A new resurrection for coal - probably not

The data for 2024 electricity trends is out. And coal use has grown. Is this a permanent shift away from sustainability toward energy security, implying a new dawn for coal use? Probably not. Investors would be wise to exercise caution - coal mining is likely to remain a sector in terminal decline.

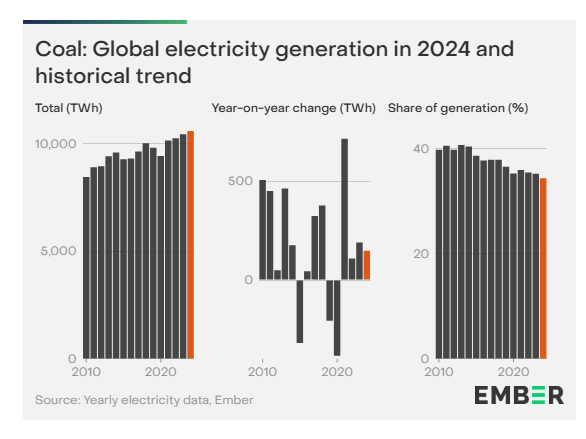

The latest data from Ember analysing global electricity trends is out. Among the many useful nuggets is some data on coal use in electricity production. It's up by 1.4% (+149 TWh), a new record high. This increase was slightly below the rise in 2023 (+190 TWh, +1.9%).

Most importantly, coal remains the largest single source of electricity generation, at around 34.4% (down slightly from the previous year).

Given the impact of coal on electricity generation emissions, that will be disappointing.

Why does the use of coal for electricity generation matter?

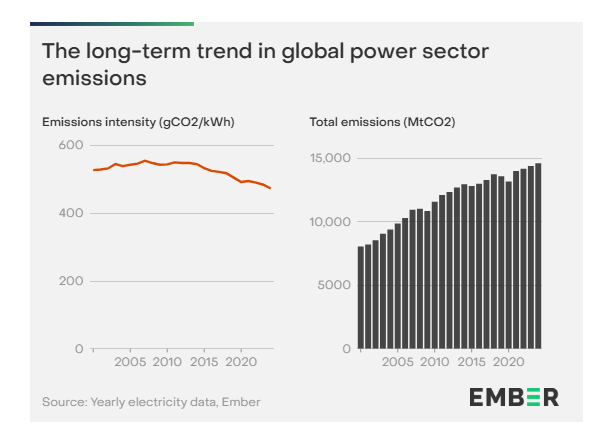

Coal emits the most GHG's of the mainstream fuel sources. The growth in coal use was one of the main drivers of global power sector emissions reaching a new (absolute) record high in 2024 - rising by 1.6% or 223 million tonnes of CO2 (MtCO2), compared to 2023.

It's important to note that the growth we have seen in renewables and low carbon electricity sources means that the emissions intensity (gCO2/kWh of electricity) is falling ie our electricity generation is getting cleaner. But, the rise in demand means that total emissions are still going up.

So what is going on, and why do we not see this as a sign of increasing long term demand for coal?

It's mostly (but not all) about China

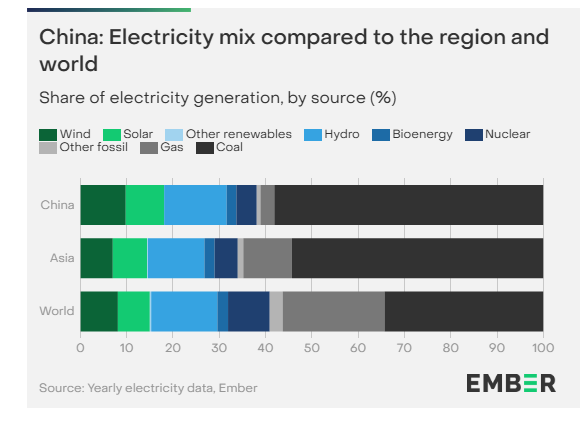

China’s size and reliance on coal generation kept it as the world’s highest power sector emitter in 2024, with emissions reaching 5,640 MtCO2. China accounted for 38.6% of global power sector emissions – more than the US, India, the EU, Russia and Japan combined.

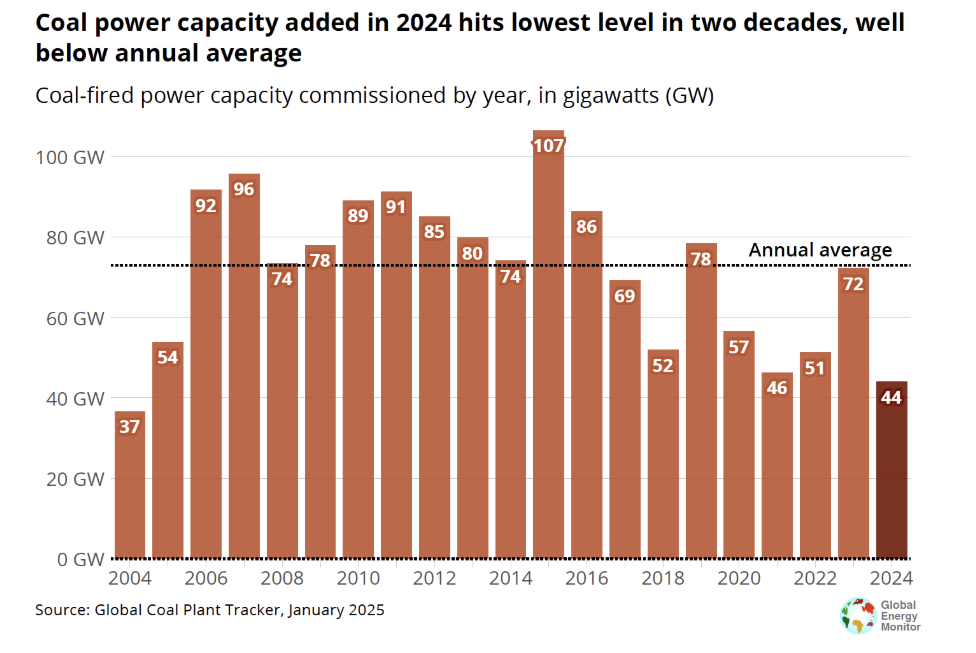

And the world is still adding new coal fired power station capacity, even allowing for retirements. According to data from the Global Coal Plant Tracker 44.1 gigawatts (GW) of coal power capacity was commissioned while 25.2 GW was retired in 2024, resulting in a net increase of 18.8 GW.

To quote the Global Energy Monitor report ... "most of this growth came from China, which commissioned 30.5 GW of coal power capacity in 2024 — 70% of the global total — and saw 94.5 GW in new construction starts, the highest in nearly a decade".

So, why will this trend (probably) not continue?

China is changing. Maybe slowly, but it's changing. China’s electricity demand continued to grow – by 6.6% in 2024. This is a similar rate of growth to that seen in 2023.

So if Chinese electricity demand continues to grow, why would coal use not grow as well? It's partly about the heat wave last year, and partly about the surge in renewables.

You should already know about the impact of the heat wave. We wrote about the impact on Indian electricity supply in a blog back in August 2024. There was a similar impact in China - but here it was more coal than gas that was the replacement fuel.

If you want to read more - this report from Ember gives the full global picture. One important question to bear in mind is how climate change will lead to more heat waves, and hence an extended period of higher coal use in China - an issue for another blog.

And then we have the surge in renewables. Last year 81% of the electricity demand growth in China was met with the rise in clean generation – wind, solar, hydro, nuclear and bioenergy. And renewables are growing fast, faster than the total electricity demand growth. Solar is taking the lead - solar generation was up 250 TWh (+43%) in 2024.

Largely as a result of this surge, coal’s share of the Chinese electricity generation market has been falling – from 70% in 2015 to 58% in 2024. But coal will be important for Chinese electricity generation for a long time.

But don't expect the replacement to be rapid. As we wrote back in April 2024, it's going to be a long slow goodbye.

Sustainability vs energy security

A topic we are hearing about more often is how as energy security becomes more important, the demand for fossil fuels in electricity generation will continue at a higher level and for longer.

Energy security is important. As we highlighted in our blog on the Indian response to the heat waves "energy security can be an abstract concept. But sometimes it's very real. And it can clash with environmental concerns. In that case energy security seems to win."

Again, this is a topic that we will come back to in a future blog, but for now we just want to highlight that a reasonable response to energy security concerns is to accelerate the roll out of renewables. This is especially the case for regions that reply on energy imports.

A recent paper from the Royal United Services Institute reviewed how the UK is thinking about these issues.

Taking all of the factors into account, it's unlikely that the recent growth in the use of coal for electricity generation signals a sustained resurgence in demand. This is despite measures by politicians, such as the recent executive order from US President Trump.

To quote the Global Energy Monitor report ..

"outside China, coal power capacity decreased by 9.2 GW, as retirements (22.8 GW) exceeded new additions (13.5 GW) in the rest of the world. In the EU27, retirements quadrupled year over year, reaching 11 GW, while the UK shut down its last coal plant, becoming the sixth country to complete a coal phaseout since 2015."

One last thought

It's important to remember that coal is not just used to generate electricity, it's also used in the production of steel. Specifically in the production of new steel via the BF-BOF process. Note that the other main production method, electric arc furnaces, largely uses scrap steel. And this produces materially lower GHG emissions.

But, the problem is that between 70 -75% of current global steel production comes from the BF-BOF method.

Whilst almost 90% of steel is recycled, the steel industry is still responsible for about 7% of all man made global greenhouse gas (GHG) emissions and so is an important decarbonisation problem that needs solving.

Grant me the strength to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference. Reinhold Niebuhr - a Lutheran theologian in the early 1930's

Please read: important legal stuff. Note - this is not investment advice.