EV charging & industry consolidation - a pre-requisite?

The EV charging chicken and egg? We need more high quality 'public' charging to drive EV sales - which will probably require industry consolidation

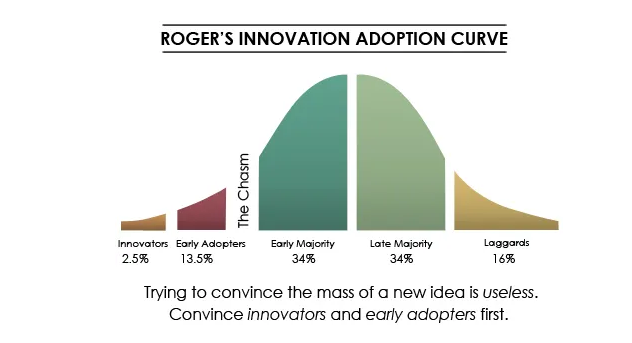

For EV sales to continue to rise we need to bridge what is rather dramatically called 'the chasm'. This is the challenge in taking a new innovation into the main stream. It's where lots of new products fail. A sizeable minority love the new product, but it cannot get traction in the larger but more cautious general population. In many markets this occurs around 15-16% market share, or c. 1 in 6 of new sales.

In some major markets, this is roughly where EV's are now. For instance, in May 2024 while the overall market share for plug-in vehicles in Europe stood at 21%, battery electric vehicles (BEVs) accounted for 14%.

One barrier is charging. It's frequently emphasised that an absence of the ability to charge at home is a material problem. Selling EV's to those with off street parking only takes you so far. Which means we need more out of home/public charging. But who will build, and perhaps more importantly operate, these chargers? Scale matters - to give people confidence that that can charge anywhere, even on holiday, at a fair price.

Which is why a recent editorial from EV Market Reports caught our eye. It turns out they were quoting an Apricum report from earlier in the year. This looked at the market concentration among the operators of public EV charging. The US market is much more concentrated, with the top 4 players controlling most of the market share.

Why does this matter? The argument was simple, markets like the US (& I guess China) have a big advantage over Europe, they are not fragmented. It makes building that all important scale easier. While in turn encourages concentration.

This is a What Caught Our Eye story - highlighting reports, research and commentary at the interface of finance and sustainability. Things we think you should be reading, and pointing out the less obvious implications. All from a finance perspective.

It's free to become a member ... just click on the link at the bottom of this blog or the subscribe button. Members get a summary of our weekly posts, including What Caught Our Eye and Sunday Brunch, delivered straight to your inbox. Never miss another blog post !

Charging towards a green future

Regular readers will know that we like the innovation curve. It's not perfect but it's useful. Too many people focus on the rapid ramp up stage of the model. One aspect of the innovation curve that doesn't get enough attention is the chasm. This is the gap between a product being loved by the 'early adopters' and not being taken up by the 'early majority'. It's where many good ideas go to die.

Before talking about EV charging, it's worth highlighting one big advantage that companies in larger and homogeneous markets have, it's the ability to build scale. The most obvious example is the US. It doesn't matter if you sell biscuits or fridges (or EV charging services), if you know that by and large people across your region have similar 'tastes', then you can make the same product for everyone. You get scale of production, marketing and distribution. On it's own it's not enough, but it's a really good start.

What does the EV charging market look like in this regard? According to the Apricum report 'Charging towards a green future: Is Europe or the US leading the EV charging infrastructure race?', the US market is a lot more consolidated. To quote the report:

Tesla currently holds a >50% market share, with few players making up the remainder of the market. The top 4 fast charging companies in California, Texas and Pennsylvania are the same: Tesla, EVgo, Electrify America and ChargePoint. One needs to go down to the #5 player to start seeing some differences.

By contrast Europe remains very fragmented. The big markets of Germany, France and the UK largely have different dominant players. So across Europe, no-one really has economies of scale.

Why does this matter?

The first reason is customer experience. If you have scale across a large region then you can say to customers, 'sign up with me, and wherever you go you will have charging sites, so you will never face the risk of your EV going flat'. This helps to overcome the range anxiety problem. We should not underestimate this as a barrier to more widespread EV adaption.

Plus, there are some economies of scale. In purchasing chargers, in operating and maintaining them, and in running the back office systems that handle billing etc. And, if you are the market leader, you are more likely to be selected for a new site - scale brings footfall. This means the market leader has a better chance of being profitable.

Implications for EV sales

As the IEA sets out: "large-scale adoption of EVs hinges on the simultaneous roll-out of accessible and affordable charging. The early adopters of electric cars have tended to live in single-family detached homes with affordable and convenient access to home charging. As a result, most charging to date has been private (at home and other private locations). "

This is supported by a 2021 survey of EV drivers in the United Kingdom, that showed that over 90% of the respondents reported having access to home chargers. But this is a finite market.

This suggests that all other things being equal, better availability of public charging that is easy to use, cheap and reliable, will lead to higher market shares for EV's. And it's probable that the companies best placed to provide this will be those that have scale, the companies with a high market share.

Which in turn supports the view that consolidation will both be inevitable, and that it will (subject to market abuse limitations) also positively assist EV roll out.

A last thought

It must be said, having a high market share on it's own is not a guarantee of financial success. It's also really important that the company provides a good customer service. We all know companies that grew rapidly, but that failed to actually make a fair financial return. This was followed by cost cutting, which resulted in poor customer service. Which in turn let a new entrant into the market.

And don't assume that EV charging will look like our current petrol station (gas station) system. It's possible that at work charging might become the norm.

Please read: important legal stuff.