EV sales growing - but where this is happening matters

Will this be the decade of cheaper Chinese EV's as they push into the mass market?

This is the first blog in a series of three on some of the key issues we need to consider in relation to EVs.

Last week the IEA published their 2024 Global EV outlook. This is significant for two reasons.

First, transport is a really important sector for decarbonisation. According to Our World in Data, transport accounts for around 20% of global CO2 emissions, with c. 75% coming from ground transport. So, a good problem to solve.

And second, its importance comes from the fact that we have a solution that reduces transport emissions, one that we know works. Along with decarbonization of our electricity network, transport is the most investible 'green' theme.

That solution is obviously Electric Vehicles. We can build them at scale, they are getting cheaper, and, assuming we decarbonise electricity generation, they can make a real difference. But, it can be complicated.

We are sure you will have seen a lot of coverage of the report. So, rather than rehash a summary, we have picked three aspects where we think a bit of thought is needed.

These are - how do we expand EVs outside of the current three big markets - is this the decade of the Chinese mass market EV, what is happening on EV charging, and advances in battery technology. What links them all, as with most things to do with EVs, is China.

This blog considers Topic 1 - how will we expand EV sales outside of the current big three markets (China, Europe and the US), plus the related question of how will we get EVs in Europe and the US to shift into the mass market. And then is this going to be the decade of the cheaper Chinese EV? And what might this mean for the market share and profitability of European and US OEM's?

This article featured in What Caught Our Eye, a weekly email featuring stories we found particularly interesting during the week and why. We also give our lateral thought on each one. What Caught our Eye is available to read in full by members.

If you are not a member yet, you can read What Caught Our Eye when it comes out direct in your email inbox plus all of our blogs in full...

Click this link to register 👉🏾 https://www.thesustainableinvestor.org.uk/register/

EV sales growing - but where they are growing matters

Topic 1: Is this going to be the decade of the cheaper Chinese EV? And what might this mean for the market share and profitability of European and US OEM's?

The IEA report sets out the case for EV optimism. "Electric car sales could reach around 17 million in 2024, accounting for more than one in five cars sold worldwide. While tight margins, volatile battery metal prices, high inflation, and the phase-out of purchase incentives in some countries have sparked concerns about the industry’s pace of growth, but global sales remain strong."

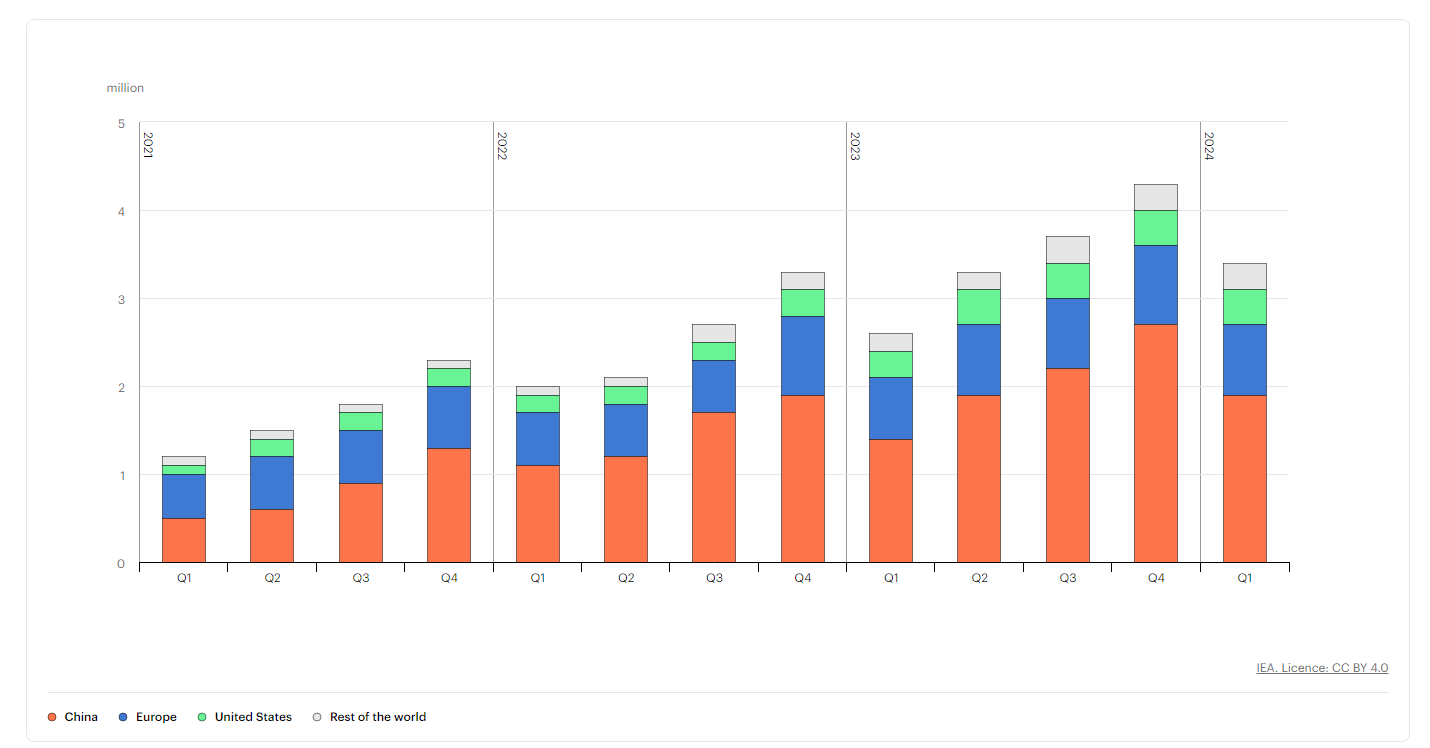

In the first quarter of 2024, electric car sales grew by around 25% compared with the first quarter of 2023, similar to the year-on-year growth seen in the same period in 2022.

In 2024, the market share of electric cars could reach up to 45% in China, 25% in Europe and over 11% in the United States.

Most of the coverage we have read takes the line that 'despite challenges EV sales continue to grow at what is an astonishing rate'. And this is true. As the IEA Executive Director Fatih Birol said in the launch video ' despite the headwinds EV sales have done much better than many pessimists expected'.

But ! Lets look at the data in a slightly different way. The vast majority of EV sales in 2023 were in China (60%), Europe (25%) and the United States (10%). Together 95% of all global EV sales took place in those three markets. And yet together they only made up 65% of total car sales. What is happening elsewhere?

The short answer is other than pockets of positive news, EV market penetration outside of the big three regions remains weak. Many analysts highlight price, with EV's being too expensive for many consumers. But this misses two important aspects.

The first is the question - are we building the 'wrong' types of EV's? As the report points out, in 2023, two-thirds of available electric models globally were large cars, pick-up trucks or sports utility vehicles. These are not the cars that most global consumers want.

And then we have China. Our second point. The IEA estimates that more than 60% of electric cars sold in 2023 were already cheaper than their average combustion engine equivalent.

This is worth repeating. In a world we we think of EV's as being expensive, nearly 2/3 of EV's in China were cheaper. Given this, is it any wonder that the IEA estimates that by 2030, nearly 1/3 of cars on the road in China will be electric. Not new vehicles sold, vehicles actually being driven around.

Yes, there are some signs that other car OEM's are focusing more on cheaper EV's. A recent example is the apparent reversal of an earlier decision by Tesla, with a shift back into building cheaper EV's. But, again quoting the IEA report - only 25% of the 400+ launches expected over the 2024-2028 period are small and medium models, which represents a smaller share of available models than in 2023.

And, can a $25,000 'cheaper' EV really compete with the mass market offer coming out of China, where local carmakers already market nearly 50 small, affordable electric car models, many of which are priced under $15,000.

I am old enough to remember how first Japanese and then Korean automotive brands reshaped the car industry. After doing the same in motorbikes.

So a useful question to ponder is - are we heading for a world where European and US automakers hold on to EV market share in premium, but lose out badly in the mass market? And what might this mean for economics and jobs?

And as you ponder this ... remember that EV's are not just about cars. Two & Three wheelers matter as well. Something we wrote about back in 2022.

👉🏾 Scooters - a silver bullet to cut fossil fuel use?

Please read: important legal stuff.