most markets meeting this need is primarily a utility scale market, using large scale battery projects (sometimes attached to wind or solar farms).

However, in those countries where local generation such as roof top solar is common (Germany, Japan, parts of the US, Australia etc), we are seeing an increasing use of what are known as small scale Virtual Power Plants or VPP's. These group together residential smart thermostats, solar panels, air conditioners, storage batteries and other home devices to both supply energy to the grid and to reduce the electricity needed. The goal is lowering peak demand by cutting back home electricity use or meeting the peaks by drawing electricity from home storage batteries. We will explore these further, together with other software-based solutions, in our next blog in this series.

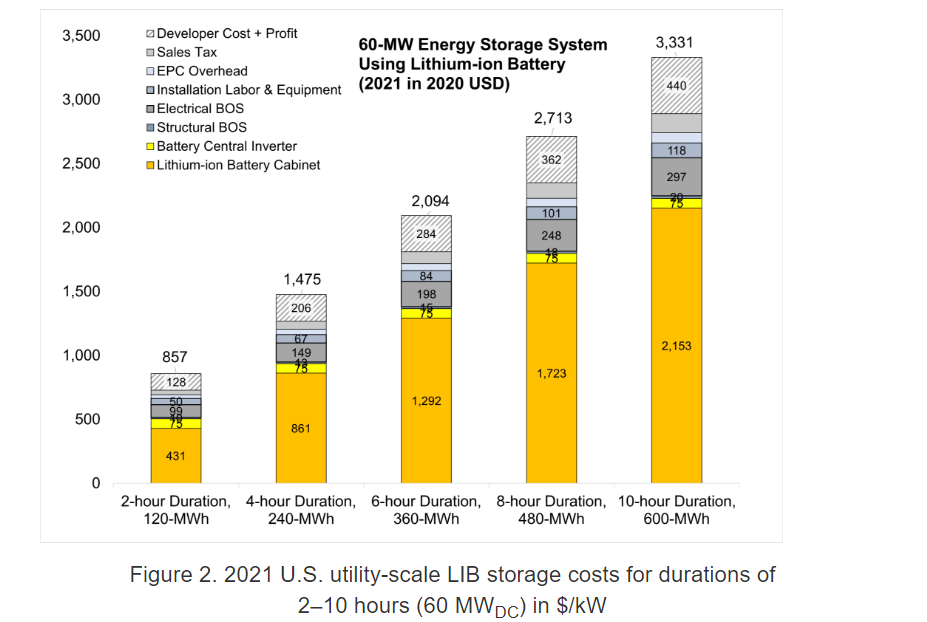

Returning to utility scale storage, it used to be thought that Li Ion batteries (similar to those in EV's), would be great for short storage periods, say up to 1 to 2 hours, but that beyond this we would need new technologies. This was mainly a cost issue; longer duration storage is a lot more expensive. The chart below, from NREL, shows the cost per kwh as the storage period rises.

However, this seems to be changing. We have recently seen contracts for Li Ion battery batteries up to 4 hours of storage and some are stretched out to 8 hours. Consensus thinking is now gradually shifting, and it's more likely that any new technologies, such as flow batteries, might only be needed for longer durations. One reason for this change in approach is that Li Ion batteries have advanced much faster than was anticipated, largely piggy backing on developments in batteries for EV's. This is an exciting topic in its own right, and yes, one we will address in a future blog.

Regulation, to allow battery storage to access the full stack of grid support revenues, is key to the expansion of this market.

And regulation change can be slow. As the law firm Baker McKenzie highlighted in a recent report, most governments who have initiated substantial reforms have focused on creating more of a level playing field for battery storage, rather than specially targeting incentives and/or subsidies. The big exceptions to this have been China and the US, and it can be no coincidence that this has led to these two markets representing over half of forecast new global storage installations by the end of the decade. Europe, however, is catching up with a significant ramp-up in capacity fueled by the current energy crisis.

Investing in this theme is likely to become easier over time. There are already specialist companies and investment funds that finance and operate battery projects, plus many renewables companies are adding batteries to solar and wind farms. And battery manufacture and its supply chain contains a number of investment opportunities - although some of these are already dominated by Chinese companies. The really interesting opportunity is likely to be in the control software, which will become the point of differentiation as battery manufacture starts to become commoditised.

Conclusion

We started this blog with the big investment theme ...

As the percentage of renewable electricity generation on the grid increases, the way we store and use electricity will need to change and change dramatically. This will be a massive disruption to the existing system.

Disruption brings opportunity. One aspect of this will be the hardware required, building interconnectors, upgrading the electricity grid, and adding battery storage. This is already a well-established, if poorly understood, investment theme, that has strong growth potential. In preparing investment cases, it's important to be aware of how the electricity grid will change. These will be long life assets, that, if chosen well, could provide a financial return for decades to come.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.