Are we thinking about stranded assets incorrectly?

If I say stranded assets to a finance person or a sustainability professional my guess is that your first thought is oil & gas. But is this missing the point?

If I say stranded assets to a finance person or a sustainability professional my guess is that your first thought is oil & gas. The risk that the shift to electrification will cause the value of oil & gas reserves to go to zero. Making the asset valueless and imposing a material cost on the company and its investors.

But is this missing the point? Let's park for a moment the question of when the planet might get to the point where we need no oil & gas, and think about this problem differently. As evocative as the words 'stranded assets' are, a more useful phrase when talking to investors is 'assets at risk'.

This is less about the value of an asset going to zero, and more about it becoming worth less, maybe a lot less. And as well as taking some of the emotion out of the debate, using this phrase instead has another big benefit. It causes us to think more broadly. What other assets, other than oil and gas, might become worth less in a low carbon future?

This encompasses a lot more industries than you first might think. Which is why a recent paper from the Institute for Climate Economics entitled 'From Stranded Assets to Assets-at-Risk: Reframing the narrative for European private financial institutions' caught our eye. No, it's not the most catchy title, but it contains some really interesting analysis.

And thanks to Nawar Alsaadi for highlighting this.

This is a What Caught Our Eye story - highlighting reports, research and commentary at the interface of finance and sustainability. Things we think you should be reading, and pointing out the less obvious implications. All from a finance perspective.

It's free to become a member ... just click on the link at the bottom of this blog or the subscribe button. Members get a summary of our weekly posts, including What Caught Our Eye and Sunday Brunch, delivered straight to your inbox. Never miss another blog post !

From stranded assets to assets at risk

Investors worry a lot abut losing money. When I started in asset management I was told 'if you can pick a reasonable number of winners, and avoid the big losers, then you will beat the market'. And as an investor, the research paper from Natasha Chaudhary provided a lot of food for thought. I highly recommend you read it, as always it's not easy going, but it's worth the effort.

Starting at the beginning. Investors do not like to lose money. And bond and debt investors hate it more. Why? Because while equity investors 'potentially' have unlimited upside, a debt investor only gets their principal back (the amount they lent out in the first place). Plus of course the interest payments. So their upside is capped.

This means that if the company that you lent money to cannot pay it back because their productive assets are generating less cash than expected, you have a problem.

In finance speak, we say that the asset has become impaired (worth less). And in the language of Natasha's research paper, these are 'assets at risk'. The risk is that they become worth less.

How is this different from using the phrase 'stranded assets'.

Stranded assets have become associated in the mind of most people with oil and gas reserves. But, assets at risk is a much broader concept. It covers all of those assets that might be worth less in a low carbon world. Not worth nothing, worth less.

And the strength of this difference is that it prompts investors to look at their portfolios in a new way.

What other industries have assets at risk. Natasha points to some good examples.

First, the easy one. Automotive.

To quote the report:

As automobile manufacturers race to replace Internal Combustion Engine vehicles with EVs the impact will be felt by all players in the value chain, not just the vehicle manufacturers.

Current production lines are optimised for ICE vehicles, and investments are locked in for the life of a car model (7-10 years). This means that a shift to an EV model would require new equipment, and material investments. This could result in significant financial losses or write-offs due to the sheer size of the global ICE fleet and the associated global upstream suppliers, that would need to adapt quickly or risk going out of business.

Estimates of industry asset value at risk by 2025 stand at €600 billion globally with the most risk observed for plant, property and equipment and leased products (including receivables).

And real estate.

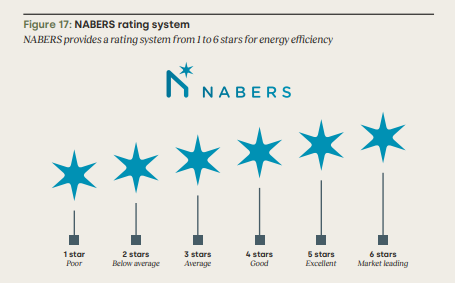

The energy transition underscores the great potential of the real estate sector to reduce overall GHG emissions since buildings account for the lion’s share of 42% of the EU’s total energy use. 80% of this energy goes towards heating and cooling needs. A very solvable electrification challenge.

We are already seeing signs that green buildings are being increasingly demanded by institutional investors. And that green buildings are 'worth more'.

Given the financialisation of the global real estate market (through international mortgage markets, real estate investment trusts, unit trusts), private financial players are exposed to potential real estate losses in both primary and secondary financial sectors.

Another good example of assets at risk - in this case 'brown buildings'.

While 'stranded assets' is a phrase that resonates, 'assets at risk' looks to be more helpful. If we are trying to persuade the financial community to think differently, let's start using 'assets at risk' and 'potential asset impairment' instead.

Please read: important legal stuff.