Thematic Thoughts: Change can happen faster than we think

Assuming business as usual is often the easy option. But often change happens faster than we expect. And this can expose the company to material risks.

Assuming business as usual is often the easy option. The people who work for us understand it and are comfortable with it. And we already have a network of technical and procedural experience and expertise to draw on. So, when we come to build scenarios around how our industry will look in the future, it's easy to drift toward those that mean little or slow change. As a result our 'new' strategy ends up assuming business as usual. Or if change is going to happen it's going to be gradual and manageable.

But often change happens faster than we expect. And this can expose the company to material risks, finding itself positioned for the old rather than the new world. Which in financial terms can lead to impaired (stranded) assets and the need for accelerated investment, just to catch up. And, if others prepare for the change and we don't, then our corporate leaders can end up being in breach of their fiduciary duty. Proper foresight is important.

As investors, it's also important to remember that the future is very industry, company, and region specific. The 'right scenarios for one company might not always apply equally to their peers.

We were reminded of this fact when we read about how rooftop solar had supplied more than 50% of the Australian grid’s power demand for first time. Which prompted two thoughts. The first was what might this mean for the Australian electricity industry?

And the second, and perhaps more interesting, was this a scenario that electricity companies around the world need to add to the list of future risks and opportunities?

This is a What Caught Our Eye story - highlighting reports, research and commentary at the interface of finance and sustainability. Things we think you should be reading, and pointing out the less obvious implications. All from a finance perspective.

Rooftop solar hits 50% of Australian supply

Let's start with the easy question. What might this mean for the various companies that operate in the Australian electricity supply chain.

So, what's the event? As the article points out "according to the data collectors at GPE NEMLog, at 1pm (AEST) on Saturday last week the output of solar PV mounted on the rooftops of millions of Australian households and businesses reached 50.4%".

And according to Gavin Mooney, as recently as 2018, the share was only 12.6%.

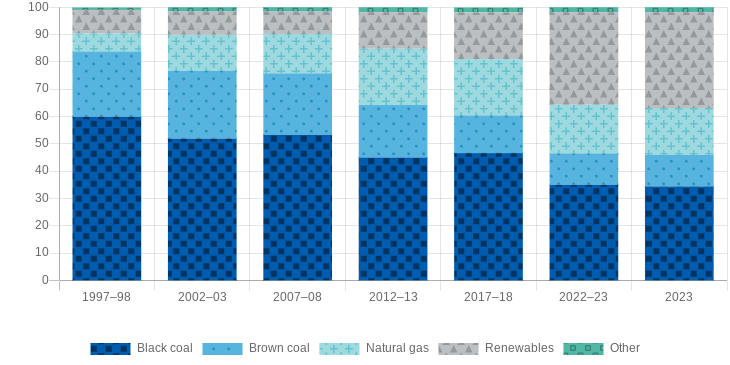

Rooftop solar is not only helping residents and businesses protect themselves against higher electricity bills, it's also helping to reduce the share of coal in the generation mix. And we all know that coal is the first fuel we need to drop out of the system if we are to keep on the path to decarbonise electricity generation. In 2023 it 'only' contributed c. 50% of generation supply, down from over 80% in 1997-98.

And not only is coal use reducing, how it gets used is also changing. It's no longer just an always on base load.

As the article says "coal plants are having to abandon their “base-load” operating procedures and learn how to dance around rooftop solar during the middle of the day, which means they can no longer be “always on”.

AGL recently announced that it had "successfully switched off an entire unit before switching it back on again just five hours later – a feat until recently considered unthinkable". As the company said this could be a way "for coal plants to capitalise on high prices in the evening peak while avoiding bearish prices in the middle of the day when solar power was most abundant".

So one interpretation could be that the continuing rise in Australian rooftop solar has prompted the fossil fuel electricity generators to rethink how they operate. And find technological solutions to what were previously thought to be unsolvable challenges.

And companies that are best anticipating and planning for this change will be best placed to financially benefit from it.

So what about the read across for electricity companies elsewhere.

We all know that solar generation is growing rapidly. The IEA recently reported that the amount of renewable energy capacity added to energy systems around the world grew by 50% in 2023, reaching almost 510 gigawatts (GW). And solar PV accounted for three-quarters of additions.

More solar, and other variable generation sources, are necessary if we are to hit net zero, but they do raise new challenges. These can be minor at lower levels of renewable penetration, but we need to be clear, they get more difficult to manage as renewables start to become the major source of electricity generation.

Ember recently noted that more than 30 countries now generate more than 10% of their electricity from solar. Chile (20%), Australia (17%), Spain, The Netherlands, Germany and Italy are all over 10%, with Japan and Vietnam not far behind.

As the IEA said in a recent report "tougher challenges typically materialise at higher levels of solar PV and wind penetration. However, frontrunner systems – including Denmark, Ireland, South Australia and Spain – are finding ways to address these issues, too, clearing the way for others."

While the transition will vary country by country, and not everywhere will reach Australian levels of rooftop solar penetration, this is clearly a challenge that the industry needs to be preparing for. 'Business as usual' will become unusual.

One last thought

As investors we need companies to clearly set out how their industry will change, and how they are preparing and adapting. Without this information it's much harder for us to make good investment decisions. Companies that do not properly consider potentially negative scenarios, and that assume business as usual, could become bad investments.

Please read: important legal stuff.