Sunday Brunch: your secret weapon for your sustainable investment case?

Pitching sustainability investments or strategies to finance people is tough. Expectations Investing could be the Sustainability Professionals secret weapon.

"Hope is not a strategy" - attributed to many, including Abraham Lincoln

Our view - Pitching sustainability investments or strategies to finance people is tough. Expectations Investing could be the Sustainability Professionals secret weapon. So what is it? It's the simple 'truth' that 'good' financial investments do not come from having a better investment story. They come from being able to explain why the financial markets have got it wrong, and why they have mispriced the investment opportunity.

Understanding this, and explaining your 'better' narrative, could be your secret weapon in getting finance into your sustainability projects, and making your organisation's strategy more sustainable.

One desire that all Sustainability Professionals seem to share is that of wanting to actually making a difference. Of being able to influence their organisation's strategy for the better, or actually raising capital/finance for projects that deliver positive sustainability progress. Which in practice normally means persuading their finance colleagues that change is needed. And that the change you are proposing makes sense for the long term sustainability of the business.

Very few Sustainability Professionals go into the industry to just collect data and write reports. Persuading your finance colleagues to support sustainability is likely to be your greatest challenge.

If you want to read the rest and are not already a member...

Expectations investing could be your secret weapon

We all know that we need to get more private finance into the sustainability transitions. The current shortfall is massive. According to a recent report prepared by the International Energy Agency (IEA) and the International Finance Corporation (IFC) "annual clean energy investments in emerging and developing economies will need to more than triple from $770 billion in 2022 to as much as $2.8 trillion by the early 2030s".

The same report highlights that c. 2/3 of this needs to come from the private sector. And that is just for energy in emerging and developing markets. We also need to transform energy in developed markets, and in agriculture/natural capital. Plus address numerous social issues including migration and labour abuses.

Getting finance colleagues to support positive sustainability investments is becoming an increasingly important part of the Sustainability Professionals role. Which means pitching investment or strategy alternatives in a way that they will understand and can support.

The popular perception of a financial investment case (or the development of a strategic option) is that it's about building an often complex set of forecasts, that when translated into a profit & loss, cashflow and balance sheet, explain why this particular investment opportunity will deliver a good financial return. This is a really challenging activity, especially if we are considering a future that looks different from the past or that opposes consensus thinking.

We talked about the importance of narrative in this process in an earlier blog. But let's be honest, for many sustainability investments and strategy options, the narrative can get complex, with lots of moving parts.

And the complexity means that it's easy to lose your audience. There is a good reason why many finance organisations insist that a good pitch is one that can be summarised in only two pages. That is about as long as most people can concentrate.

This is where Expectations Investing can help. The first time you read this, it might feel wrong, as it contradicts much of what finance people are taught at University, but stick with me. It's worth it.

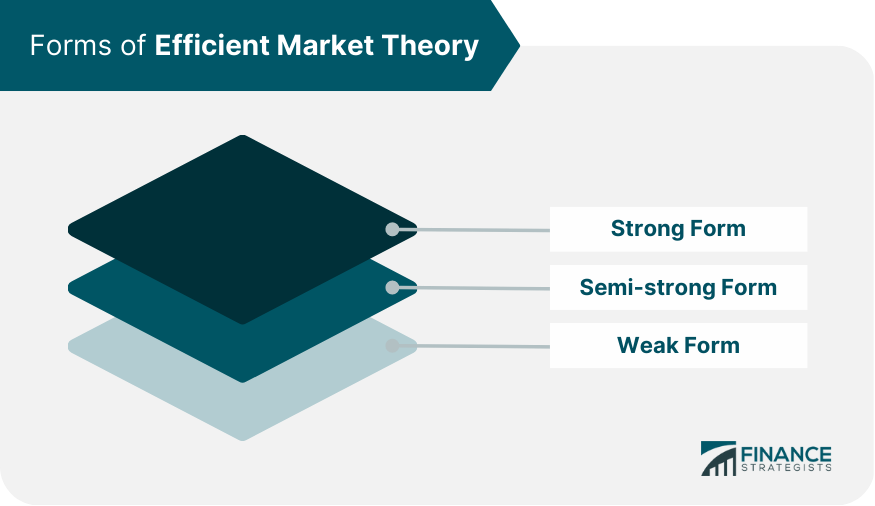

Financial markets are mostly efficient. By that I don't mean that they come to the right decision. I mean that they are really good at absorbing all of the available information, and turning it into a view on what a particular investment or company is worth. In financial terms. There are all sorts of criticisms of what is called the Efficient Market Theory, including some pretty damming ones from the behavioral investing side.

And of course, there is a massive debate about if this efficiency means that markets act in societies best interest (a lot of the time they don't - Professor Hart has written some good stuff on this). But even the critics accept that markets are mostly efficient at pricing investment opportunities, just not always.

This is why by and large passive investments out-perform active ones. It's hard to beat the market. This is sometimes known as The Wisdom of Crowds. And it dates back to 1841 when Charles MacKay wrote his book, although most people know it from the work of James Surowiecki.

If the financial markets are correct, then the price you have to pay for an investment opportunity will be the same as it's fair value. As we said in our blog on the Cost of Capital:

If the price you have to pay for this investment opportunity today is greater than the estimated fair value, the investment opportunity is too expensive (it's worth less than you have to pay for it). And if it's lower, then it's cheap (worth more).

So, to beat the market you have to 'know' something that the market is not correctly either understanding or pricing in. This is where Expectations Investing comes in. To deliver financial performance that is better than the market, which is what most finance people want to do, you should focus on three questions:

- What assumptions is the market making in estimating financial fair value? Or putting in finance speak 'what news is already priced in'.

- How are my assumptions different?

- What does this mean for financial value?

Expectations Investing has been around for some time now, it forms the foundation of some of our most successful long term investors. It's been brought to greater prominence through the work of Alfred Rappaport and Michael Mauboussin. But, it's not well known outside of financial circles. It should be as it's a great tool for explaining sustainability investments in a concise way, one that can get support from the financial community.

This is great news for your two page summary. Focus on where the market assumptions (what in finance speak is call consensus) is wrong, how your narrative is different (and why), and what this means for financial fair value. Yes, you still need to do the detailed work that supports your argument, that stands behind your analysis. But, by focusing on where your thinking differs from consensus you can deliver a concise and easily understood summary of your investment case. One that shows to finance people why this would make a good investment or a good strategy option.

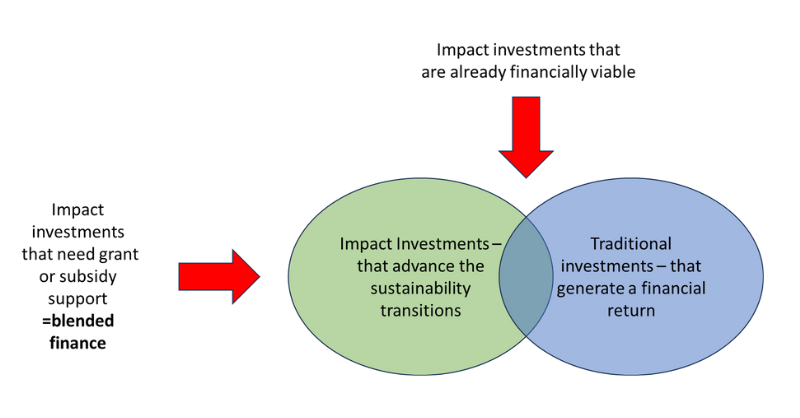

And the extra good news is that this approach doesn't only work for individual impact projects. It's just as applicable to strategy setting and it also works with Blended Finance (where private sector capital is used alongside government and grant funding).

Blended Finance is going to be increasingly important as an mechanism for allowing impact projects to actually happen. We encourage you to read the work of Harald Walkate (and other's) on this topic.

Something a little more bespoke?

Get in touch if there is a particular topic you would like us to write on. Just for you.

Contact us

Please read: important legal stuff.