Bridging the gap 26.23

In case you missed it ...

Not a subscriber yet? Click here ('Bridging the gap' is free)

Here is a selection of recently published Deep Dives, Perspectives and Quick Insights that our subscribers get to read in full.

- Yes, we need more mining but how much investment do we need? (Greener Energy Applications, Electricity systems)

- Processed foods - from cost advantage to competitive disadvantage (Health and Wellness, Agriculture / Natural Capital)

Plus a few from the archives:

- Mine rehabilitation - who pays and what do we get? (Transitions / Human Rights)

- Biodiversity and food solutions (Agriculture / Natural Capital)

- The simple and the ancient (Built Environment)

What subscribers are reading this week

Yes, we need more mining but how much investment do we need?

(Greener Energy Applications, Electricity systems, Premium and Professional)

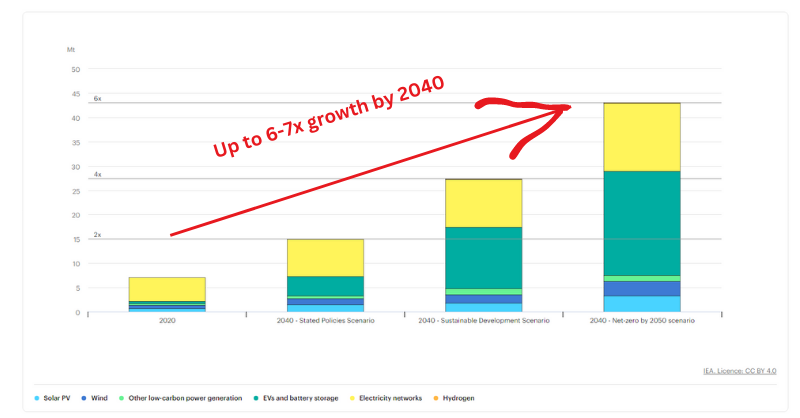

By now we should all know that if the sustainability transitions are going to happen, then we will need more mining. How much more, and how much will this cost?

Green energy inputs such as lithium and rare earths are getting a lot of press coverage. However, it may surprise you to learn that the biggest investment needs are going to be for extra copper and nickel. Copper is used in solar, wind, EV's and electricity networks. So we should expect demand to rise sharply. And nickel plays an important role in increasing the energy density of EV batteries. And EV batteries will make up 50-60% of the demand for energy transition metals. So that shouldn't be a surprise either.

How big is the gap? According to the IEA it's roughly US$180 billion, or c. US$23 billion pa. This sounds like a massive number, as do the figures often used in reports on future green energy mineral demand. Annual copper production will need to increase by 11.5 million metric tons (45%) by 2031—equivalent to doubling production from the top four copper-producing countries. Demand for lithium, nickel, and cobalt (the core battery metals) is expected to increase by 8x, 2x, and 1.8x, respectively. And the availability of rare earth metals (a crucial components of electric motors) will need to double.

Will we be able to raise all of this extra investment, or will the transitions hit the buffers?

Actually, the shortfall is not as big as you might think. Yes, it's challenging, but we have done it before when we scaled up fossil fuel production in the second half of the last century. The biggest challenge is probably going to be political - balancing the need for more mining with other social and environmental issues.

We need an informed debate on what matters to us, and what price we are prepared to pay.

Link to blog 👇🏾

Processed foods - from cost advantage to competitive disadvantage

(Health and Wellness, Agriculture / Natural Capital, Professional)

The impact of obesity / overweight on the world could reach $4.3 trillion annually by 2035. Right now the global average proportion of the adult population that is obese is 21.8%. Europe, the UK and the US are higher than that, but more worryingly the rate is growing in low- and middle-income countries too.

There are significant health risks with being obese. In addition to cardiovascular disease, there are also links to type 2 diabetes, cancer, dementia, psychological distress and infertility.

One major contributor is the high consumption of ultra-processed foods, particularly those high in fat, salt, sugar or all of them!

The growing calls to incentivise the shift from high fat, salt or sugar foods and drinks to healthier options has been joined by Danone from the food industry itself.

As an investor or industry participant, understanding the shift to healthier options and particularly the velocity of that shift will be key. And there are parallels with other industries.

Link to blog 👇🏾

From the archives

Mine rehabilitation - who pays and what do we get?

(Transitions / Human Rights, Premium and Professional)

We know we need more mining if we are to deliver the energy transition, but there is one type of mining that we know will almost certainly decline over time, that is coal mining. According to the World Coal Association, there are over 10,000 operational coal mines in the world. This doesn’t include the mines that have already closed and artisanal mines. So, this is going to become an even bigger issue in the future than it is now. So what happens when the mines close? And does rehabilitation mean something different from what most people expect to get?

The green transition is going to need a lot more mining. Without it most of the transitions will just not happen. There is not a simple alternative, one that “does no harm”, while at the same time providing us with all of the raw materials we need for everything from electric vehicles, through greener buildings and transport, through to renewables such as wind and solar, and the vast amount of electricity grid investment we are going to need.

Link to blog 👇🏾

Biodiversity and food solutions

(Agriculture / Natural Capital, Professional)

The food industry has the potential to make a massive difference in terms of slowing and even reversing biodiversity loss. And many of the things they can do also can make good business and financial sense. Product reformulation is one of the less obvious, but potentially most powerful, routes.

For finance people, biodiversity can sometimes seem to be a problem to be solved by the “wider society”. One on which we act because of the risk of regulation or legal challenge. But, there are also very real financial reasons why acting now makes sense. The food industry has perhaps the greatest ability to drive change, through better supply chains and product reformulation. Not only can this protect future supply chains, but it can make near term financial sense as well.

Link to blog 👇🏾

The simple and the ancient

(Built Environment, Professional)

The simple and ancient often works. In many cases we need new solutions, but sometimes it should be more a case of applying what we already know, just much more widely. Sometimes, this “known” technology has been around a long time. Nowhere does this logic apply so aptly as in our built environment, the physical landscape that makes up our cities. We look at opus caementicium, Chaudes-Aigues, dikang, ondol, the hypocaust, and mediaeval tapestry. These ancient approaches led to modern equivalents. Different approaches to concrete production (or more strictly making cement), the use of geothermal, especially for district heating, underfloor heating, insulation, and retrofitting buildings, rather than demolishing them and starting again.

New technologies take time to perfect and implement. We have had thousands of years of innovation that could be deployed now.

The built environment is an important sustainability theme, both as an integral part of societal existence but also as a major decarbonisation (40% of energy-related GHG emissions) and resource consumption problem (40% of global raw materials). There are many avenues to decarbonise across all phases of a buildings life: design, construction (and deconstruction or demolition), operations and interaction with other structures and the environment. Reduce, reuse and recycle and circular design principles can be applied to the built environment to reduce its overall environmental footprint and sustainability.

Link to blog 👇🏾

Become a subscriber

Click here to joinPremium subscribers get to read in full...

- 'Quick Insights'

Designed to be short, easily digestible summaries to educate and stimulate thought and further exploration. 3-5 minute reads.

Professional subscribers get to read in full everything that Premium subscribers get plus...

- 'Perspectives'

Our unique perspective, based on our decades of financial and sustainability experience, on a key news story, development or report that is impacting sustainability investing, decision-making and transitions. We encourage you to think laterally. 5-6 minute reads.

- 'Deep Dives'

Setting the scene in more detail to aid understanding of how the transitions will develop and thinking laterally. 10-12 minute reads.

Please forward

to a friend, colleague or client

If this was forwarded to you, click the button below and sign up for free to get this email, 'What caught our eye' and the 'Sunday Brunch' in your inbox every week.

Please read: important legal stuff.