Insurance - the 'hidden' risk for real assets

Adequate insurance is a crucial part of many financial investments, including homebuying. We take it for granted, until it's no longer available. The impact of climate change is prompting private insurers to exit some markets. But this is not inevitable - resilience investments can reduce the risks.

Insurance is the canary in the coal mine

Insurance is a topic we have written a fair bit on. Back in 2023 we wrote about the impact of Cyclone Gabrielle as it swept down the east coast of the North Island of New Zealand, leaving destruction in its wake. And we covered how the expected rise in mean sea level (by at least 10cm by 2040) would change how we think about storm frequency. Giving this some context, back in 2015 the New Zealand Parliamentary Commissioner for the Environment estimated that in some locations, a 10cm of sea level rise will turn what is currently a 1 in 100 year storm into an event that happens 1 in every 20 years.

The bottom line is that we should expect serious storms to come through more often. Which is not great news if you happen to live in places where storm damage (or any other number of nature related disasters including fires) is already a problem.

Today I want to start with household insurance in the US and then expand out to where insurance meets nature based solutions.

Developments in the US insurance market

While investors are becoming more aware of the withdrawal of companies from the home insurance market, it's still an underappreciated risk. Which is why a recent JP Morgan report titled "Insurance: Weathering the storm of inflation, climate change and market-distorting state regulation" is worth a read. Yes, it's about the US market, which has its own idiosyncrasies, but many of the conclusions remain applicable elsewhere.

There is some good data in the report on the rising costs of (insured) climate damage, and how the insurance withdrawal issue is becoming more common. But what really caught my eye was their thoughts on possible solutions. To quote the report ...

"Private sector exits are not inevitable in the face of climate change. These challenges can be countered by a subset of resilience investment to reduce risks at a building and community level, financial investment and regulatory action".

What concrete actions can we take?

The obvious first action would be to act to reduce the risk of climate change. But outside of this it is also possible to reduce the vulnerability of our existing assets to the negative impacts.

As they say "the built environment can become more resilient to extreme weather and climate events. This can be achieved through measures such as implementing building codes for new construction, retrofitting existing homes to new standards, and improving community-scale disaster management to lower the risk of loss to everyone (e.g., flood waters and fire). While 75% of people surveyed assume their greatest risk to their homes is related to extreme weather, only 50% have taken any action to reduce their risk".

Back in November 2022 we wrote about building resilient hubs which could act as a lifeline when disaster strikes, and help people get back on their feet more quickly afterwards. This is not a trivial investment need. The UN estimates that climate adaptation spending, just in developing countries, could reach $300bn by 2030. This is on top of the tens of billions being spent by national and regional governments in developed countries.

Your home may become uninsurable

But even with this we need to recognise that many regions may simply become uninsurable, even with extensive government support. The reality is that insurance cannot be expected to pay for something that we know is certain to happen.

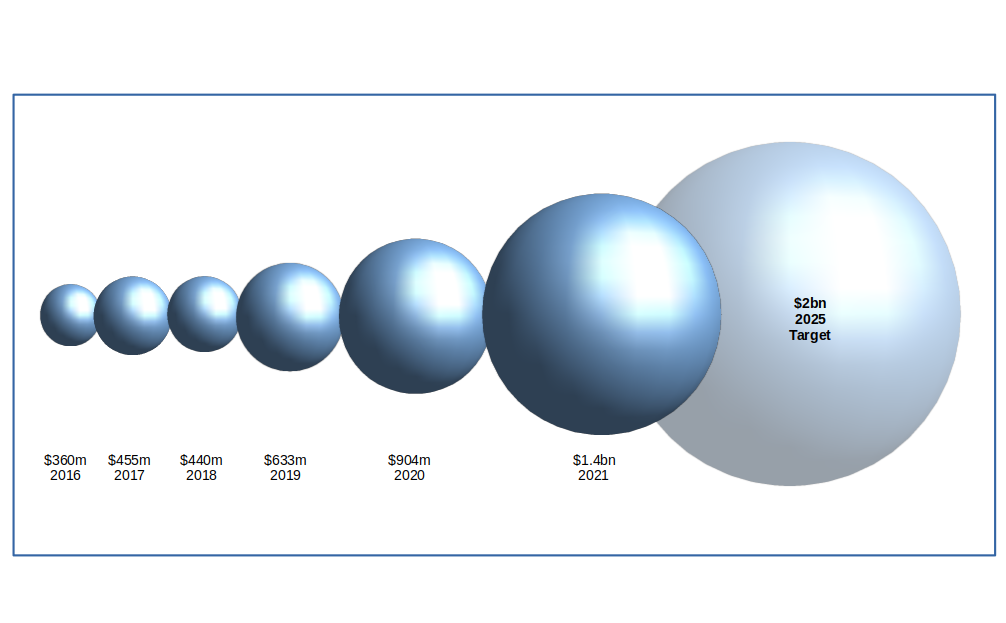

In this situation the ability of the state to pay only goes so far. The cost in the US for what are known as FAIR (Fair Access to Insurance Requirement) plans has risen sharply, from c. $351bn in 2019 to over $1093bn in 2024 (see page 9 of the JP Morgan report).

Making our systems more resilient

So if how we think about insurance needs to change, who pays for these actions to increase resilience ? This rather neatly brings us the question of funding nature based solutions. The short answer is we need new funding models. It's hard for an individual insurance company, on its own, to justify major investment (the free rider problem). But together it makes more sense.

Early last year I read an interesting report by the Center for Coastal Climate Resilience at the University of California Santa Cruz,the U.S. Army Corps of Engineers,and Guy Carpenter. I have been waiting for a good chance to highlight it - so here goes. The report went by the catchy title of "Nature-Based Solutions & Risk Management Recommendations for Integrating Nature into Risk Science & Insurance"

As well as talking about building broader based risk models (well above my pay grade) they highlight possible solutions. These include parametric insurance (where the payout is triggered by a physical event rather than proving the damage suffered), expanding insurance for ecosystems as natural assets (such as the policy developed by Nature Conservancy (TNC), in partnership with the reinsurance company Swiss Re, covering potential storm damages to a portion of the Mesoamerican coral reef in Quintana Roo, Mexico) and one of my favourites, resilience insurance.

How might resilience insurance work?

Resilience insurance is a risk financing tool that incentivises risk reduction, risk transfer, and habitat restoration. Essentially, in a resilience insurance coverage, the policyholder invests in nature-based adaptation projects and their insurance premium prices are accordingly reduced to accurately reflect the reductions in risk due to the nature-based solutions.

Apparently no policies have yet been written on this basis, but the idea builds on similar policies such as the MyStrongHome program. This provides residential homeowners in South Carolina, Florida, Alabama, Mississippi, and Louisiana with the opportunity to fortify their roofs and receive significant savings on their insurance premiums, which pay for the roof upgrades over a 7-year period.

Putting it another way, rather than judging how material a risk your building faces, your insurer would identify actions you can take to reduce your premiums.

This is subtly different from projects such as the QBE Asia Premiums4Good programme. Under this a proportion of premiums are invested in projects that create social and environmental impact whilst making a financial return.

One last thought

For all of these efforts to work we need good data. The number of natural disasters causing more than $1 billion in damages has risen steadily for more than 15 years. Against that backdrop, the US Treasury put forward a proposal requiring insurers to provide five years' worth of underwriting data, broken down by zip code, to help them understand risks of major disruptions in insurance coverage in different areas of the country.

However, there was been push-back from various groups including the US Chamber of Commerce and insurance industry groups arguing that the additional burden of providing that data would ultimately be passed on to consumers through higher policyholder premiums. Our best guess is that this work will probably now not happen.

Grant me the strength to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference. Reinhold Niebuhr - a Lutheran theologian in the early 1930's

Please read: important legal stuff. Note - this is not investment advice.